Inc42’s 30 Startups To Watch series was launched in February 2020, and August 2022 marks the 30th edition of the list that features notable and sector-agnostic early stage startups

So far, the Inc42 team has featured 700+ unique tech startups founded between 2018 and 2022 and disrupting the sectors where they operate

This month’s list focusses on enterprise tech use cases across fintech, ecommerce, drone and blockchain

We are finally in the month of August and celebrating a milestone at Inc42. The current list of 30 Startups To Watch marks the 30th edition of this series, bringing to the fore a unique journey with the focus on evolution and innovation embraced by the Indian startup ecosystem.

Over the past 29 editions, we saw an overwhelming response from young companies, explored thousands of startups and featured more than 500 early-stage entities, many of which raised big funding or even got acquired. For the past 12 months, we have also taken this content off the paywall, and one can peruse the previous editions here for free.

As we sat down to shortlist the startups for July 2022 and did a scrupulous reality check, things got curiouser and curiouser. After a prolonged funding frenzy in the wake of the pandemic and the resultant unicorn boom, 2022 is witnessing strong headwinds. The uncertainty over the Omicron variant of the coronavirus continues. The investor dollar is no longer sloshing around. Bloated head counts are getting axed every day. And profit has become the new survival mantra. Still, there is an all-new frothy territory, a common theme emerging and quickly taking over the startup land.

Just scratch the surface and see how success has become synonymous with new-age tech adoption and applications. How India’s digital-first narratives are creating bottomless opportunities for enterprise tech, be it the financial ecosystem, customer intelligence or Web3 and blockchain. Or how breakthroughs in artificial intelligence, IIoT, electric vehicles and UAVs are driving the deeptech space.

In brief, the Industrial Revolution 4.0 is here to stay, and tech startups may soon reach a new peak of froth. The 30th edition of the ‘30 Startups’ column captures the new normal, the tweaks and pivots, and the seize-the-day philosophy of new-age Indian startups.

30 Startups To Watch: July 2022

Throughout the ‘30 Startups’ series (including the July 2022 edition), Inc42 featured companies which became operational after 2018 even though they were registered earlier. These were either bootstrapped companies or in the early stages of equity funding.

It is worth noting that when we started the list amid the pandemic, startups providing remote solutions for various segments, including edtech, healthtech, entertainment and ecommerce, took centre stage. This trend has not changed, although life is slowly returning to normal. In other words, solutions that initiated the digital hustle are here to stay and evolve.

So, it is not surprising that we have featured 11 enterprise tech startups, followed by fintech (8), ecommerce (4), blockchain (2) and drone technology (2). We have also listed an environment tech startup curbing the carbon footprint and another building a wealth management platform to solve users’ healthcare and insurance-related issues.

Of the 11 startups in the enterprisetech segment, three companies specialise in assistive sales; one analyses customer behavioural data, and another helps companies manage their SaaS spending.

Although certain sectors (read edtech) are drawing flak from consumers, social media users and even the government, others, like some fintech sub-segments, are struggling to cope with the recent reforms that disrupt the status quo. For instance, the ‘buy now, pay later’ (BNPL) model is still in the regulatory crosshairs, and the road ahead is unclear.

In contrast, various fintechs from the list are adding value by working on inclusive finance or improving the savings and investment habits of Indians instead of pushing people to ‘buy’ high-value products online.

The 30th edition highlights 30 upcoming companies whose products and services have been developed to cope with the new normal. They are putting technology on the pedestal and accelerating their way into market disruption.

Editor’s Note: The list below is not meant to be a ranking of any kind. We have listed the startups in alphabetical order.

Actyv.ai

Share On:

Why Actyv.ai Made It To The List

While embedded finance is primarily associated with small loans, serial entrepreneurs Ramkumar Thirumurthi and Raghunath Subramanian found that small businesses across the supply chain ecosystem still lacked the finance to grow their businesses. To help ease the process, the duo started Actyv.ai in 2019.

The Bengaluru-based lending tech startup has embedded B2B BNPL and insurance products to bring together all stakeholders, including enterprises, channel partners (distributors and retailers), banks and insurers.

Actyv.ai offers four products. First, there is Actyv Go to automate SME onboarding and offboarding by digitising document collection, information extraction, data verification, fraud checks and digital document signing. Its second product, called Actyv Score, provides a financial health report for each distributor and retailer to help financial institutions underwrite loans. Next comes Actyv PayLater, a BNPL option for target distributors and retailers to raise loans based on their Actyv Score. Finally, there is Actyv Insurance, providing general insurance products (against fire, burglary and more) to secure the businesses of distributors and retailers and bite-sized credit insurance to reduce the BNPL credit risk. Actyv charges an annual platform usage fee.

The startup has partnered with B2B businesses from FMCG, energy and construction sectors and deployed loans by tying up with Axis Bank, Kotak Bank and Canara Bank. It is now building a sector-agnostic product bouquet with minor sector-specific changes. Actyv aims to partner with all Tier 1 banks and insurance companies by FY23 and looks to expand to the Southeast Asian and the MENA regions. It also plans to enter the EU market in another two years.

Arboreum

Share On:

Why Arboreum Made It To The List

The credit approval rate for MSMEs in India is less than 50%, even though they contribute more than 29% to the GDP and SMEs alone account for two-fifths of the loan applications for trade finance. The outcome: Most debtors approach informal sectors or the grey market and end up paying high interest rates. To address this pain point, Arboreum refrained from launching a run-of-the-mill lending tech company and built a credit unions-as-a-service platform in 2019, allowing formal credit to piggyback on informal loans.

This is how it works. The Mumbai-based startup allows MSMEs and allied players to form credit unions where they deposit some of their funds or future assets like accounts receivable. When a small business requires a loan, the union members concerned facilitate part of it from this and earn interest income. The rest of the amount comes from external lenders through a structured lending process where the credit risk is reduced through a well-diversified loan portfolio. The fintech company has developed a credit underwriting system based on behavioural patterns and helps its users build a good credit score for timely payments.

Currently, the fintech startup offers BNPL loans or issues commercial paper (CP). It earns revenues from interest on credit and margins on invoice factoring.

So far, Arboreum has only done a small pilot with the Andhra Pradesh government. It is now building efficiencies to market its products at scale in FY23.

Baaz

Share On:

Why Baaz Made It To The List

The concept of selling products via videos dated back to the blaring Homeshop18 channel on TV and then made a foray into YouTube, with product links in description boxes. Next came social selling and live video commerce to help create customer trust and push sales. But the process is not fully automated yet. In most cases, customers place orders after videos are played instead of in-streaming shopping.

To make the process quick, convenient and efficient for buyers and sellers, Baaz from Bengaluru launched a virtual store in 2020 where businesses can create live videos to hawk their products online and answer shoppers’ queries in real-time. For buyers, the SaaS platform features an online inventory to pick and choose products, add them to carts and pay within the same streaming window.

Shipping systems are available on the platform to help companies sell globally. These solutions can also be integrated with Shopify stores and ecommerce websites for greater convenience.

Baaz claims to have onboarded more than 1K merchants and witnessed an add-to-cart rate of 40% and a conversion rate of 11%.

Buildd

Share On:

Why Buildd Made It To The List

Digital commerce is growing exponentially, and so is the need for micro-fintech services on every transactional platform. So, Buildd was launched in 2021 to help fintech and non-fintech companies provide financial products and services to their users. To begin with, the Pune-based startup has developed an API middleware for a credit line. Like conventional APIs, this layer sits between the client level and the backend core system of record, translating commands into execution. It also offers a service bouquet, including revenue-based financing, BNPL, fund transfer and card-as-a-service.

The fintech startup providing embedded solutions is still in the early-access mode, but 19 brands have already integrated its offerings. Its flagship is Buildd OS, a credit-as-a-service stack that allows digital companies to offer products and services on credit. Additionally, Buildd OS provides an escrow API and a patent-pending treasury API for safe payments and zero mis-selling. The SaaS firm gets a commission on the transaction volume and charges a monthly API subscription fee.

Buildd aims to go live by FY23 with 50 partners on credit stack and 20 each on escrow and treasury API and eyes $225K in revenue. It plans to work with 200+ brands to offer vertical fintech SaaS solutions and targets an ARR of $20 Mn by 2025.

Castler

Share On:

Why Castler Made It To The List

As India increasingly adopts a digital ecosystem, online commerce frauds and scams are growing in sync. But when a friend fell prey to a phishing attack, former MobiKwik CBO Vineet Singh decided to build a robust product that would keep people’s money secure during online transactions. After months of research, Singh and former Treebo sales head Dinesh Kumar launched Castler in 2020. The idea was to create an escrow service for every online transaction to safeguard the interests of all stakeholders.

