The significance of unified data in today’s context is of great importance, as it brings data from different sources and platforms, and gives the end user the ability to make business, strategy and sales decisions with data that is structured and analysed for interpretation.

A unified data infrastructure bridges disparate data sources by consolidating them into a single data set or warehouse. This helps to analyse and make strategic decisions, based on the mindfulness of every data point. It cuts down on multiple silos of data, which can obstruct the bigger picture, so that data on a unified platform is accurate, effective and actionable.

Some of the key considerations when creating a unified data cloud infrastructure should include business goals, so that the collection and reporting on data can be optimised, building commonalities with the organisation to access the unified platform. An effective unified data model should be easily scalable to handle increased volumes as an organisation expands and be flexible to be integrated with new platforms and data sources. Another key is to have technology-enabled intuitive analytics and automatability, so that it can manage the scale of data efficiently.

For fintechs, a secured and unified cloud storage offers the opportunity to build their data pipeline for not only their external customers to offer customised offerings, but also for internal teams to build contextual solutions. It is instrumental in setting up automation processes, building risk portfolios and cost optimisations, without the need to build data centres and other back-office infrastructure. Another very important aspect to employ a unified cloud storage is to keep the data generated under a secured ecosystem. For an industry that has strict guidelines on regulations and data governance, this also helps them to stick to compliance of data usages.

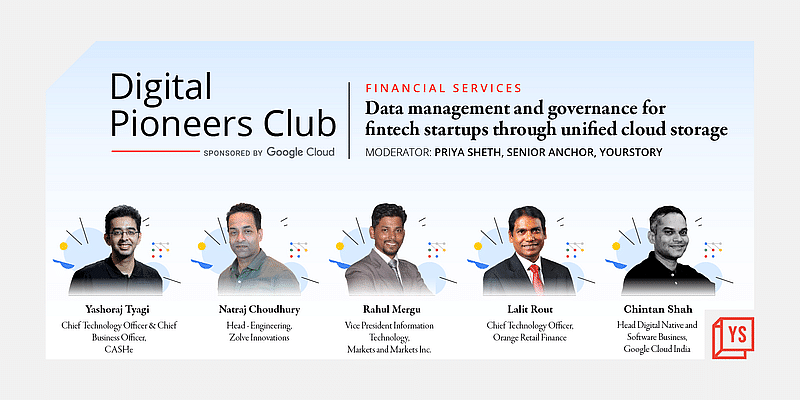

The roundtable ‘Data management and governance for fintech startups through unified cloud storage’ will feature startups from the fintech segment to discuss how unified cloud is a means to securing, structuring and understanding data, helping them make strategic decisions about what solutions to build for the sector.

Hosted by YourStory and Google Cloud, the aim is to bring players from the segment on a common platform to discuss technology opportunities, identify challenges, and create a dialogue for future solutions.

Our esteemed panelists – featuring Chintan Shah, Head Digital Native and Software Business, Google Cloud India; Yashoraj Tyagi, Chief Technology Officer and Chief Business Officer, CASHe; Natraj Choudhury, Head Engineering, Zolve Innovations; and Rajesh Vyas, Co-founder and Head Digital and Product, Apnapaisa.com – will offer future-forward insights to help catalyse the revolution that fintech is poised for.

To all stakeholders, experts from technology, cloud and fintech sectors, this is your chance to be part of the discussion with your questions and insights, and understand how a unified cloud infrastructure could be a game changer in the fintech business to drive innovation for the future.