According to reports, Twitter will be accepting Elon Musk’s $43 billion cash offer to purchase the company. The Tesla and SpaceX Founder and CEO had earlier called the offer, also valued at $54.20 per share, his “best and final” in the offering document.

This clause has worried the Twitter board, but they have been unable to extract a “go-shop” provision from Musk’s team, according to Reuters. This provision would allow them to solicit other bids once the deal is signed, although they retain the ability to break the deal for a fee should a better option arise.

While the deal has not been completed, it is expected that barring an unexpected last-minute collapse, Twitter could recommend the sale to its shareholders as early as Monday.

While Twitter’s share price has been notoriously stagnant compared to the public value and usage, it was higher than the offer price as late as last November. Although, Twitter was trading at around $38 per share when Musk first purchased a significant stake in the company in March, it is currently trading at over $50 a share.

However, public opinion seems to be behind Musk’s bid and there seems to be rising belief that he will be able to grow the company in the long term.

Earlier last week, Twitter co-founder and former CEO Jack Dorsey had complained that the board was the source of the company’s “dysfunction” after Musk revealed that he would be looking to reduce board salaries to $0 should his proposal be accepted.

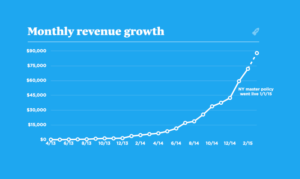

Earlier today, Shark Tank USA judge and co-host Kevin O’Leary had also backed Musk’s bid and said that the social media giant could use improvements from its current form. O’Leary said, “Twitter has done an abysmal job of creating value for shareholders since it went public just over nine years ago, creating zero value year after year.”

As reported earlier, Musk will be able to finance up to $33.5 billion of his own money for the bid while Morgan Stanley and other banks will underwrite another $13 billion. Musk’s bid was boosted by Tesla’s outstanding Q1 results last week that will grant him an additional $23 billion in performance-based payouts.