Simply put, the New Delhi-based startup allows a buyer (operating in B2B/B2C space) to create an instant digital escrow facility where he can block the money for the said transaction. To start using Castler, both buyer and seller must get their eKYC done, agree to the service terms and specify the transaction value. The buyer will then deposit the payment in the escrow account created with Castler, and the seller will deliver the goods/services. If the buyer approves the same, Castler will release the payment to the seller, ensuring that no fraud happens on either side.

The fintech SaaS startup currently offers custom solutions for sellers of physical goods, especially businesses leasing properties, property and vehicle resellers and a wide range of service providers. It has partnered with banks, law firms and trusteeship companies to provide API-based solutions, including digital escrow, agreement and contracts and trusteeship services. The company charges a fee/subscription from buyers/sellers (or both).

The minimum transaction value has to be INR 1,000 to use Castler, but there is no upper ceiling. Since its launch, the company claims to have facilitated a total transaction value of INR 2,500 Cr for 1,500+ customers. It plans to make the most of its early-mover advantage and maintain monthly transactions worth INR 1,000 Cr in FY23.

Climes

Share On:

Why Climes Made It To The List

Uncontrolled carbon emissions trigger global warming, leading to climate change and its catastrophic effects. As we use the internet, mine cryptos, burn fossil fuels and extend industrial ops without paying much attention to our carbon footprints, the environmental and health impacts could be irreparable. Of course, projects and NGOs are trying to reverse these impacts. But these are often poorly funded, and their activities are rarely publicised to power the environmental drive. On the other hand, Anirudh Gupta (ex-Airbus) and Siddhanth Jayaram (ex-Kalaari Capital) believe that financing these projects will be the biggest lever to solve climate issues, and Climes was born in 2021.

The New Delhi-based startup has initially targeted the consumer internet space to fulfil its mission. It has partnered with ecommerce companies and provides details to consumers to make them aware of the carbon footprints they generate during online shopping. Shoppers are then requested to contribute to the projects working on restoring biodiversity, reviving degraded forest lands, promoting regenerative land management, producing energy from waste material and increasing the green cover.

Some prominent projects raising funds via this platform include Farmers For Forest, Say Trees, Hasten and Acacia. According to Climes, more than 37K individuals shopping on partner brands like Roamhome, Zingbus, MakeMyTrip and The Wedding Brigade have neutralised over 281,000 kg of CO2. Users can also contribute via the Climes website.

For every rupee contributed to Climes’ projects, the startup rewards an in-app currency called Climes. These can be used to redeem rewards when people buy from sustainable brands like Neemans, Blue Tribe and Clan Earth. The company is now looking to design the right incentive for partner ecommerce brands.

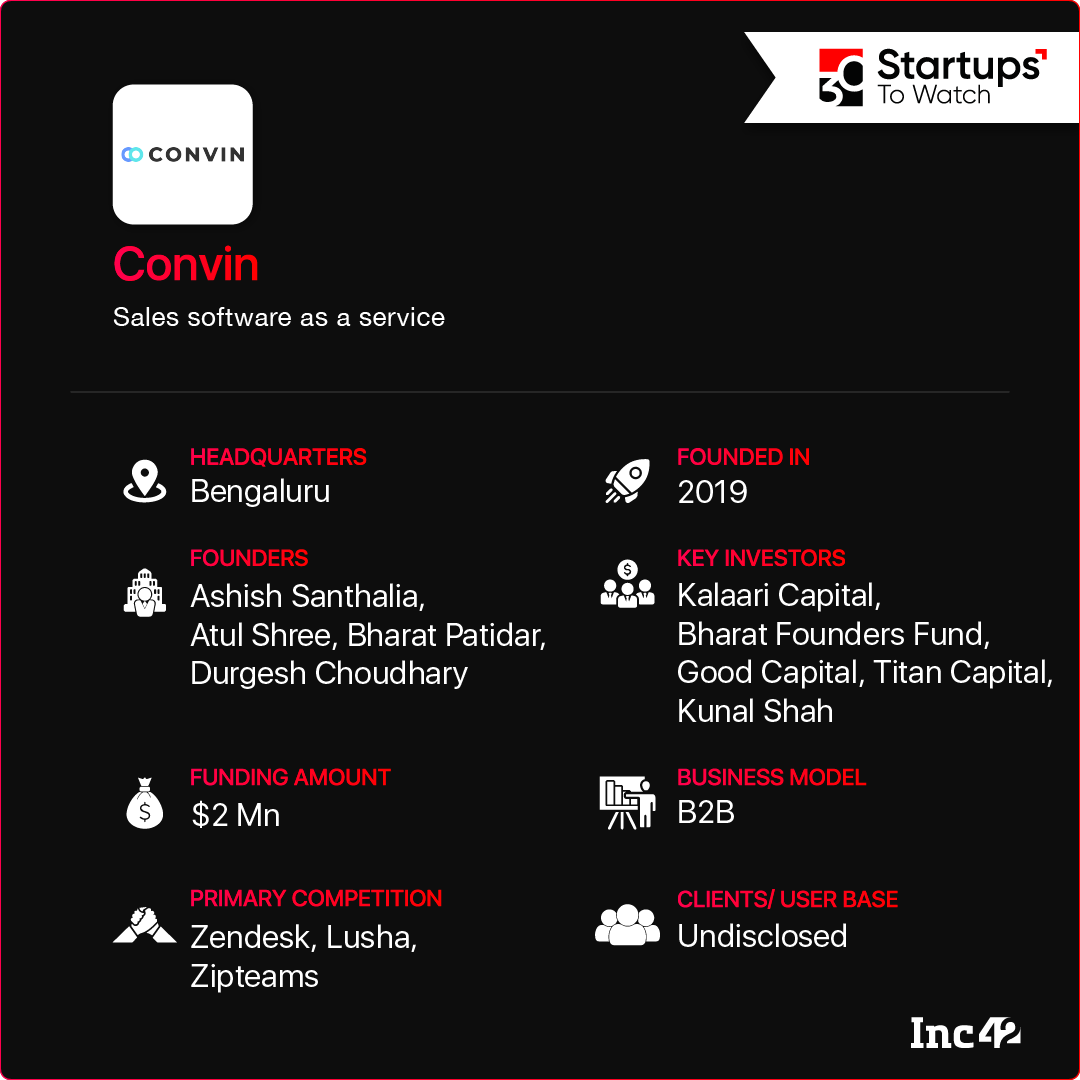

Convin

Share On:

Why Convin Made It To The List

As the world has turned digital and remote selling has become the norm in post-Covid reality, sales enablers play a critical role in driving conversions and amplifying customer experiences. Consequently, assisted selling has emerged as one of the most extensive use cases of the $18.4 Bn conversational intelligence tech market. Although these are pretty recent trends, Bengaluru-based Convin was a step ahead of the rest and launched a SaaS platform for sales intelligence solutions in 2019.

Convin records salespeople’s conversations with prospects to help managers review interactions and share feedback at scale. Also, to make salespeople more proactive in their approach, the platform features more than 30 tech features such as data analytics, transcription services, sales strategy indicators, revenue intelligence and sales automation. Its SaaS offering comes alongside a CRM, costs $50 per month for small teams (less than 30) and is customisable for large groups. This year, Convin will focus on product development and hire product and marketing teams for optimum utilisation of its $2.1 Mn funding.

DAOLens

Share On:

Why DAOLens Made It To The List

As DAOs aim to achieve the ultimate blockchain vision of member-controlled or decentralised autonomous communities, every member faces a common issue. Most tech tools are not up to the mark for DAO development. So, IIT-Guwahati alumni Vikram Aditya and Apoorv Nandan launched DAOLens in January 2022 as the SaaS equivalent of Web3, less complicated and easy to operate.

DAOLens is building three main products for the ecosystem – a discovery portal where DAOs and contributors can connect, a contributor onboarding solution for scaling up the infrastructure and a host of community management tools for workplace management.

The Bengaluru-based startup is working with more than 70 DAOs and their contributors. It offers its SaaS products with some manual intervention during integration as all DAOs are different in size and operations. It is now building a self-service tool for DAOs and an assistance service for developing custom products for startups.

