NSE Nifty50 ended the week over 1% lower at 16,049.20, while BSE Sensex closed 1.3% lower at 53,760.78 on Friday

Shares of Paytm’s parent One 97 Communications surged as much as 5.7% this week to over INR 738 apiece to touch their highest levels since March 11 on the BSE

Zomato shares ended the week 1.6% lower from the previous week, and analysts expect further downside in the stock

The Indian share market continued to remain volatile this week, with the benchmark indices – NSE Nifty50 and BSE Sensex – ending lower on a week-on-week basis, shedding some of the last week’s gains. Major selling in IT and banking shares weighed heavily on the indices.

NSE Nifty50 ended the week over 1% lower at 16,049.20, while BSE Sensex closed 1.3% lower at 53,760.78 on Friday (July 15).

However, despite a steady drop in four sessions this week, the indices ended 0.69% and 0.65% higher on Friday, respectively, from Thursday’s close.

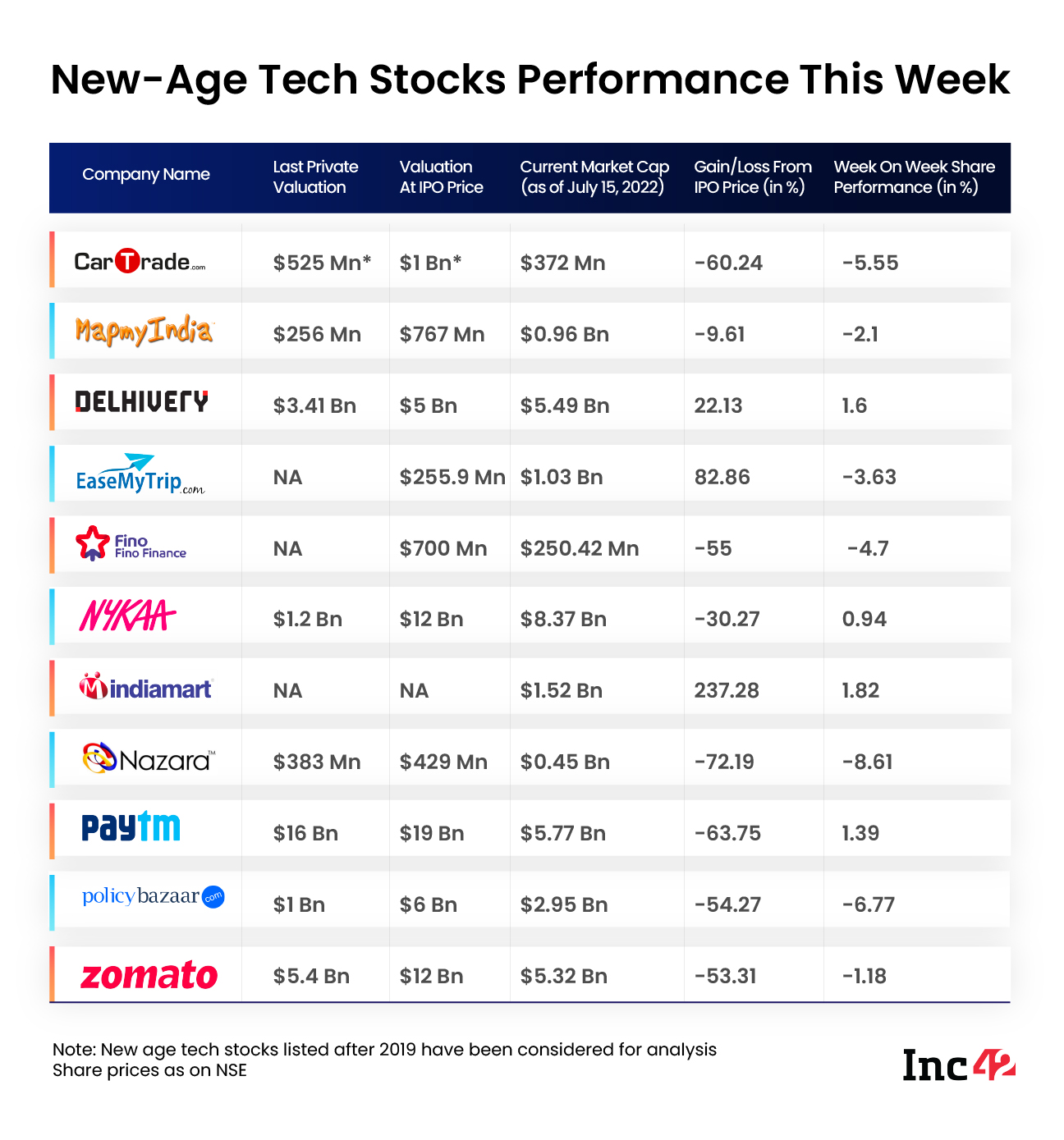

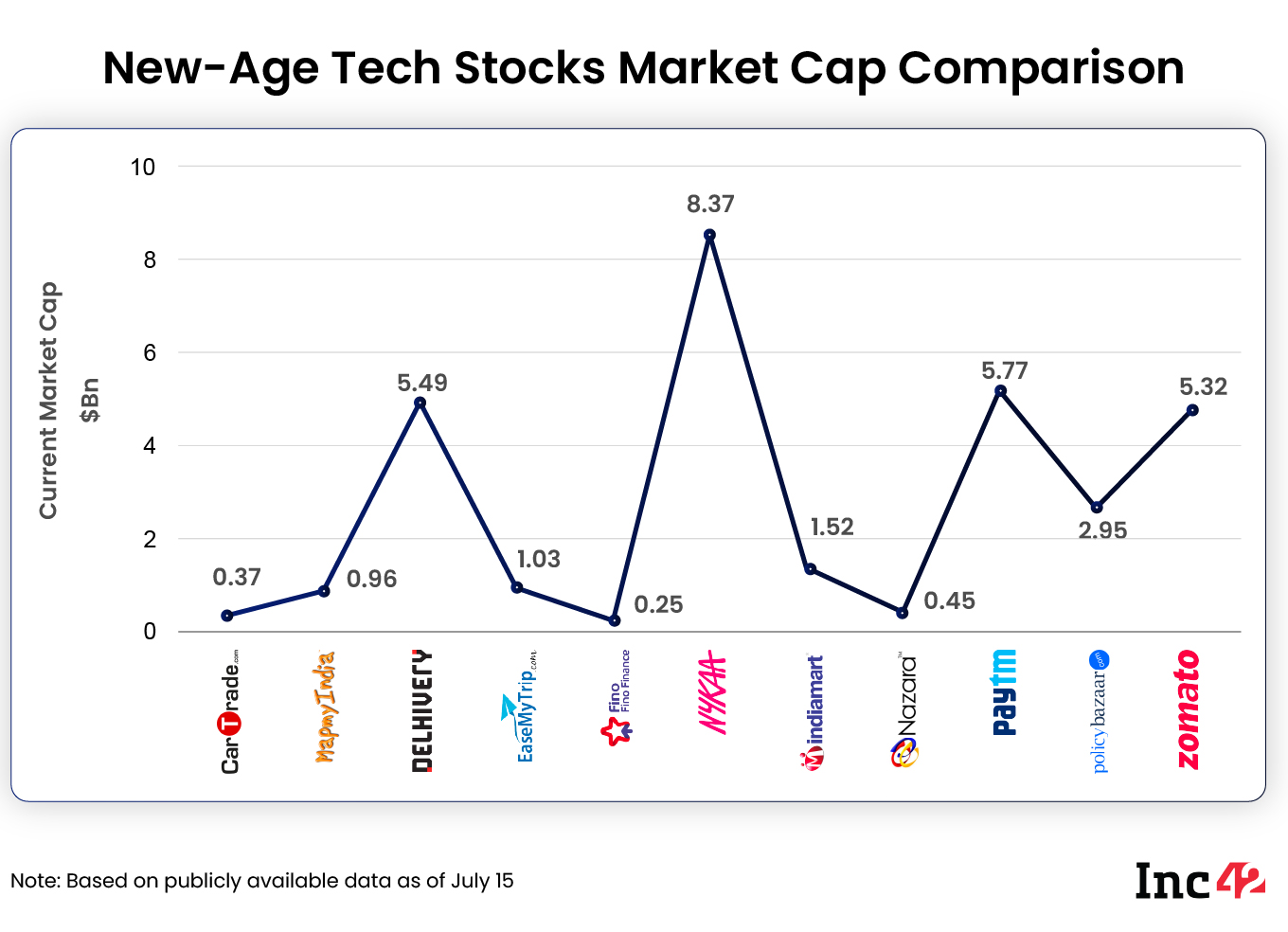

The 11 new-age internet companies listed in India after 2019 saw mixed market sentiments this week. Driven by various sector-oriented as well as business-specific factors, a majority of these stocks ended the week on a sombre note.

However, shares of Delhivery, the latest startup to list on the exchanges, rose 1.13% from Thursday’s close to INR 605.15 on Friday, while it ended 1.6% higher on a week-on-week basis.

On the other hand, shares of IndiaMART rose 1.46% to INR 3,975.75 on Friday. On a week-on-week basis, the shares of the company closed 1.82% higher.

Nykaa parent FSN E-Commerce and Paytm parent One 97 Communications closed lower on Friday compared to Thursday’s close, but on a week-on-week basis, the stocks ended higher by 0.94% at INR 1,409.25 and 1.39% at INR 708.65, respectively.

