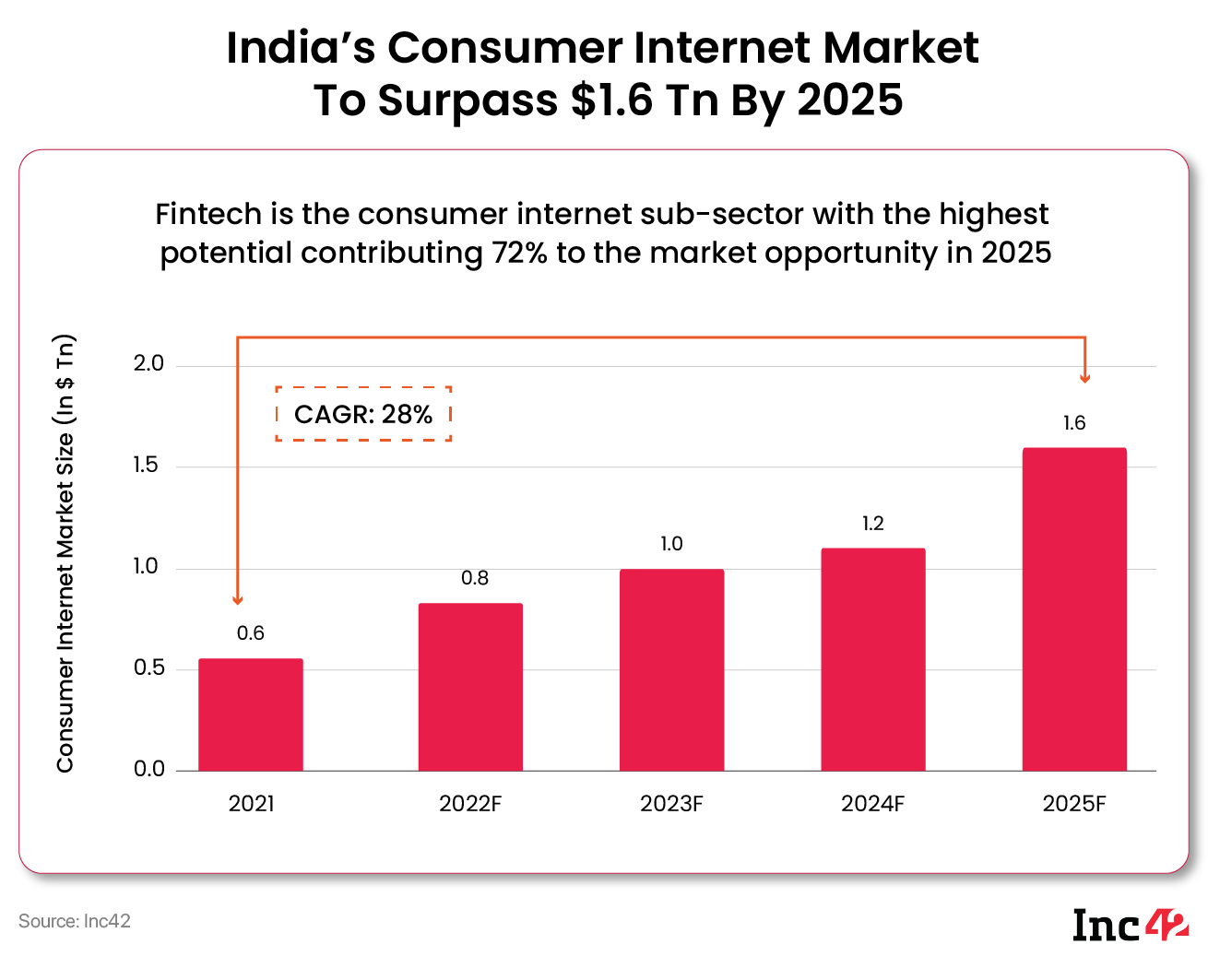

India’s consumer internet market opportunity is estimated to surpass $1.6 Tn by 2025

The country’s biggest conglomerates, e-retailers and aggregators are now capitalising on the growing app fatigue to deliver an all-inclusive digital experience to consumers via super apps

Despite the growing number of users, nailing the product-market fit with positive unit economics still remains a challenge for super apps in India

In an age where digitalisation is the new normal and affordable smartphones put the digital world at one’s fingertips, the average consumer’s perception of connectivity and online activities has undergone a massive shift. Brick-and-mortar shopping has turned hybrid (if not fully digital at the moment).