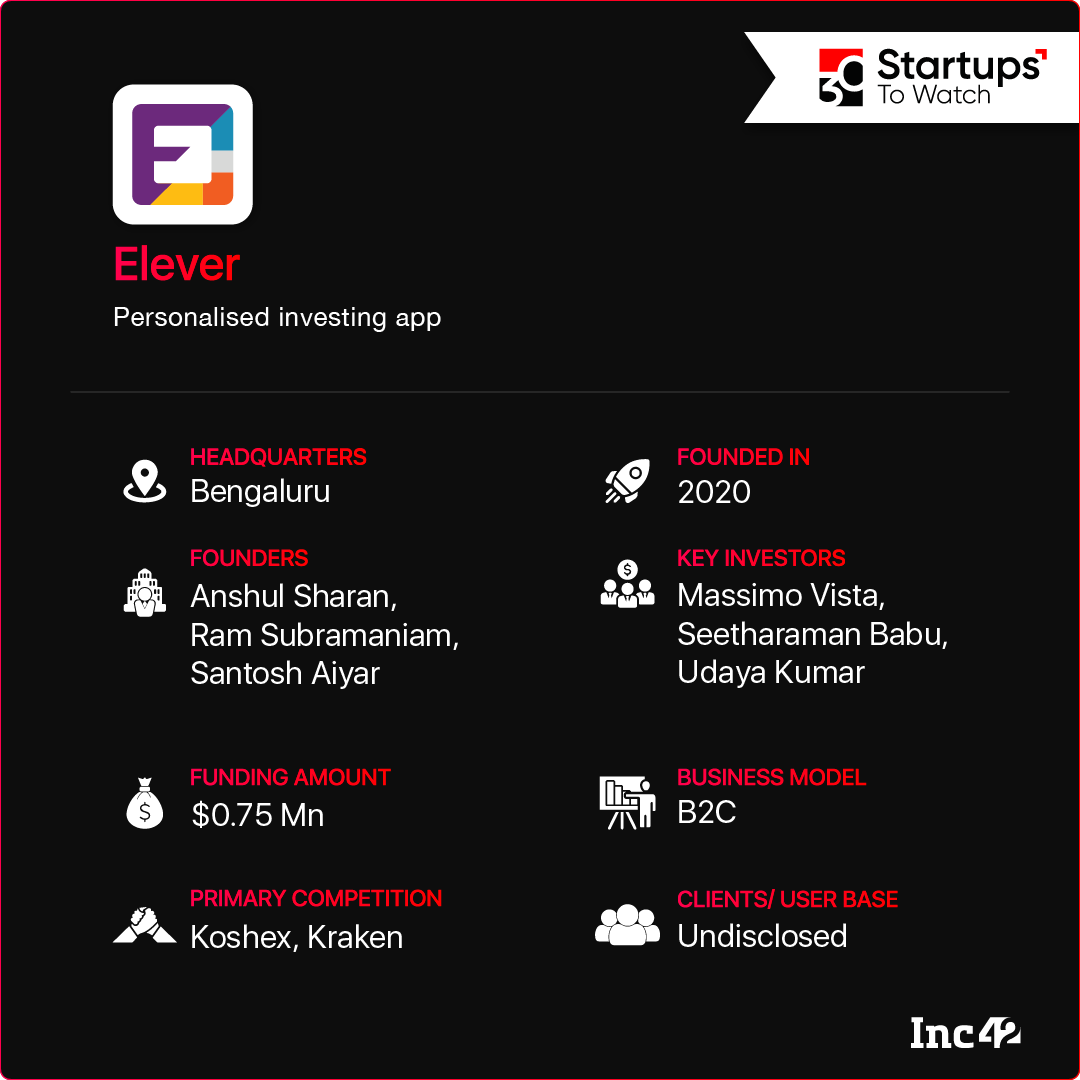

Elever

Share On:

Why Elever Made It To The List

As people look for ways to improve their finances and realise critical goals, personalising financial services according to individual requirements becomes essential. But the lack of guidance, tools and platforms often leaves customers in the lurch. This has given rise to platforms like Elever that match granular data analytics with investment options.

Set up in 2020, the Bengaluru-based platform identifies the volatility band suitable for an investor’s risk profile based on historical data. It then applies a proprietary modern portfolio theory to design portfolios for the corresponding risk profiles. The investment tech startup follows a passive investment model, focussing on 200+ data points for more than 5,000 listed companies. In doing so, it analyses 15 years of historical data to ensure top-level precision.

Elever charges a monthly fee based on the portfolio value and offers investments in ETFs, BSE- and NSE-listed stocks, fixed-income securities, international equities and digital gold.

Explorex

Share On:

Why Explorex Made It To The List

The restaurant industry was severely affected when India was reeling under the pandemic-induced lockdowns in 2020. Consequently, the takeaway/dine-in order processing platform Eatable had to shut shop. But the founders, IIT-Kharagpur alumni Pritam Khan and Mainak Sarkar, learnt a valuable lesson from the outcome. The duo understood that the digitalisation process was broken as far as eateries were concerned, and Explorex came up to bring techvantage to their operations.

Set up in 2020, the startup offers a full-stack SaaS solution to enable digital menus, automate order placements, implement mobile PoS, inventory, vendor and staff management systems, and collect customer data. It charges a transaction fee on each payment processed and claims that 50% of all payments happen via Explorex across its partner restaurants.

Explorex services are available only in Bengaluru, and the foodtech firm claims around 300 restaurant partners. However, it plans to expand to all Tier 1 cities and onboard 1K+ restaurants by FY23.

FastBeetle

Share On:

Why FastBeetle Made It To The List

Even three years after the abrogation of Article 370, the Union Territory of Jammu & Kashmir struggles to cope with logistics and connectivity issues, which hinder the growth of small businesses. So, FastBeetle was launched in 2019 to build a better logistics ecosystem for businesses in the state.

Headquartered in Srinagar, this logistics startup has in place a fleet of executives for quick commerce deliveries, including groceries, medicines and other healthcare items. It also provides logistics services for Instagram sellers, door-to-door courier service and B2B (wholesale) shipment service. The diverse range of sellers using its services includes online businesses from all over the country, contract orders from companies selling on Amazon, Flipkart, Snapdeal and JioMart and delivering their goods in J&K and local users who want to send parcels. The company charges a parcel fee in each case.

The Porter-style platform specifically caters to the population of J&K and plans to cover the entire UT, up from eight hubs in Kashmir province and one in Jammu. It will also enter the warehousing space by FY23 and eyes INR 3 Cr in revenue in the current financial year. By 2025, it plans to expand its reach to the entire Himalayan belt and provide shipments across the hilly terrains.

Feetwings

Share On:

Why Feetwings Made It To The List

Over the years, fashion has witnessed many dramatic twists and turns. Now it is time to don smart clothes, which can double up as 24×7 health monitoring platforms. At least, the founders of Delhi-based Feetwings firmly believe in a health-tracking wardrobe.

A brainchild of celebrity nutritionist Dr Siddhant Bhargava and biotech majors Hrithik Jaiswal and Animesh Kumar (both are NSUT alumni), Feetwings has been developing a pair of socks since 2019 that can help detect, diagnose and manage diabetes through real-time data and health alerts via a dedicated app.

The socks will help users track and control diabetic complications early on by checking foot temperature, blood pressure and pulse rate, tracing blood glucose via non-invasive spectroscopy and raising emergency alerts in case of hypoglycemic shocks or heart strokes.

The D2C brand makes these socks from a proprietary Smart Yarn that helps weave the 1 mm thick sensor layer but can still be worn as regular socks. All its products are manufactured in-house and have recently made it to research labs. Upon product refinement, Feetwings socks will be launched as an assistive device for diabetes care.

Fitmint

Share On:

Why Fitmint Made It To The List

In the wake of the pandemic and the stringent lockdowns it mandated, there was an increased focus on long-time wellness goals, viewed through a much broader lens than mere fitness routines one used to follow earlier. But with life returning to normalcy and the Covid-19 waves gradually waning, fitness regained its popularity, albeit slowly, and its application changed quite a bit in sync with our tech-driven journey. Launched in January 2022, Fitmint is a case in point as it aims to bring gratification to workouts with Web3 and SocialFi (think of it as decentralised social media) elements. But there’s more. On the Fitmint app, one can earn rewards in crypto/NFTs for walking, running or exercising.

The Bengaluru-based fitness startup believes traditional fitness regimes require a tech makeover as the young generation moves towards Web3. Adding GameFi and SocialFi, NFT gaming and community effect, innovative rewards and incentives into the mix can help inculcate the habit of exercising among Gen Z and beyond. For instance, after coming on the Fitmint app, a user can mint an NFT and start working out to earn the in-game cryptocurrency/native token named FITT.

