The importance of last-mile delivery, or the movement of goods from a shipping hub to their final destination, came into sharp focus during the pandemic. Statista projects that ecommerce will drive the global last-mile delivery market to double to more than $200 billion by 2027. But as last-mile deliveries of essentials continue to increase, so, too, do customers’ expectations. According to an Anyline survey, more than three-quarters (76%) of shoppers said that an “unacceptable” delivery experience — e.g., a very late one — would affect their decision to order from a company again.

It comes as no surprise that the market for last-mile delivery technologies is an active one, then. Companies like Zippedi and Carmagos are using robots and mini distribution centers to streamline inventory for last-mile delivery, while others, such as Berlin’s GetHenry, are supplying e-bike fleets to delivery business customers like Gorillas and JustEatTakeaway.com.

A growing segment of the last-mile market is squarely focused on logistics, including Onfleet, which claims its software facilitates millions of deliveries per week for thousands of businesses (including Sweetgreen). Offering evidence that the demand for last-mile solutions might overcome broader economic headwinds, at least in the short term, Onfleet today announced that it raised $23 million in Series B funding led by Kayne Partners with participation from Savant Growth.

Co-founder and CEO Khaled Naim said that the new capital will be put toward product development, expanding Onfleet’s product and engineering capabilities, and enhancing the company’s enterprise offering. It brings Onfleet’s total raised to just over $40 million to date.

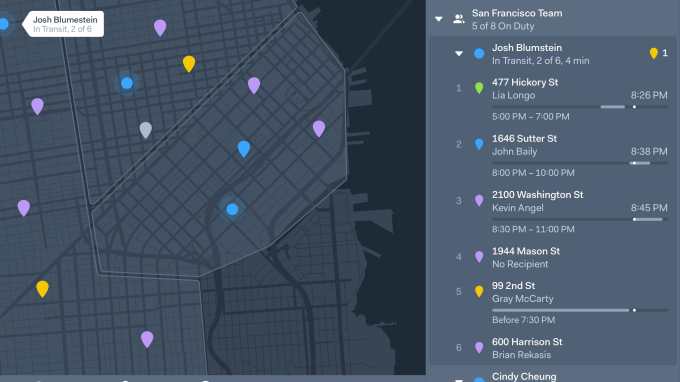

Tracking deliveries with Onfleet.

“The pandemic dramatically accelerated growth in the market (and Onfleet’s growth) and created a need for these types of services that did not exist previously,” Naim told TC in an email interview. “There was a time when fear and uncertainty surrounded grocery store visits, so delivery was simply a safer option for consumers, especially for demographics like the elderly or those with pre-existing conditions. Delivery, driven by consumer demand and the pandemic, is increasingly becoming the key channel for businesses especially in grocery, cannabis, prepared meals and restaurant, alcohol, pharmacy, and retail categories.”

Naim co-launched Onfleet in 2015 with Mikel Carmenes Cavia, a high school peer of Naim’s, and David Vetrano, who Naim met while pursuing his MBA at Stanford. Growing up in the Middle East, the three were inspired to develop a “universal way to share a location,” which became Addy, a platform that allowed anyone to create a URL representing latitude and longitude coordinates.

After trying to commercialize Addy with delivery businesses, Naim said he realized that many of these businesses weren’t using logistics technology. Instead, their dispatchers were memorizing every tree and fork in the road and using that experience to manage driver fleets. It’s then when he, Cavia, and Vetrano decided to expand their vision to develop a delivery management platform: Onfleet.

“As delivery drivers started to use smartphones to communicate with dispatchers we thought: ‘Okay, that’s interesting. Most drivers are going to have smartphones very soon. If they all have devices, the dispatcher could track them with GPS, send them work in real time and optimize routes in a more dynamic way,’” Naim said. “The ‘last mile’ costs and complexities associated with delivery, especially for newcomers, are difficult to manage. Onfleet’s technology helps businesses streamline this onerous undertaking by efficiently connecting businesses, dispatchers, drivers, and deliveries to happy customers.”

OnFleet offers a dashboard for dispatching where users can optimize routes and search for drivers and deliveries or pickups. The platform recommends routes accounting for factors like time, location, capacity, and traffic, and can auto-assign tasks to drivers.

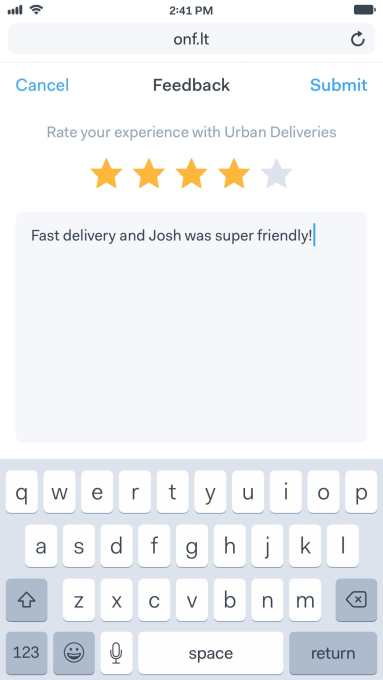

Onfleet also provides status updates to customers including real-time driver tracking and proof of delivery. On the backend, managers — who can chat with drivers via the platform — see performance metrics like on-time rates, service times, feedback scores, and more.

“Onfleet leverages machine learning for driver optimization and prediction, providing operations teams and consumers to-the-minute information, decision-automation, and proactive notifications. We derive a dataset by analyzing location data for delivery segments and filtering anomalous segments — we’ve collected around 500 million miles of anonymized driver location data comprising tens of billions of data points,” Naim said. “Our predictive ETA feature was the first significant application currently of this data. We’re working on more refined models to better predict travel time and operational parameters and aspects of the delivery process, such as parking and building entry time.”

Image Credits: Onfleet

Some drivers might object to that kind of telemetry, particularly in light of recent reporting on the travails of third-party delivery fleets. For example, according to a recent study by the Strategic Organizing Center, nearly one in five drivers making deliveries for Amazon suffered injuries in 2021 as they faced punishing quotas and pressure to ferry packages as quickly as possible.

Naim, though, argues that Onfleet merely offers a way to help underperformers improve at a time when there’s a severe shortage of drivers. The U.S. alone is experiencing a shortfall of more than 80,000 truck drivers, the American Trucking Associations estimates — a number that’s expected to climb as delivery demand climbs.

“We want to make it easy for small- and medium-sized businesses to track the value they add to their business by offering delivery,” Naim said. “The driver shortage has plagued the transportation, logistics, and delivery industry for years, and the pandemic worsened the impact it has. With the talent shortage, the prioritization of work/life balance since drivers spend more time away from home, and the skills gap given the profession can require special training such as truck licenses, etc, it’s getting harder to find people to hire for these types of roles. Our platform supports businesses in this area with automated route optimization, so they can monitor activity and reduce the number of drivers needed at any given time.

Naim wasn’t willing to peel back the curtain on Onfleet’s financials, but he claimed the company is “on track for continued growth” as it attempts to differentiate itself from rivals such as Wise Systems, Routific, and Bringg. Within the year, San Francisco, California-based Onfleet plans to expand its workforce from 120 people to around 150.