Full-stack financial services (from lending and borrowing to payments and investments) are a tap away. Healthcare, education, travel, entertainment and nearly all other consumer-facing services have forayed into the digital space to be more inclusive, sustainable and purpose-driven. And there is a mobile app for almost everything, giving rise to a humongous app economy.

According to Google Play statistics, 3.48 Mn apps were on the Play Store in June 2022, and around 3.7K are added every day. Think of the Apple App Store, and the number of third-party apps will go up by a few millions.

However, an overcrowded app market or middling performances would not gain the addictive and exploitative arbitrage that consumer internet companies are looking for to dominate the market. The hunt will be on for an ‘everything’ app that will ensure growth and empowerment until all stakeholders – businesses, consumers, investors and even policymakers – are firmly embedded in an overarching metaverse away from the app culture.

In brief, times are now ripe for the rise of the super apps and a win-win narrative until the next digital disruption.

Before we discuss how the Indian stage is set for homegrown super apps, looking at the backstory will not be out of context. To begin with, BlackBerry founder Mike Lizardis coined the term in 2010. A super app is a one-stop digital platform that hosts millions of ‘small apps’ to bring various products and services (ecommerce marketplaces, financial services, ticket booking, gaming, ride-hailing, food delivery, utilities and more) under one umbrella. They are the new app stores that can scale up to challenge Google and Apple.

Over the years, many successful super apps have emerged across different markets. We have WeChat in China, Rappi in Latin America, Grab in Singapore and Gojek in Indonesia, among others. But surprisingly, the concept has failed to flourish in some digitally mature markets like the US and Europe. Major tech companies have also struggled to reach the scale that transforms super apps into super platforms, touching all aspects of a consumer’s daily life.

India is one such market.

The country has already seen an impressive list of super app aspirants, including the Adani group, Reliance Industries (RIL), the Tata group, Paytm, Amazon India and Walmart-owned Flipkart. They are building large digital ecosystems with multiple services, but so far, no one has been able to position itself as the go-to platform commanding maximum stickiness.

“We haven’t seen the super app work in India so far, and I think the jury is still out on whether super apps… or super brands will work,” foodtech giant Zomato’s cofounder and CEO Deepinder Goyal told analysts at the Q4 FY22 earnings call.