Using these earnings, users can engage in various in-app activities such as upgrading/repairing their NFTs, unlocking features and rewards, generating new NFTs or even cashing out the tokens (despite regulatory and legal hurdles). They can also choose to sell their NFTs on the in-app marketplace, while the number of NFTs will indicate their overall lifestyle performances based on power, durability, stamina and comfort.

The startup has a community of 100K+ members on Twitter and Discord and is on track to generate $10-15 Mn in revenue in gas fees and commissions on NFT sales by FY23.

Hashstack Finance

Share On:

Why Hashstack Finance Made It To The List

Decentralised finance (DeFi) is often over-collateralised, which is good for securing lenders but limits a borrower’s ability to improve their finances, believes Hashtack’s founder Vinay Kumar. Set up in 2021, the Bengaluru-based startup is creating ripples by under-collateralising loan undertakings as it taps into the DeFi lending space and issues 3x the loan on a borrower’s collateral.

Hashstack claims to convert the US$ against the cryptocurrency Compound to enable paperless loans via its non-custodial money market protocol called Open. These loans help boost personal finances and meet the borrowers’ trading capital needs.

This is how it works. Say, a borrower provides collateral worth INR 100 for a loan of INR 300. Going by the over-collateralisation norm in crypto trading, the startup provides 70% of the collateral equivalent (INR 70) into the borrower’s wallet. However, the person can use the loan balance of 230% (INR 230) as in-protocol trading capital to trade across Hashtack’s crypto network featuring Starknet, Polygon and BNBChain.

The DeFi startup generates revenue through dApp fees, commissions on interest and profit-sharing during borrowers’ asset liquidation. Although it is still in the testnet stage, Hashtack claims to have done transactions worth $183 Mn. It will go for a mainnet launch by Q3 FY23, integrate 50+ dApps across Starknet and Polygon by the fourth quarter and target $700K+ in revenue for the current financial year.

Humantic

Share On:

Why Humantic Made It To The List

Sales is an art and a science, according to Amarpreet Kalkat. However, most sales intelligence tools now focus on processes instead of looking at the buying side that mainly thrives on human connections, narratives and perceived improvements following the purchase of products/services. To leverage these critical factors that can help companies drive sales, Kalkat launched Humantic in 2021, providing buyer intelligence to sales teams and focussing on other business enhancement solutions.

The Bengaluru-based startup’s assistive AI platform equips salespeople with actionable insights by providing conversation materials (what to say and what to avoid) and tips on content personalisation and structuring while writing sales email.

Currently, the SaaS platform offers three products based on behavioural and data science-driven approaches. These include an AI tool for revenue and sales, a buyer persona-based solution for use cases like fundraising, lending and wealth management and a tool for customising hiring operations. All three Humantic products are patent-pending in the US.

The company’s plug-and-play API fulfils the need for human-centric ‘smart’ solutions and makes work more productive. It claims 150+ clients and plans to use the recent funding to scale up its revenue-based AI tool in FY23.

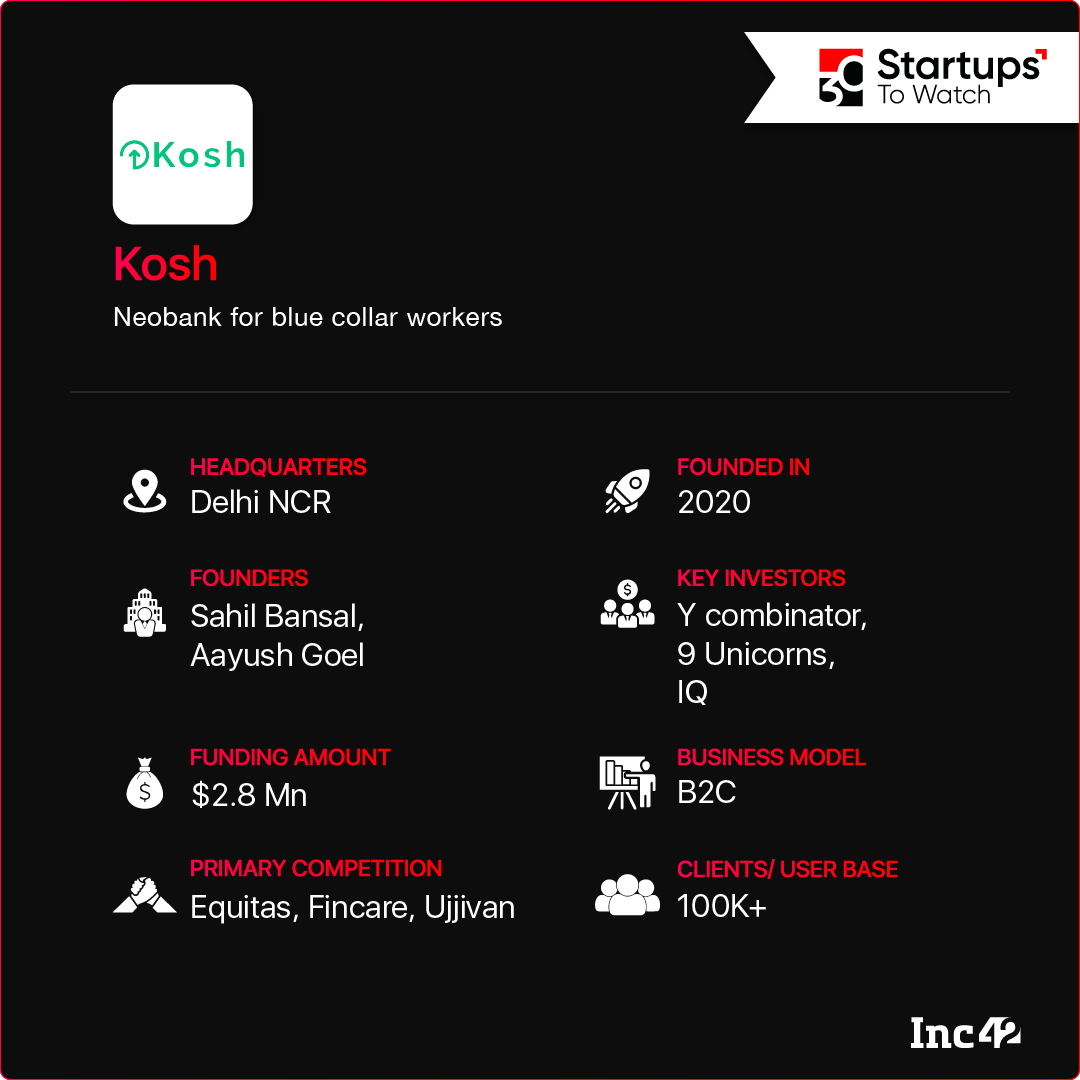

Kosh

Share On:

Why Kosh Made It To The List

Despite the ongoing financial inclusion initiatives, blue-collar workers still find it tough to raise even small loans due to income instability and lack of credit history. Launched in 2020 as a credit facilitator for this segment, Kosh, too, faced underwriting issues and bad loans. Initially, the company asked all potential borrowers to name a co-borrower/guarantor to reduce credit risks. Although it made things a bit easy for the lender, such measures did not guarantee quick and hassle-free loans for the underserved sector. That was when the idea of leveraging social collateral in underwriting came up. The Gurugram-based startup decided to bank on social capital (trust and network) and peer pressure as tangible collateral.

The micro-credit startup currently underwrites loans for groups of three or four, offering an average of INR 20K to blue-collar workers and self-employed women in joint-liability loans via an android app. The company earns through interest margins from partner NBFCs and banks. Incidentally, Kosh only acts as a service provider for them, and its NPA is now less than 2%.

The lending tech startup claims to process INR 4 Cr worth of loans every month, growing at 25% month-on-month. In FY23, Kosh is targeting a top line of INR 10 Cr a month and will further add upskilling resources and build a job discovery feature. It is available in six North Indian states besides Delhi-NCR but plans to expand nationally by 2025. Kosh also aims to build a loan book of INR 1,000 Cr by that time.

Mekr

Share On:

Why Mekr Made It To The List

Serial entrepreneurs Anand Yadav and Gaurang Kuchhal had earlier experienced manufacturing challenges first-hand. They also realised the difficulty of taking a project from proof-of-concept to commercial production at competitive pricing on a par with global manufacturing hubs like China. To make production cost-efficient in India and help companies outsource manufacturing without compromising on quality, the duo launched Mekr in November 2021.

