Since beginning its journey in 2021, Rozana.in has served 4-5K gram panchayats in rural UP and Haryana, offering 10K+ SKUs, the startup claimed

It uses an asset-light, composite model to onboard shoppers and make deliveries in rural India

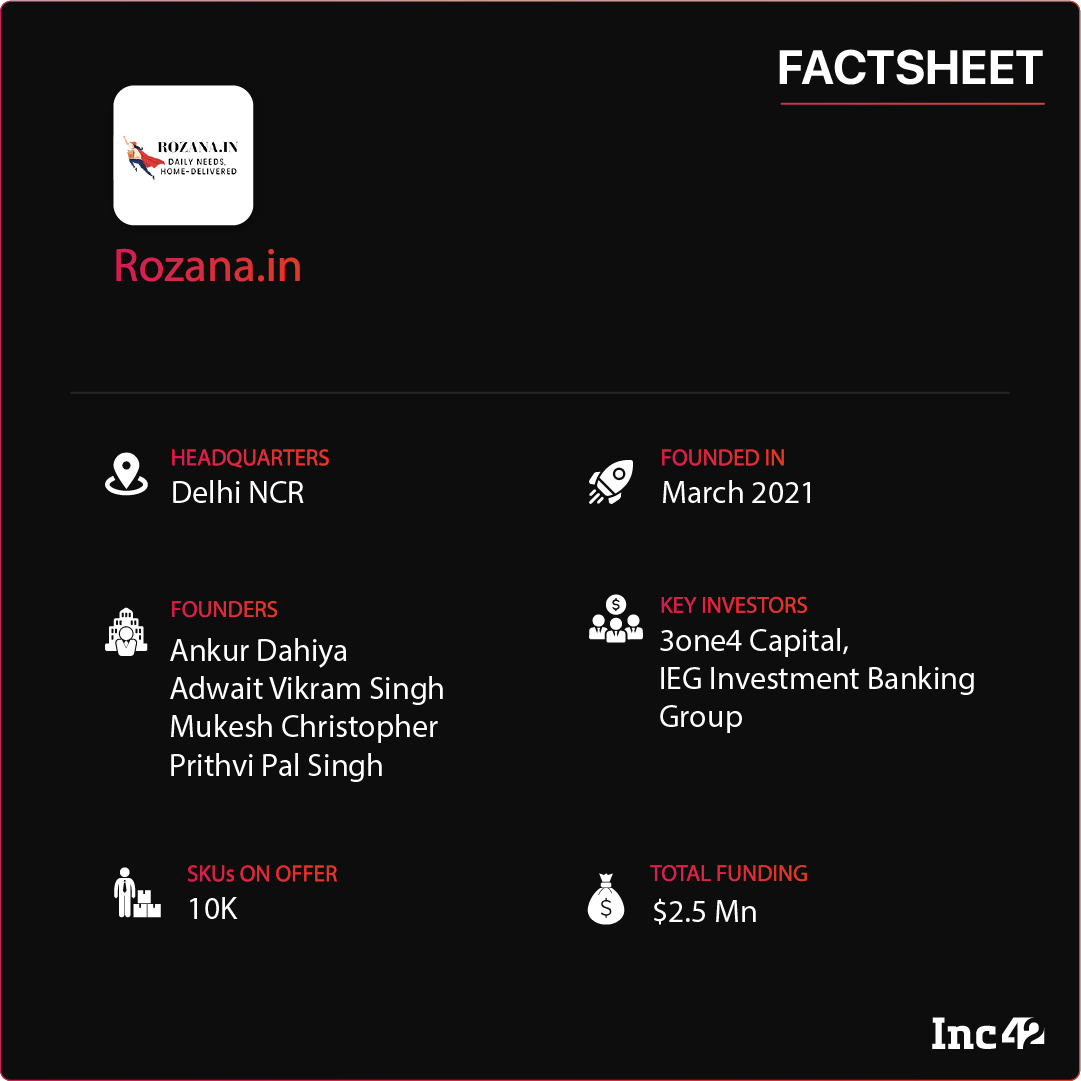

The startup recently raised $2.5 Mn in a Pre-Series A round, co-led by 3one4 Capital and IEG

Rural India is increasingly shedding its tech-averse image due to smartphone penetration and widespread internet use. The fantastic benefits of low-cost technology have bridged information gaps and brought consumers the latest lifestyle trends, making them savvy shoppers keen on aspirational buying.