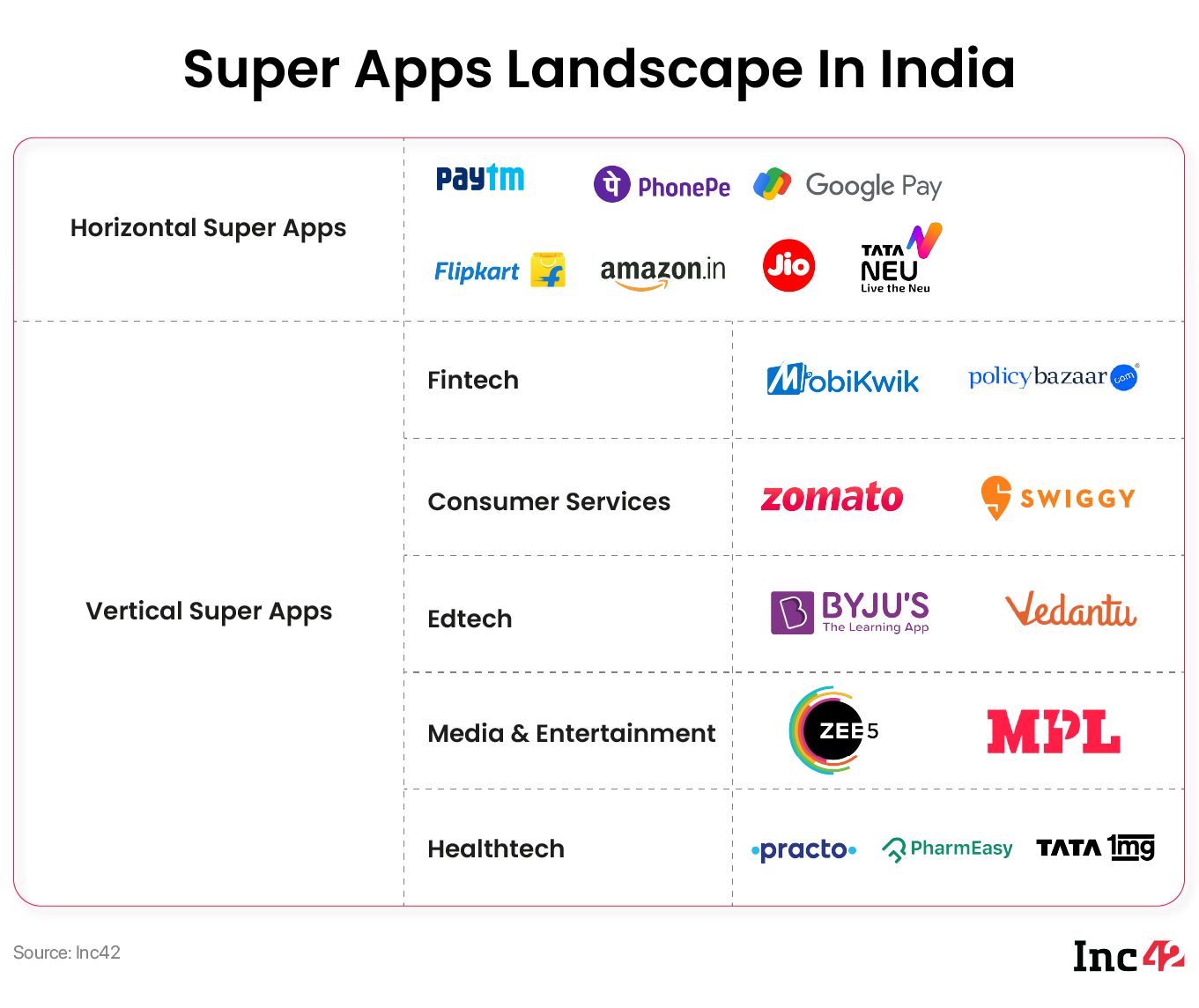

Besides, these industry giants have to compete with the fast-growing vertical super apps, which bet on this format as a natural extension of their existing business, according to Inc42’s latest report titled The State Of Indian Consumer Internet Q3 2022, Infocus: Super Apps. Lately, there have been more entrants, including legacy banks and payment businesses such as the SBI, HDFC Bank, Kotak Mahindra Bank, Paytm, PhonePe and Google Pay.

Digging Deeper Into India’s Super App Landscape

Indians have always wanted ‘thoda aur’ (a little extra) to sweeten any deal. As the internet’s novelty has worn off to some extent, consumers are now looking for the next level of convenience – a one-stop app for all their requirements, easy access to products/services and affordable pricing.

External triggers also worked in their favour. With more than 750 Mn smartphone users in 2021, digital technologies spread rapidly, and so did digital dividends. As smartphone penetration is estimated to reach 87.7% by 2030 from 54.2% clocked last year, it will continue to create a massive user base for the super apps.

The emergence of Indian super apps can be further attributed to the exponential growth of the consumer internet sector. This market is estimated to reach $1.6 Tn by 2025 and covers various sectors such as ecommerce, fintech, healthtech, edtech, consumer services, media & entertainment, travel tech and more. With 20,380+ startups in this space, the segment is home to more than 50% of Indian unicorns.

How These 3 Indian Conglomerates Are Building Their Super Apps

As the super app era seems all set to sweep in, some interesting trends are likely to unfold. For starters, it can be Indian big tech’s big moment, a never-before opportunity to develop operational and transactional networks with businesses and consumers across sectors. This will lead to an ultimate exercise in scale (and possible M&As), similar to what we have seen in the cases of WeChat, Grab and GoTo.

Brands, too, will have to rework their growth strategy and find the ‘glue’ to retain their loyal customers as too many similar products and services will be there under the super apps. Paradoxically, there could be tough competition from vertical marketplaces looking for a substantial chunk of this incredibly lucrative sector.

