Finch, which builds APIs to connect corporate payroll, HR, and benefits systems, today announced that it raised $15 million in a Series A funding round led by Menlo Ventures with participation from General Catalyst, Bedrock, Sempervirens, and Y Combinator. Co-founder and CEO Jeremy Zhang said that the new money will be put toward growing the startup’s 36-person workforce, particularly on the engineering, sales, and developer sides.

Zhang and Finch’s second co-founder, Ansel Parikh, initially started the startup to build a platform that would allow companies to offer lending products to their customers. But after contacting payroll and HR providers to discuss integrations, most didn’t reply, Zhang said, or asked that Zhang and Parikh go through a lengthy procurement process.

“As developers, we were looking for a Segment-, Plaid-, or Stripe-like developer experience. We discovered that such an API infrastructure did not exist in the employment sector,” Zhang told TC in an email interview. “Many developers have been forced to resort to CSV uploads and FTP, or be added as third-party admins. Other companies have instead opted to spend millions in development costs … to build one-off integrations. This lack of connectivity in the industry results in high administrative costs for employers, increased lock-in by legacy providers, and prohibitively high barriers for innovators.”

Zhang previously worked at Amazon under the company’s robotics R&D division before leading product for Smartcar, an API platform for connected vehicles. Parikh came from the venture investing sector, having worked as an analyst at Paradigm Capital and an investor at Bond and Kleiner Perkins.

With Finch, Zhang and Parikh set out to build what Zhang describes as an “API for employment systems.” The platform acts as a connectivity layer for over 140 employment systems, letting apps and services such as Gusto, Justworks, Zenefits, and ADP access employment data stored in disparate systems.

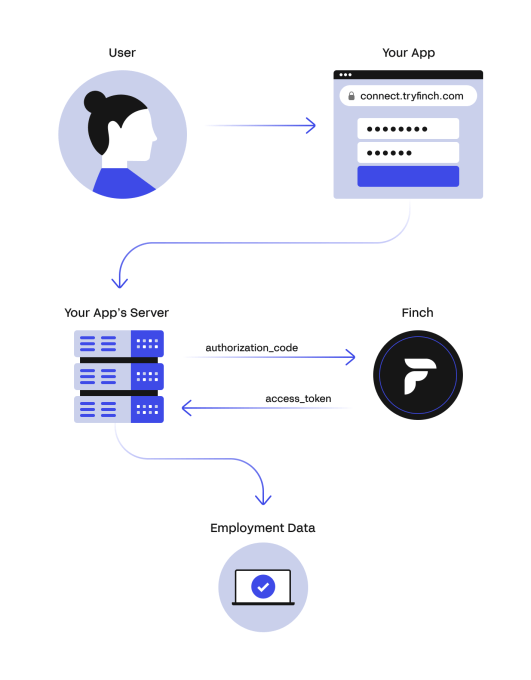

Image Credits: Finch

“Our direct competitor is the current status quo in the industry, which operates in three main models: CSV uploads, SFPT servers, and internal operations,” Zhang explained. “Applications require HR admins to upload employee information, enrollment, and pay statements. Most of the industry has adopted transferring files through SFTP servers, which is more secure than sending employee data via email. But it requires setting up SFTP servers and lacks standardization across companies. As a result, many companies depend on an internal operations team to manually log in and pull employee reports or set deductions and contributions.”

To address specific HR pain points, Finch also offers specialized services like Finch Benefits, which is designed to simplify the process of creating benefits plans, enrolling employees in benefits, and handling benefits deduction and contribution updates. When an employee changes their contributions in a benefits app, Finch Benefits automatically updates it in the correct tax category on their paycheck.

Some companies might balk at the idea of funneling employee data through a third-party platform like Finch. But Zhang said that Finch doesn’t currently run an analysis on data passing through its systems and that customers can delete data from Finch or stop sharing data with an individual Finch-connected app at any time.

“Suppose you have used Finch to facilitate a connection between your employment system and an app. In that case, Finch will share the employment data with that app. The types of data Finch shares with your apps depend on the permissions granted through the authorization process and the information made available by the employment system,” Zhang said. “We do not share the data with any app without consent. We do not sell or rent the personal information collected.”

Demand, evidently, is strong. While declining to reveal revenue, Zhang said that Finch is serving over 10,000 employers ranging from startups to publicly-traded companies. Pave, Vanta, and Teampay are among its customers.

“Employee data is scattered across multiple systems without a single source of truth. This continues to be the case as the industry becomes more complex with additional players,” Zhang said. “We have built a strong partnership and engineering team to build connectivity and create innovation and collaboration within the industry.”

The goal in the coming months is to expand Finch’s support for systems beyond those that manage benefits, recruiting and staffing, time and attendance, and employee identity, Zhang said. He expects that — down the line — Finch will be able to assist with tasks including process reimbursements, running payroll, and “other areas that directly impact money movements.”

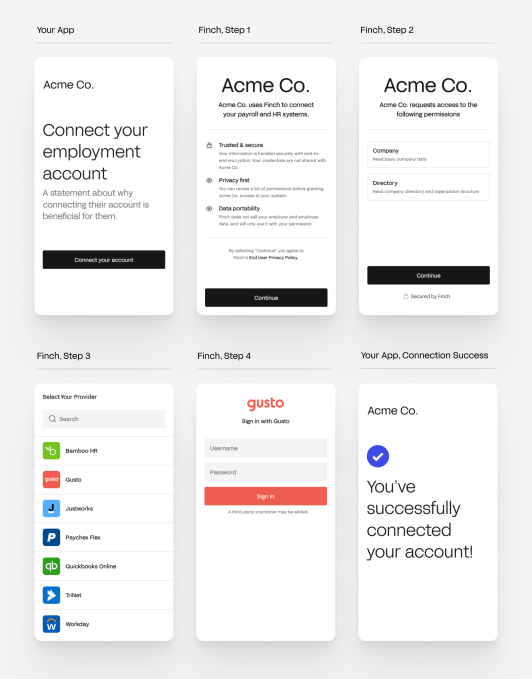

Finch’s connect flow.

“The pandemic accelerated our business and caused several shifts in the employment sector. More than $12.3 billion was invested into global HR tech in 2021,” Zhang said. “Finch is powering benefits providers that help employers offer alternative retirement plans, mental health benefits, commuter reimbursements, financial wellness programs, and even climate change benefits. [We’ve] teamed up with hybrid workforce management platforms, business registration services, and procurement and expense tools that help employers create more flexible work environments for their employees. [And we] work with learning management systems, onboarding, and professional training platforms to help employers invest in their workforce for the long term.”

Finch’s growth strategy will be the key to it remaining competitive in a market that’s seen a lot of interest lately. Andreessen Horowitz published an entire research report on the promise of payroll APIs, while Plaid recently released a payroll API system for income verification called Plaid Income.

Finch competes with Merge, a platform that integrates with existing HR, accounting, and ticketing platforms in a single dashboard. Another rival, Flexspring, also offers a product that connects different HR systems to enable data sharing between them.

With the most recent funding, Finch’s total capital stands at $18.6 million.