The New Delhi-based on-demand manufacturing enabler specialises in white-label electronics and sources a wide range of materials, including printed circuit board assembly (PCBA), plastic moulding, product parts and semiconductors, for its clients. Currently, it manufactures three products – payment soundboxes, egg boilers and EV components – for Reliance, BharatPe, Fyllo, ElectricPe and the like. It also supplies spare parts and components to manufacturers like Napino Digital Solutions and Aeris Communications.

Businesses can connect with Mekr via its website and share their proprietary designs after signing NDAs with the startup. Post that, Mekr takes care of the entire manufacturing, from R&D and design to material and supplier selection, prototyping, quality checks and delivery.

The platform claims to work with mass projects (producing more than 500-1,000 units) and delivers globally. It is now looking to expand to telecom, IoT, agritech and the home appliance space.

MicroGO

Share On:

Why MicroGO Made It To The List

The world is witnessing a series of unprecedented health scares due to novel pandemics, the emergence of antibiotic-resistant organisms or even inclement weather conditions triggered by climate change. Add to that the rise of global travel and tourism, and it will be hard to predict how and when the masses will fall victim to such outbreaks. A case in point is Covid-19, which is still raging worldwide.

For ex-BARC microbiologist Rachna Dave, the quest for effective hygiene management started in 2016, when she left her job to start MicroGO. But her dream did not materialise until 2020, when the Chennai startup moved from the R&D stage and piloted a hygiene management solution for commercial kitchens and an infection control device for the healthcare industry.

MicroGO offers seven products across three patented categories in India. These include GOassure (Lite and Max), an IoT-powered hand hygiene station with in-built 250+ hand sanitiser pumps; GOpure (Plus, Lite100 and Lite200), which treats water without leaving chemical residues and works against diarrhoeal bacteria and other waterborne pathogens; and GOclean, a low-cost surface disinfectant. The SaaS-based, IoT-enabled devices provide compliance data back to the system for effective monitoring, maintain sanitisation consistency, save water and prevent plastic wastage.

The medtech startup earns revenue from hardware sales and subscriptions from monitoring devices. It currently operates in a host of cities, including Chennai, Hyderabad, Bengaluru, Kolkata, Delhi, Mumbai and Gujarat. MicroGO plans to launch its products at scale for B2B partners from the country’s food, hospitality and healthcare sectors. It will also launch a post-harvest management solution for perishable fruits and vegetables by 2025.

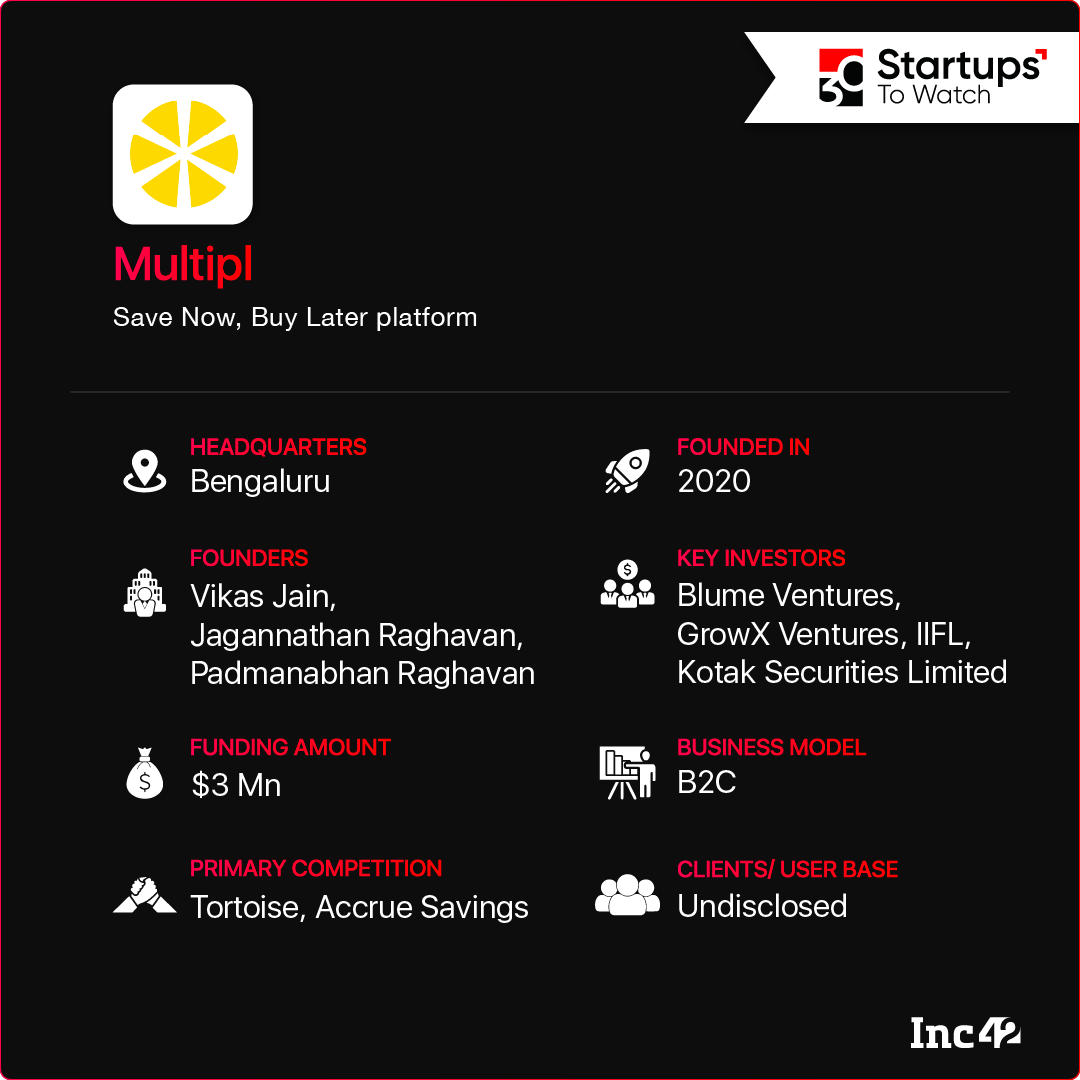

Multipl

Share On:

Why Multipl Made It To The List

Today’s credit-driven consumption model has increased the likelihood of impulse buying and the possibility of wading into a debt trap. To offset this unsavoury impact, second- or even third-gen fintech startups have left the BNPL business model to explore the tried-and-tested path of ‘save now, buy later’. Among these startups is Bengaluru-based Multipl, which promotes healthy spending habits through the habit of saving and investments.

Started in 2020, Multipl is a goal-based, personalised investment advisory, helping users invest in mutual fund-style baskets and linking the savings to relevant lifestyle spending. The baskets come under three categories – one-time spending (for buying a bike, car, furniture piece and more), recurring spending (school fees, insurance premiums or festival gifting) and long-term wealth and savings (retirement fund, tax-savers and more).

The investment part of the business is implemented in partnerships with many legacy investment companies. For the ‘buy later’ part of the deal, it partners with brands like MakeMyTrip, Croma, Vedantu, Kalyan Jewellers and Aether to help create wishlists for future buying.

Multipl gamifies and incentivises users on their saving and spending behaviour and claims to give 5x returns compared to shopping via credit cards and conventional BNPL offerings. It charges a platform usage fee, plans to scale the ‘save now, buy later’ concept and wants to tie up with more consumer-facing brands to onboard more consumers.

Paras Aerospace

Share On:

Why Paras Aerospace Made It To The List

With the Make-in-India push gaining momentum, the nascent drone industry in India has witnessed favourable tweaks in policies and regulations for the growth of the UAV (unmanned aerial vehicle) sector and allied fields. Given its multisector applications, the industry is poised to reach a turnover of INR 12-15K Cr by 2026, according to an estimate by the civil aviation ministry.

Understanding the huge scope of indigenous tech development in this segment, Navi Mumbai-based Paras Aerospace was launched in 2019 to offer a wide range of solutions involving the development, integration, manufacturing and certification of UAV systems. Besides working on military-grade drones, Paras has a portfolio of UAV products and subsystems, including multispectral and electro-optic cameras, ground and power control systems, payload development, autopilot and emergency recovery systems, spraying techniques and drone trackers, among others.

The drone startup integrates UAV hardware and software for use in defence, agriculture and industrial sectors and also specialises in regulatory compliance.

The company has partnerships with the Indian and Israeli governments and aims to bring the best drone technology to India.