Here is a quick look at the three major homegrown super apps and how they are going about these techno-social changes. While MyJio and Tata Neu have similar offerings (focus on products and services), Paytm’s USP as an overarching payment processing company is critical in the super app space as this convenient core feature binds all third parties and consumers on the platform.

Paytm: The company started as a prepaid mobile and DTH (direct-to-home) recharge service in 2010 and added data card, postpaid mobile and landline bill payments in 2013. Next, the Paytm wallet was launched and accepted as a payment option by Uber and the Indian Railways. It entered the ecommerce space with online deals and bus ticketing. By 2015, the company added educational fees; metro recharges and utility bill payments to its service kitty.

A year later, Paytm added movies, events, amusement parks and flights to its ticket booking portfolio, introduced PayTM QR, a payment solution for businesses, and went ahead with rail booking and gift cards. The payment startup also launched PayTM for Business, enabling merchants to track their payments, and a gaming platform called Paytm First Games in 2018. It is the first Indian super app to offer more than 200 services.

MyJio: Reliance Retail (RRL), a wholly owned subsidiary of Reliance Industries (RIL), initiated a massive revamp of its MyJio app. The aim was to turn it into a super app by integrating various consumer offerings from the recently acquired local search engine, JustDial.

MyJio: Reliance Retail (RRL), a wholly owned subsidiary of Reliance Industries (RIL), initiated a massive revamp of its MyJio app. The aim was to turn it into a super app by integrating various consumer offerings from the recently acquired local search engine, JustDial.

The app currently bundles a suite of 20+ consumer-facing mini-apps, including UPI and other payment services, entertainment mini-apps, mobile recharge options and JioMart for online grocery. Powered by in-house technology and third-party app integrations, this super app will operate as a marketplace for consumer services.