Consider this. A recent study by Nielsen has found that 351 Mn individuals in rural India are active internet users, while the internet penetration stands at 49%. However, only 140 Mn Indians shop online. Add to that the growing demand for a wider range of FMCG products, cool fashion items and spiffy gadgets, and one would clearly understand the untapped potential of the Indian hinterland.

Aware of this demographic dividend, traditional ecommerce players and new-age direct-to-consumer (D2C) brands are expanding their reach to onboard rural customers.

“India is yearning for a (consumer) tech revolution in every small town and village that will cover more than 80% of the country,” said Ankur Dahiya, cofounder and CEO of Rozana.in. This ‘peer’-powered delivery platform has been modelled on social commerce, leverages AI for enhanced capabilities and caters to rural users.

Growing up in rural Haryana, Dahiya knew how difficult it was for villagers to procure ‘city-grade’ products readily available to their urban peers. Delivery process was far from hassle-free due to the lack of organised delivery systems.

That early experience made her more determined to sell best-priced sustenance to the rural populace, an advantage always enjoyed by urban shoppers whether they are buying online or offline.

“Even now, rural consumers have limited options. If they want to buy something out of the ordinary, they have to travel to another village or a neighbouring town,” rued Dahiya.

Dahiya, a PhD scholar in Data Science from IIM-Lucknow, along with Adwait Vikram Singh – set up her maiden venture. They exited the business when it got acquired in 2018 (more on that later).

Next on the cards was a rural-focussed startup. Last year, the former colleagues, along with Mukesh Christopher and Prithvi Pal Singh set up Rozana.in.

Referring to itself as a ‘rural commerce’ startup, Rozana.in aims to provide the same products to rural India as its metro counterparts. Dahiya claimed that its services reached more than 4 Lakh households within nine months. In April this year, it raised $2.5 Mn in a Pre-Series A round led by 3one4 Capital and Germany’s IEG-Investment Banking Group.

The startup currently claims to serve 4-5K gram panchayats in rural UP and Haryana, offering 10K+ SKUs.

Deep-Reaching, Asset-Light And Profitable: The Rozana Way Of Doing Business

Rozana.in’s cofounders had a demonstrated history of developing, scaling up and exiting a successful business called Routier. Four years ago, the Delhi-based B2B marketplace for trucking logistics was acquired by EbixCash, the India subsidiary of the NASDAQ-listed Ebix, a specialist in on-demand software and ecommerce services.

Routier used an effective combination of data analytics and AI to make seamless operations available in the cloud. The platform helped drive efficiency in the supply chain and catered to big retail and FMCG players like Reliance, Asian Paints, Coca-Cola, Pepsi and Mother Dairy.

“But this time, we wanted to channelise our entrepreneurial zeal and tech skills for the greater good of the rural community,” said Dahiya.

In simple terms, Rozana.in is an innovative blend of social commerce and hyperlocal delivery to bring everyday essentials and consumer goods to one’s doorstep. The goal is to provide a premium shopping experience to rural buyers in terms of quality and convenience.

Given its unique social commerce model, the peers at Rozana.in play three critical roles.

The first is to onboard new customers by spreading awareness about the Rozana.in app and website. The peers assist locals in placing orders for a smooth journey. “We carefully pick our peer partners. We want to empower locals who can help us reach a wide consumer base— be it an anganwadi worker, a local seller or an ASHA worker,” explained Dahiya. “As we directly source all goods, peer partners need not set up their shops. They can put the banners outside their homes and the entire village will know. That provides a lucrative opportunity to work as micro-entrepreneurs without spending much,” she added.