Let’s see how the major tech stocks from the Indian startup ecosystem performed on the Indian stock exchanges this week and some of the key trends:

The 11 new-age tech stocks ended the week with a total market cap of around $32.48 Bn.

Paytm Shares At A Four-Month High

Shares of Paytm parent One 97 Communications surged as much as 5.7% this week to over INR 738 a piece to touch their highest levels since March 11 on the BSE. Paytm started rising since the beginning of the week, first driven by its announcement about increased loan disbursements in the June quarter of FY23.

The fintech startup said that it disbursed 8.5 Mn loans during the quarter ending June 2022, a growth of 492% on a year-on-year (YoY) basis.

The gain continued further during the week after Paytm announced extending the deadline to update KYC for its direct mutual fund users and opening demat accounts by October 31. Earlier, the deadline was till July 25.

Paytm, founded by Vijay Shekhar Sharma in 2010, offers several payment instruments on its platforms, including a wallet, net banking, among others. It went for an IPO in November 2021, and got listed at INR 1,950 on the NSE and INR 1,955 on the BSE.

As per its latest announcement, Paytm has a network of 3.8 Mn payment devices across India, as of June 2022, including its soundbox and point of sale (PoS) devices.

Paytm also joined the government’s ambitious Open Network for Digital Commerce (ONDC) recently.

However, the stock has been a laggard on the exchanges ever since its listing. It also made a lacklustre debut at a discount of about 10% on the issue price.

Paytm reported a 41% YoY increase in its net loss to INR 2,396.4 Cr in FY22. As per analysts at LKP Securities, Paytm, after a massive underperformance post listing, has now started showing some base formation at the lower end.

“The stock on the daily chart is trading in an uptrend and remains in a buy-on-dip mode with strong support at 635 levels,” LKP Securities said.

Policybazaar Among The Biggest Losers; Hits All-Time Low

Shares of PB Fintech, the parent company of insurtech startup Policybazaar, hit their all-time low at around INR 521.06 this week. On a week-on-week basis, the shares were down as much as 7%, ending the week at INR 524.30 on the BSE.

While the Policybazaar shares have been falling ever since their stock market debut, plummeting over 54% since its listing in November last year, the big decline this week came as a surprise to several market analysts Inc42 spoke to.

Analysts largely believe that Policybazaar is well-positioned to benefit from the increasing insurance penetration in India and said that the fall this week was largely driven by technical reasons. However, the downtrend is likely to continue, at least in the near term.

“The stock is trading in a strong downtrend with lower high and lower low formations intact. The stock on the daily chart has given a fresh breakdown which indicates the momentum is likely to be on the downside in the near term,” said an analyst at LKP Securities.

Founded in 2008 by Yashish Dahiya, Alok Bansal and Avaneesh Nirjar, Policybazaar allows users to purchase insurance policies – from life to car to two-wheeler – on its online platform. PB Fintech listed on the exchanges last year at INR 1,150, a 17.35% premium over the issue price of INR 980.

In its Q1 FY23 analysis report for tech-stocks, brokerage JM financial said that after a topsy-turvy FY22 for the insurance sector, return to normalisation is expected in FY23, particularly in categories such as auto and term insurance.

“While we do bake-in Policybazaar to lose some market share to insurers’ direct channels and fintech players such as PhonePe, we still expect the company to continue being the dominant insurance distributor in the country with 41.1% market share of total insurance sourced digitally,” said the analysts.

Zomato Falls Again After A Week’s Rise

Shares of foodtech startup Zomato have gone through several series of downfalls so far. The latest one was driven by its acquisition of quick commerce platform Blinkit. After a significant fall and losing over INR 12,000 Cr of investors’ wealth during the market week ending July 1, the shares rose in the subsequent week.

However, the stock again declined this week, ending 1.6% lower on a week-on-week basis on the BSE to INR 53.95.

Analysts expect the downtrend to continue in the near term given investors worry about the loss-making trajectory of the food-delivery startup.

An analyst at LKP Securities said that the stock looks quite weak currently. “One should avoid the stock at the current levels as a further downside of 10-15% is expected from the current levels,” added the analyst.

The Deepinder Goyal-led startup reported widening of its net loss to INR 1,222.5 Cr in FY22 from INR 816.4 Cr in FY21, though its operating revenue more than doubled to INR 4,192.4 Cr in the fiscal year.

While its Q1 FY23 results are still awaited, JM Financial analysts trimmed its revenue CAGR estimate to 29% from an earlier 32% over the FY22-25 period. However, the analysts said that they expect over 10% sequential growth in Zomato’s food delivery gross order value (GOV) in Q1 to INR 6,457 Cr, driven by strong order volumes due to IPL seasonality

Zomato listed on the BSE and the NSE in July last year. The shares listed on the BSE at INR 115 per share, an over 50% premium to its issue price. On the NSE, the shares made their debut at INR 116.