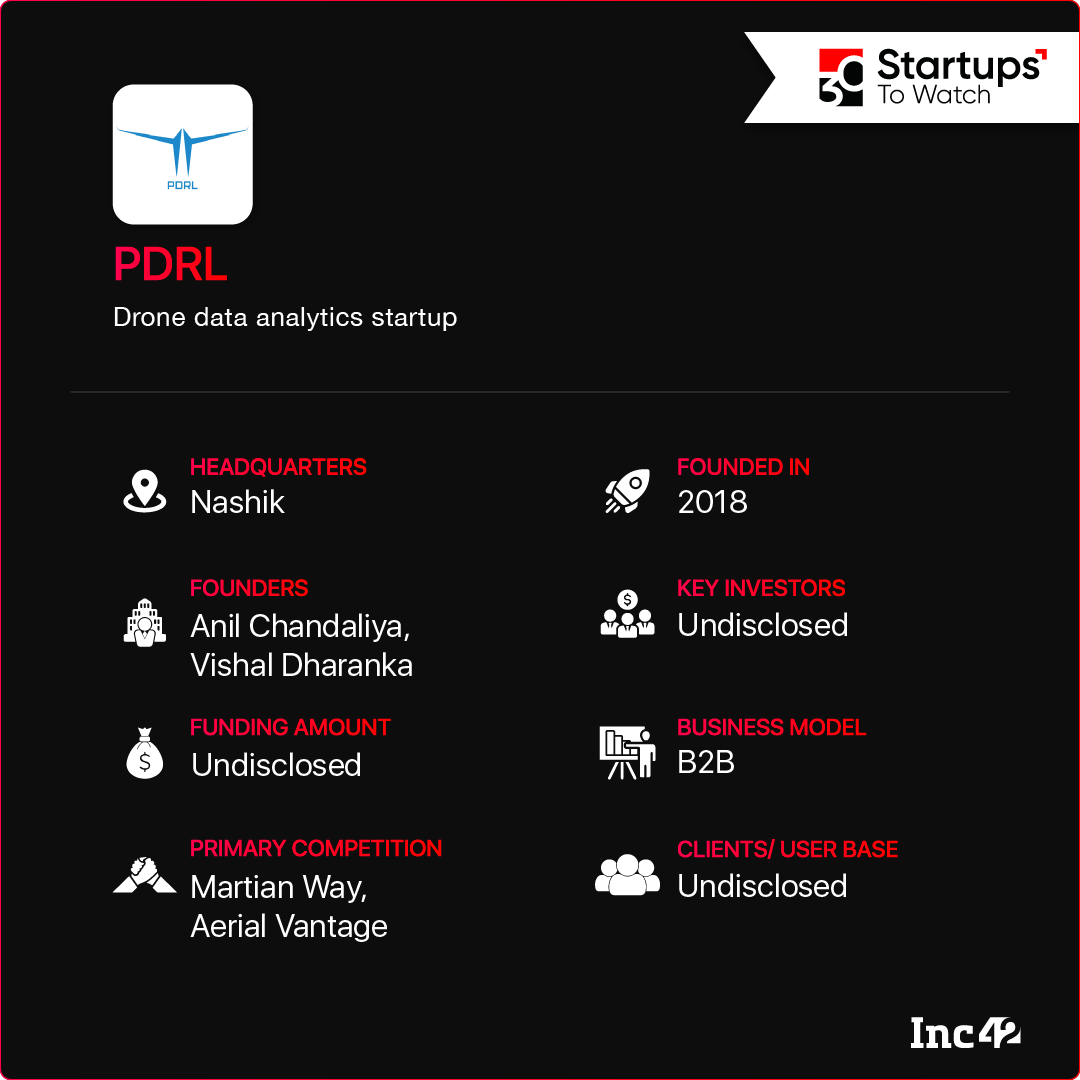

PDRL

Share On:

Why PDRL Made It To The List

Drones are ubiquitous nowadays, given their many use cases across critical sectors, whether agriculture or environment support, defence or emergency delivery. Launched in 2018, Nashik-based deeptech startup Passenger Drone Research Lab (PDRL) leveraged this opportunity and developed sophisticated tech tools to analyse drone data and turn it into actionable insights. Interestingly, PDRL was one of the pioneers in India to build an AAV air taxi prototype and worked with the DGCA in 2019.

But PDRL pivoted as it realised the need to build an end-to-end tech stack in the commercial drone space. It has developed its flagship product AeroMegh to process the data gathered from aerial images and analyse the same for surveys and mapping, precision farming and agriculture analytics, fleet tracking, construction performance analysis and power inspection. To date, it has processed more than 19.5K images from 960 hours of drone flight data, according to the company.

AeroMegh has three sub-products – DroneNaksha, PicStork and AeroGCS – which do data processing and analysis through integration with the existing GIS software. The startup charges for data analysis and a monthly/annual fee for providing product-specific API kits to companies.

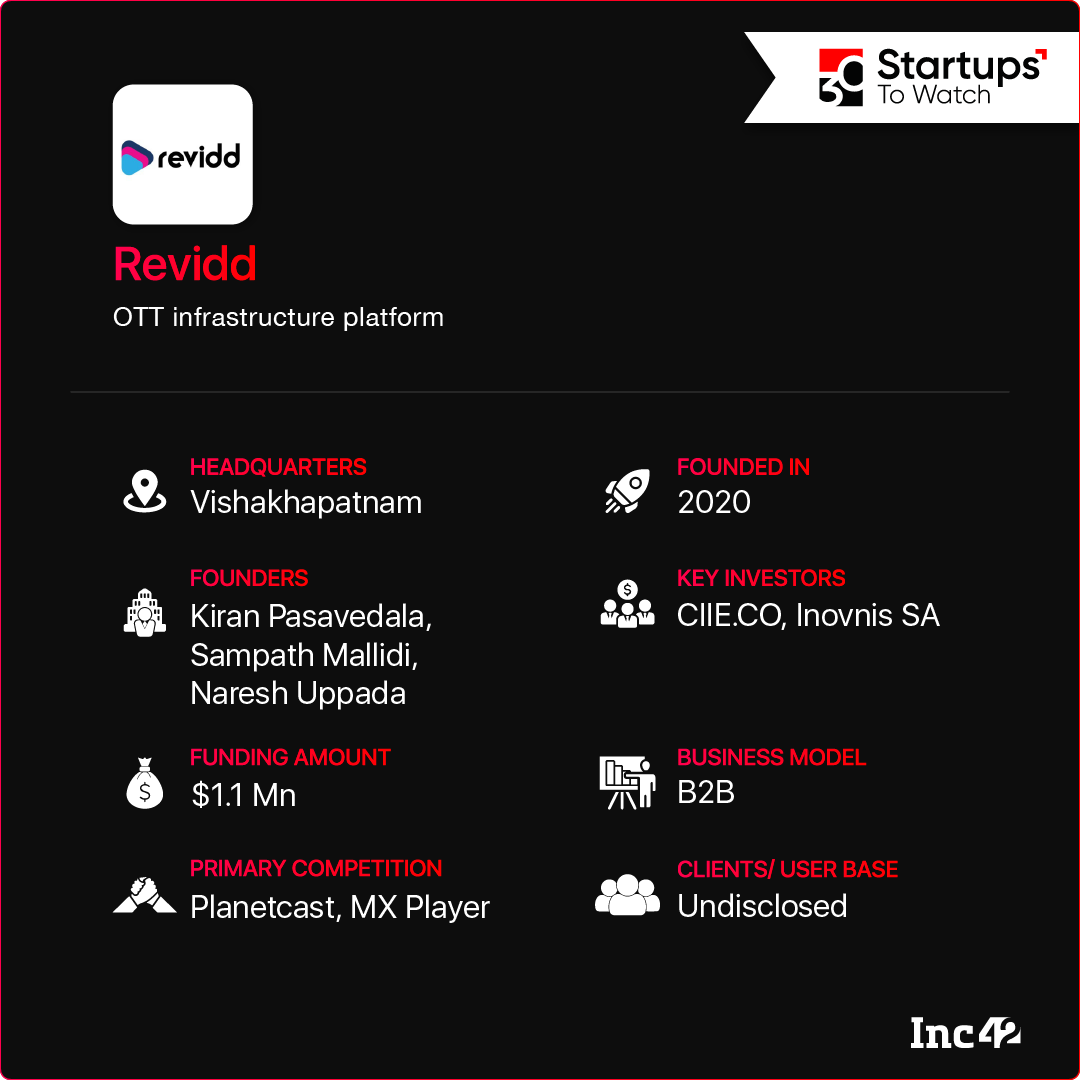

Revidd

Share On:

Why Revidd Made It To The List

Lately, all sorts of video content, from YouTube videos to entertainment OTTs to shorts, has become the most popular form of content consumption. So, Revidd was set up in 2021 to provide a no-code SaaS platform to anyone who needs the video infrastructure for custom video streaming, live streaming, video conferencing, digital TV or CloudTV channels.