The startup directly procures products from the brands, thus eliminating the intermediaries and delivers it to the peers. The delivery time takes anywhere between a few hours to a day.

But there is a more significant advantage here. As the peers actively engage with the locals, these community communications and word-of-mouth publicity have gained the startup early traction, leading to minimal customer acquisition (CAC) costs.

The second business function includes forwarding all relevant deals and discounts to shoppers via popular social media channels like SMS and WhatsAp. This is a critical service for households in need of saving some money as food inflation climbed to a six-month high of 4.0% in December last year, according to NSO data.

Finally, since the peers live within a close distance to the customers, they either make deliveries to the customers’ doorstep or act as pick-up points for customers, Dahiya told Inc42.

This is a win-win for all as producers get better gate prices, thanks to the absence of intermediaries, and peers earn a 4-8% commission on each delivery. Rozana.in has not disclosed the pricing model but claims that the asset-light setup keeps every stakeholder in the black.

How AI Is Driving Rozana’s Growth

“Rozana.in is using artificial intelligence to grow its business so that a whole new generation becomes financially independent by working as entrepreneurs (read peers). This also helps us expand the online B2C market in the remotest parts of the country,” said Dahiya.

The rural commerce startup uses AI and big data analytics to delve into people’s purchasing behaviour and understand consumer demand. Also, the insights afforded by geolocation data help it zero in on people’s preference for each brand/product in each area and revamp the supply chain. The startup also takes feedback from its peer partners who are locals and know what products work in a specific area and what don’t.

Dahiya elaborated on how different brands would work in different localities. “The combination of AI/ML, big data and peer feedback tells us which are the highest-selling consumer products in rural parts of the country. This information helps us understand the local needs and products are populated accordingly on a user’s screen when they open the app/website.”

Tweaks And Turns: Will Rural India Change Ecommerce Forever?

The ecommerce sector in India has evolved rapidly in the past few years, spinning out intriguing variations like D2C (direct-to-consumer) and social commerce. Undoubtedly, the consumers’ willingness to shop everything online — from food and grocery to apparel to electronics — has emerged as a critical growth driver in this space.

According to IBEF, there are currently 157 Mn social commerce consumers in India. Further, the domestic social commerce market is expected to grab a $16 Bn to $20 Bn opportunity by 2025.

This space is getting quite exciting with the rise of social commerce-driven businesses such as Rozana.in, CityMall and Shop101.

It is not difficult to guess why a business model as urban as online shopping has taken the social commerce route to foray into rural India. Consider how customer trust is gained through community leaders/resellers/peers who drive down key challenges like exploding CACs or the lack of digital literacy. No doubt it makes perfect business sense to add the ‘social’ layer to any ecommerce format.

Rozana.in, a new entrant in the space, has leveraged this ‘social’ advantage and gained an overwhelming response, the startup claims. This further shows that Bharat shoppers are no longer apprehensive about going digital, while dipping their toes into rural India may be the right move for most online players.

Aware of the potential of ecommerce in rural India, Rozana.in is not resting on its laurels. First up is the rollout of a full-stack tech platform, followed by onboarding 300 Mn customers in the next two to three years. The startup plans to utilise its latest round of funding for this purpose.

The startup now has its sights set on every gram panchayat. It has initiated its operations beyond north India, beginning with Karnataka. “The response we’ve received from our peer partners and consumers has been overwhelmingly positive. We aim to diversify our product portfolio to cater to the growing aspirations of rural India,” concluded Dahiya.

![Read more about the article [YS Learn] How True Balance built a robust MVP to enable gradual portfolio expansion](https://blog.digitalsevaa.com/wp-content/uploads/2021/03/Imageb9rz-1614595093878-300x150.jpg)