While the board meeting took place as scheduled, the directors decided to adjourn voting on key issues, including the management buyout or liquidation

If the MBO is accepted by the board and shareholders, the new entity will likely have new appointments for chief financial officer

The management buyout offer includes a commitment from an unnamed investor for $8 Mn as well as a five-year business plan for the new entity

While all eyes and ears were on Zilingo and its high-profile board meeting today morning to discuss the company’s future and the proposed management buyout offer, things came to an anticlimactic end as the voting on various agenda items was adjourned.

Sources told Inc42 that while the board meeting took place as scheduled, the directors decided to adjourn voting on key issues, including the potential liquidation of Zilingo and also the management buyout offer (MBO) by cofounder Dhruv Kapoor and backed by the other cofounder and ousted CEO Ankiti Bose.

While the board is said to have agreed to engage with the management on the buyout offer, the decision is likely to be only made in 48 hours or later this week.

The management buyout offer, reported first by Inc42 on Sunday (June 19), included a commitment from an unnamed investor, who would be infusing $8 Mn into the company in tranches. It also spoke about the liquidation of the existing corporate entity behind Zilingo and the formation of a New Company or NewCo, which would assume control of all Zilingo subsidiaries.

If the MBO is accepted by the board and shareholders, the new entity will likely have new appointments for the chief financial officer and other leadership positions that are currently vacant.

Zilingo’s existing debt commitments would be paid off through the liquidation, according to the terms proposed by Kapoor to shareholders including Sequoia Capital India and SEA, Sofina, Burda Principal Investments, angel investors Kunal Shah and Sandeep Tandon as well as key ZIlingo employees such as COO Aadi Vaidya and former head of marketing Marita Abraham.

Zilingo Founders Reconcile

Former CEO Bose has backed the plan and sources tell us that the two founders are looking to reconcile and discuss the way forward after many disagreements over the past few years.

Indeed, the primary motive behind the reconciliation is the desire to continue running the company and protecting the jobs of employees, as indicated by Bose’s statement after the MBO was proposed.

“As founders it is our ultimate responsibility to make sure that we do whatever it takes to make sure the lights stay on at Zilingo and in the homes of the hundreds of people who are part of it. No matter what our differences may be, at the end of the day we started this company with the same goal. Today we have come together to fight for that same goal,” Bose said.

Future Still Uncertain

However, there are serious concerns about the reputational damage to Zilingo’s brand name in the aftermath of the months-long battle between Bose and the board.

Indeed, given that a new company is being formed to take the business forward, it is very likely that the company will rebrand itself in the months to come.

However, the biggest questions currently are around the viability of Zilingo’s business itself. Through the course of our conversations with several fashion industry stakeholders over the past few months, we have realised that not only is the supply chain still highly fragmented, but Zilingo does not have adequate penetration among the suppliers, manufacturers or retailers.

Can Zilingo Stay Afloat In The Future?