The Hyderabad-based B2B2C startup provides white-labelled templates for users to upload content, incorporate monetisation tools and ensure custom branding for their streaming channels or apps. Besides the entertainment industry, Revidd can cater to other professionals and businesses such as artists and craftspeople, educational institutions, fitness and sports brands, healthcare companies and more. The subscription-based video infrastructure operates through a centralised CMS and is compatible with various interfaces such as iOS, Android, Apple TV, Roku and Fire TV.

The startup intends to set up shop in the US in the current financial year. It also aims to expand across the North American market with its no-code, end-to-end horizontal solution for multiple verticals so that anyone can launch a video platform to grow their business.

Rucept

Share On:

Why Rucept Made It To The List

The gaming ecosystem is one of the largest sources of pop culture merchandise, only next to cult movies and TV shows. While the internet has made it easy for creators to publish and distribute gaming content, sales of game-related merchandise still face many bottlenecks like high production and logistics costs.

To help games and metaverse creators showcase and monetise their custom merchandise, New Delhi-based Rucept set up a third-party marketplace in 2019. It manages its clients’ sales, inventories, warehousing and logistics and also offers state-of-the-art cataloguing services by turning a single image into 250+ unique product pictures.

With Rucept in action, gaming companies can display and sell customised T-shirts, footwear, fashion accessories, stationary and home decor items on more than 30 global marketplaces like Paytm and Taobao. This is how it is done. A sample is created first via a 3D printer and shared with the client. Upon approval, factories closest to consumers handle production and fulfilment. The marketplace has a network of more than 40 factories and warehouses for efficient operations.

The platform charges a designing fee, a product creation fee, a third-party marketplace listing fee and a 10% margin on the net profit from product sales. It has not disclosed top-line numbers but currently works with US-based studios Electronic Arts and Disney. In addition, it has recently expanded its merchandising to influencers and celebrities.

Spendflo

Share On:

Why Spendflo Made It To The List

The pandemic and the subsequent shift to remote and hybrid working have expedited the adoption of SaaS, and startups worldwide now thrive on multiple SaaS tools for their business operations. But the lack of streamlined procurement and easy renewals hinders overall SaaS usage as businesses scale and significantly impacts their bottom line. Set up in 2021, Spendflo is a SaaS management tool that helps companies buy, manage, track and save on subscription costs.

The Chennai-based startup guarantees up to 30% savings on SaaS spending and a minimum of 3x returns on investment as it identifies the most suitable SaaS tools required by companies, buys bundled subscriptions and negotiates with 100+ vendors to get the best deals. The Spendflo dashboard also features subscription details and usage analytics to help its clients.

Its revenue comes through subscriptions, but it is currently in expansion mode and aims to enter the US market in the current financial year. The startup also plans to manage SaaS spending worth $100 Mn by 2025.

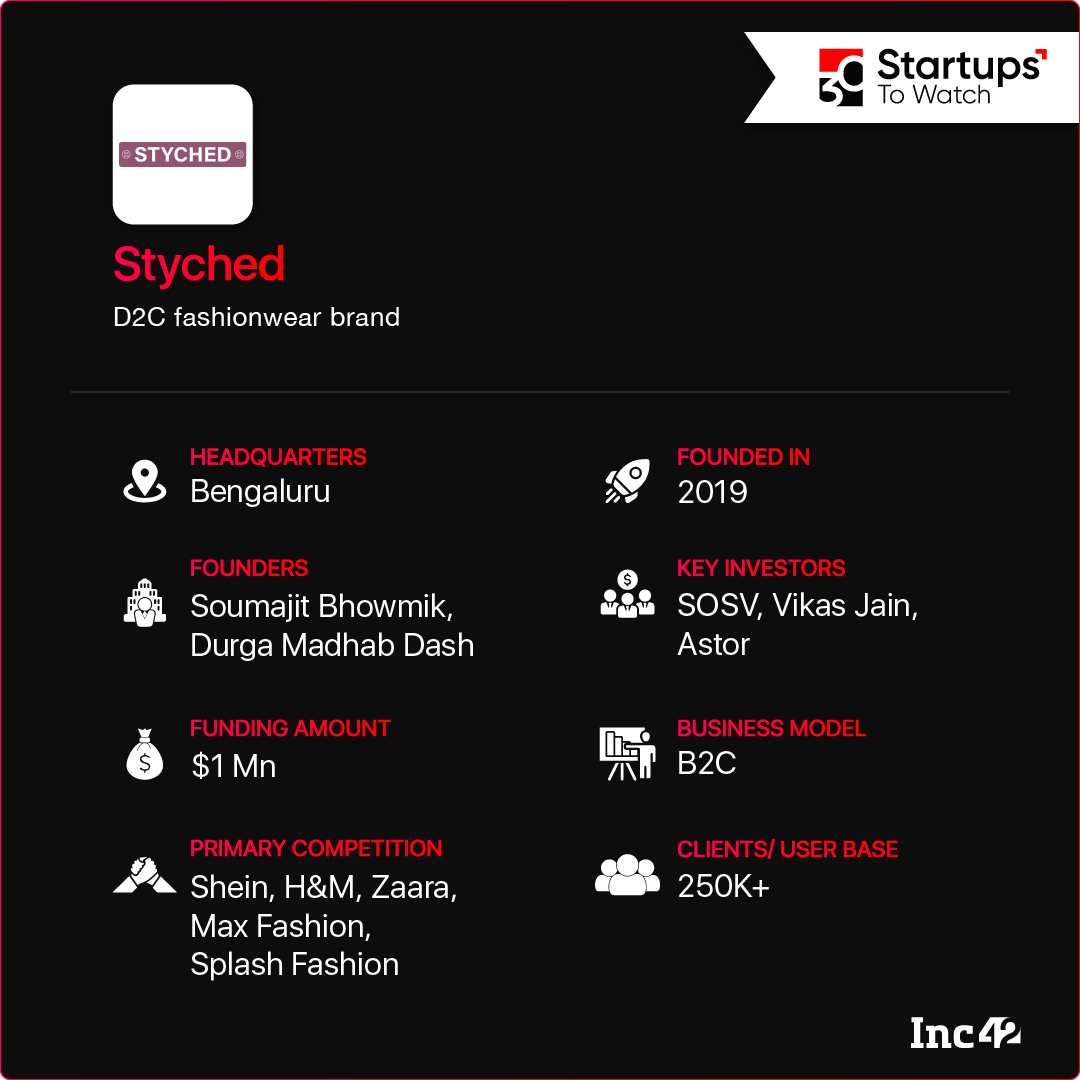

Styched

Share On:

Why Styched Made It To The List

Fast fashion in India has several loopholes, including product quality, lack of customisation on-demand, high wastage of raw material and logistics issues. Launched in 2019, Bengaluru-based Styched aims to bridge the product-cost-quality gap by offering customisable fast fashion items such as graphic tees, activewear, T-shirt dresses and footwear.

The D2C brand is operating in India and the UAE and has set up its in-house manufacturing units in Bengaluru, Tiruppur, Chennai, Delhi, Dubai and Ajman. Styched partners with independent tailors, who design the final products, and the dyeing and printing are done by the production units. It follows a zero-inventory, zero-warehousing model and offers made-to-order products without minimum order requirements. This reduces fixed costs and wastage and helps keep the pricing competitive. As for RTOs, the fast fashion brand reuses the fabric by reverse-engineering patterns.

Styched offers more than 7K products across 20+ categories. It also creates exclusive and original pop culture merchandise in partnership with PETA, sports clubs, musicians and bands.

The startup plans to launch in Indonesia in FY23 and expand its catalogue to 100K styles, powered by more than 1.5K tailors. By 2025, it will set foot in more than 10 countries and begin a ‘House of Styched’ initiative to help fashion designers launch their styles under the Styched banner.

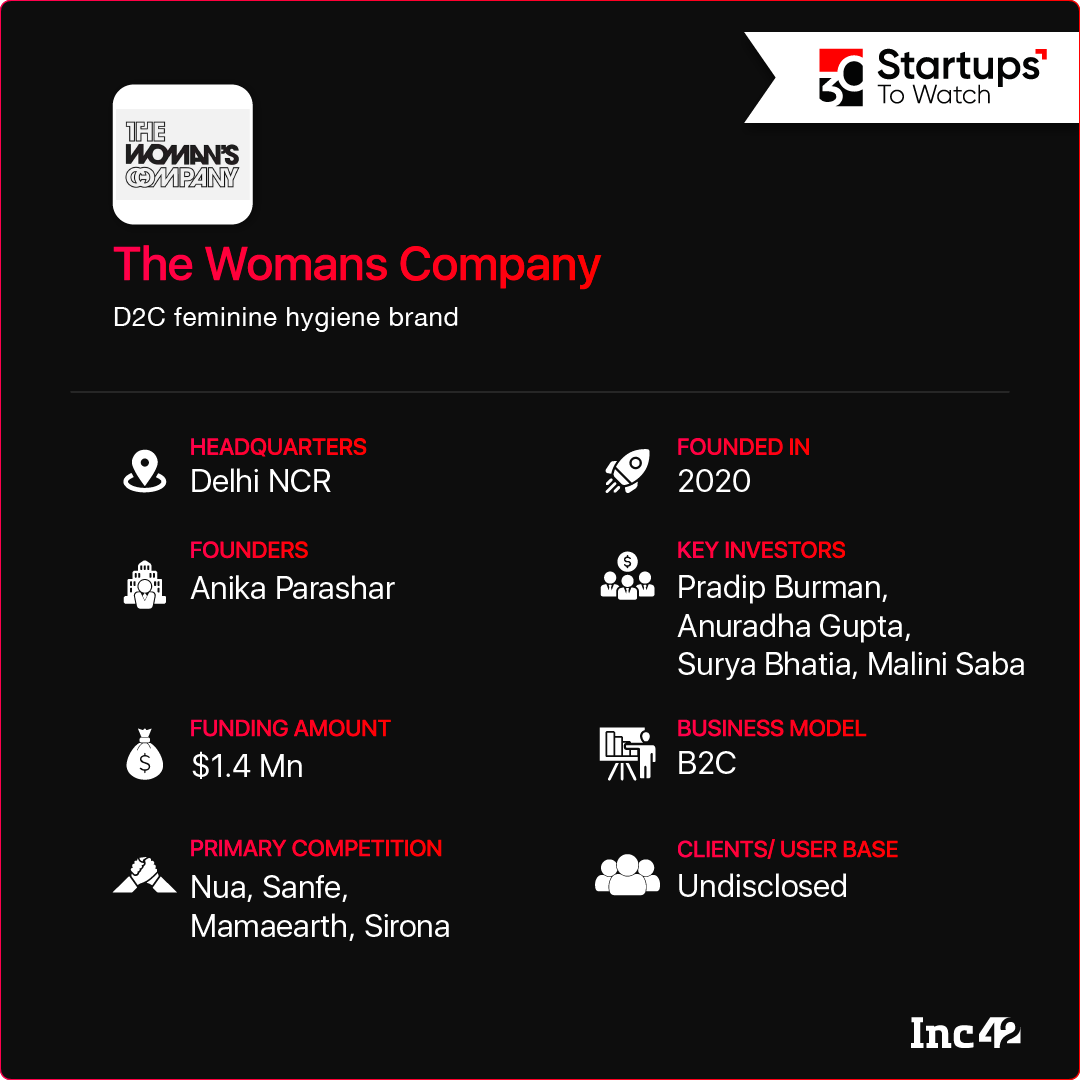

The Woman’s Company

Share On:

Why The Woman’s Company Made It To The List

Only 40% of women in India use menstrual products (locally or commercially produced), while the rest cannot afford them. But even this meagre usage can harm the environment as most disposable branded products contain huge amounts of plastic. It was a double whammy for Mamma Mia founder Anika Parashar as she wanted her daughter to use a safe, hygienic, sustainable product. In doing so, she also realised that more and more women should be a part of this product ecosystem that can ensure good menstrual hygiene and an environment-friendly approach. So, The Woman’s Company (TWC) was launched in 2020.

The New Delhi-based feminine hygiene brand currently offers eight products under three categories (period, shaving and daily essentials). From sanitary napkins to hot pads and bamboo razors, all TWC products are manufactured in-house, safe to use and easily disposable so that environmental impact is kept to a minimum. The D2C brand has adopted an omnichannel strategy for maximum leverage and sells its products both online (via website and ecommerce marketplaces) and offline across India and the US. At home, it runs a growing distribution network with Kolkata, Mumbai, Delhi and Siliguri as its main hubs.

The startup claims a 30% month-on-month increase in customer base and plans to serve rural consumers soon. It will also educate women on menstrual product usage and good personal hygiene practices.

Tortoise

Share On:

Why Tortoise Made It To The List

Gullak-style goal-based savings happen to be a time-honoured practice that Gurugram-based Tortoise has taken to the digital level. Launched in 2020, the micro-savings startup runs on the ‘save now, buy later’ concept, allowing users to plan and save for future purchases.

Moving away from the world of loans, credit and EMIs, Tortoise offers an escrow account in partnership with Razorpay for every item a user plans to buy. The procedure is quite simple. One has to visit its Android/iOS app, select the item category (electronics, fashion and so on), select the site for buying it, choose the timeline and monthly deposit amount and start saving for the purchase. So far, users can create a savings plan for any of their future purchases from Apple’s Indian reseller Imagine, MakeMyTrip and Croma. Tortoise charges a take-rate fee from the merchants based on the amount.

The fintech startup went live in April 2022 and onboarded 10K+ customers. By FY23, it plans to onboard more brands and merchants across multiple categories and expand its product, engineering and sales team.

Trufedu

Share On:

Why Trufedu Made It To List

Financial planning for a secure future is fast gaining traction among middle-class Indians. But most services on offer are fragmented, expensive and lack personalisation. So, Trufedu was launched in 2019 to educate people on healthcare, insurance and wealth management.

The Bengaluru-based financial management startup operates via an Android app, where users can sign up by submitting personal details, financial requirements and investment budget. Based on this data, Trufedu features relevant baskets to compare and choose from.

While users pay all premiums and third-party costs, Trufedu also charges a monthly subscription based on the services. The packs start from as low as INR 99, and services are offered in partnerships with Healthians, mFine, Bajaj Finserv, PropTiger and MediBuddy, among others. Its service bouquet includes financial planning (robo advisory), tax planning and tax filing; teleconsultations and online medicine ordering; insurance claim settlement (life, health and vehicle); lending support and real estate planning.

It is currently building an ecosystem of in-house trained seller-partners to sell Trufedu subscriptions and earn commissions.

Turno

Share On:

Why Turno Made It To The List

Turno was set up in April 2022 to electrify commercial vehicles, which account for 80-90% of the fossil fuel used today. Former Zoomcar executives Hemanth Aluru and Sudhindra Reddy were behind the fintech initiative, and the duo decided to cater to the fast-growing EV segment to make sustainable mobility a popular narrative in India.

The Bengaluru-based startup enables SMEs and individuals to select and buy the right EV three-wheelers as per their requirements. The company has partnered with banks and NBFCs to finance the buyers via its credit app. Post-purchase, Turno tracks battery performance and other metrics to keep tabs on vehicle health and offers its customers a resale guarantee.

The fintech firm has twofold income, earning from EV partners like Mahindra & Mahindra, Piaggio, Omega Seiki Mobility and Etrio (margin sharing) and finance partners (a cut from profit margins). Its key customers include Amazon, BigBasket, Blowhorn and the like. Turno aims to hold a consolidated position within the $152.2 Bn EV ecosystem and move into EV insurance and reselling.

Zipteams

Share On:

Why Zipteams Made It To The List

Zipteams is the brainchild of former LEAD School executives Siddhartha Srivastava and Akash Chatterjee, who observed that desk sales teams were growing 15x faster than field groups due to diminishing geographic boundaries. The duo further noticed that there were CRMs and sales technology for B2B and B2C sales, but these segments heavily relied on manual data entry.

Founded in 2019, the Mumbai-based SaaS startup specialises in conversational intelligence. It automates the workload of salespeople and assists teams with its flagship product – an intelligent digital sales room. Simply put, its solutions capture customer conversations, put them in one place and analyse the data to provide revenue, growth and productivity insights to sales and customer success teams.

The sales room also enables ‘intelligent’ meeting rooms for engaging and fruitful customer conversations. It identifies the next steps for sales follow-ups and provides self-guided nudges to help sales teams onboard and train faster on the job. Plus, there is a complete repository of customer meetings to keep all contexts and references together. This is a sector-agnostic product with prices starting at $29 per user per month.

Zipteams is planning to enter the US market in Q4 CY22 and finalise its partnerships with three or more big clients by FY23. In the long term, it plans to build a Zoom-style marketplace for third-party developers to leverage the conversational intelligence layer and build custom use cases to enhance existing products.