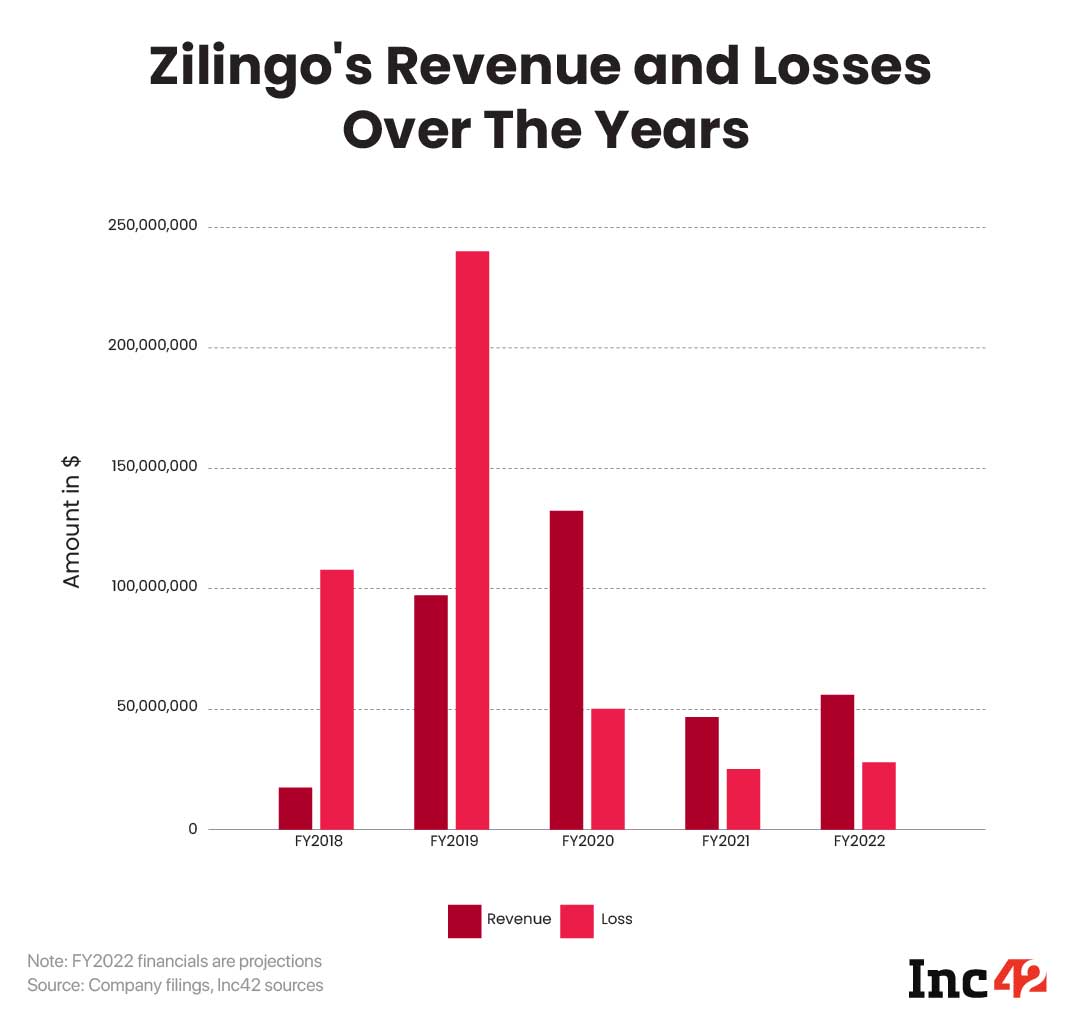

In terms of revenue, the B2B business has been the only income-earner for Zilingo. According to unaudited and undisclosed financials, which Inc42 has procured from sources in the company, Zilingo pulled back its losses in 2020 and 2021 due to its shedding of the B2C business.

Unaudited financials show that B2B services (longtail, and enterprise sourcing & SaaS) brought in $43.4 Mn in operating revenue (7% of GMV) for Zilingo in FY2021, with this projected to grow to $61 Mn in FY2022 (6% of GMV), however, in the past Bose has claimed that it is unlikely to have met this projection.

Without the audited financials, it’s hard to estimate just how sustainably the B2B business is growing.

Sources have informed Inc42 that the five-year plan indicated in the MBO hinges around enterprise sourcing and SaaS businesses, while the long-tail fashion marketplace for niche fashion items is likely to be shelved due to its operations-heavy nature.

What About Employees?

And finally, when it comes to the impact on employees, at the moment, there’s no clarity on that front either. While typically management buyout offers are seen as a relief for companies in crisis, it is largely a solution to prevent dilution or devaluation.

Typically, such buyouts involve churn and transitions that led to restructuring, cutbacks on benefits or downsizing. This is likely to be the case with Zilingo, according to the source who is working closely on the MBO.

The five-year plan being proposed under the MBO terms might include certain performance benchmarks and not only will the management of ‘NewCo’ be under pressure to deliver them, but so will the employees.

And then there’s the matter of culture as well. Not only will Zilingo have to prove that it is a viable business for the new investors and whatever shareholders stay on board, but there will also be intense pressure to prove itself as a worthy destination for technology and engineering roles, which are super critical for a B2B business.

So despite the potential ray of light at the end of the very dark tunnel with Kapoor and Bose’s MBO proposal, the future for Zilingo still remains uncertain.