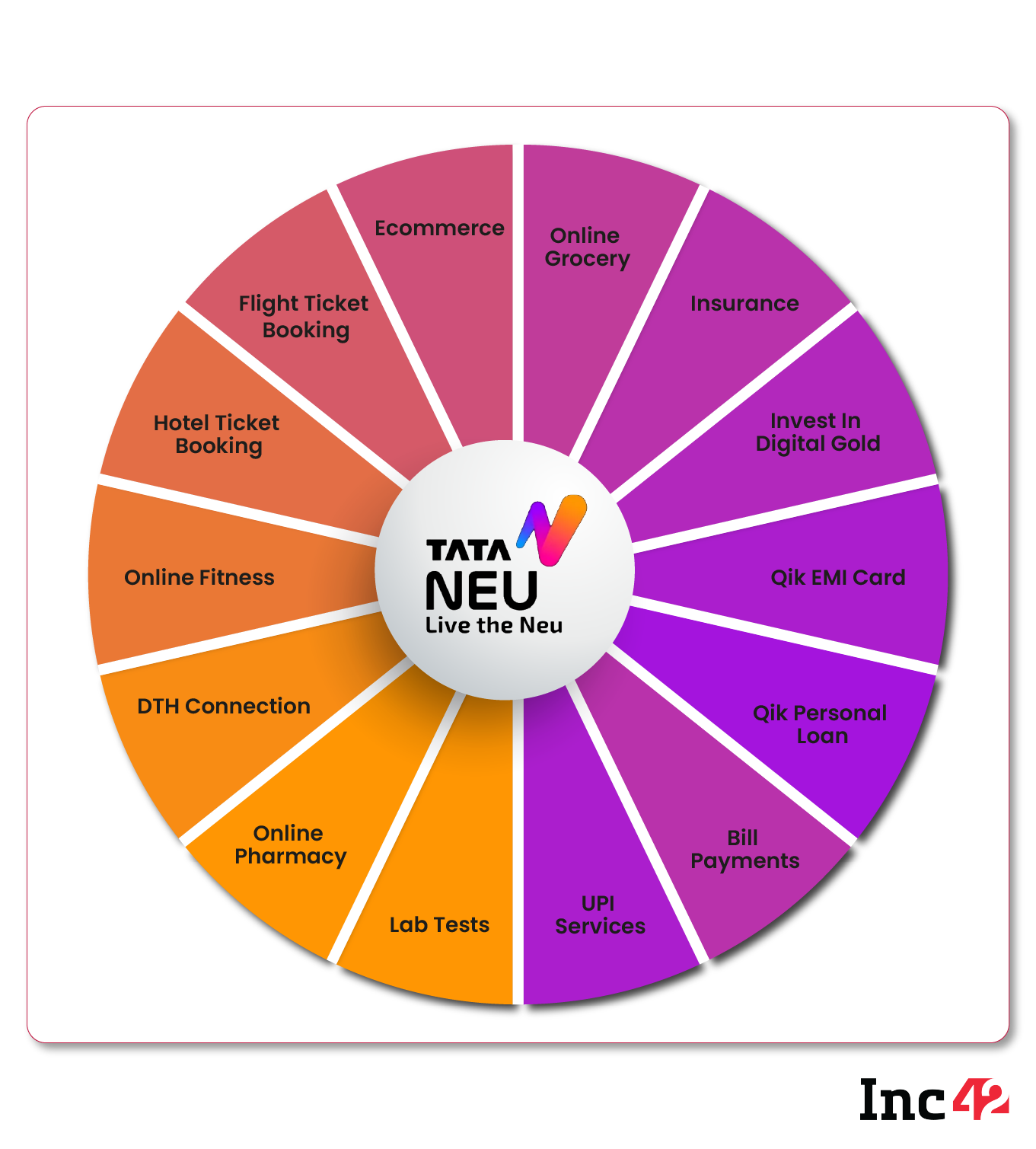

Tata Neu: It entered the super app space in April 2022 and clocked 7 Mn+ downloads just seven weeks after the launch. It is now working on increasing the number of NeuPass members (the loyalty programme of Tata Neu) to 100-150 Mn in the next two-three years. Currently, the app showcases its marquee brands across sectors such as beauty, fashion, e-pharmacy, e-grocery, travel, fitness and entertainment. It also plans to open the platform for non-Tata brands but only in the domains where the group has no significant presence.

Inc42’s Consumer Internet Report (Q3 2022) also offers a competitive landscape analysis covering the vertical apps across sectors and how they will impact super app aspirants.

Will Super Apps Thrive In India?

Time and again, numerous media reports have quoted analysts who are concerned about the success of super apps in India. Tata Neu has the potential to scale to the desired heights, given its product and service diversity and the consumer trust that the group has earned over the years.

But it is still a newcomer in this space and learning the ropes. Historically, the Tata group had shown little inclination to position itself as a digital conglomerate. Whether it can realise the mind-bending potential of a super app this time is something one has to wait and see.

Although Reliance has been hosting many consumer-facing services, it has never specifically promoted MyJio as a super app. Others like ecommerce behemoths Amazon and Flipkart and payments giant Paytm can be considered super apps, but they have only been successful in attracting audiences for certain categories. They are not yet the ‘everything for everybody’ platforms, the unmistakable trademark of a successful super app.

A volatile regulatory scenario can also make things difficult for super-app aspirants. As the government continues to release new guidelines for the digital economy, such measures will affect the sectors and sub-sectors covered by super apps and may pose multiple compliance challenges.

Take, for instance, ONDC (Open Network for Digital Commerce), a government-backed initiative to democratise digital commerce so that buyers and sellers can seamlessly connect irrespective of the platforms where they are registered. ONDC will play a major role here and may soon challenge the dominance of ecommerce marketplaces, thus hindering their super-app potential.

Data privacy is another primary concern that may pose existential challenges. In a digital world plagued by rising levels of cybercrimes and raging debates on ‘who owns customer data’, the need to comply with stringent laws safeguarding consumer interest will make the data flow difficult for super apps as they continue to battle between the mini-apps within the super app and third-party integrations.

Apart from vertical entities or ecommerce giants like Amazon and Flipkart, homegrown super apps will have to lock horns with Google and Apple, top foreign conglomerates active in the Indian market. While Google is calibrating Google Pay as its super app, Apple does not need to create a separate one as its iOS network commands a 4.4% app market share in India as of February 2022.

Essentially, its operating system features all essential services, from payment to messaging, music, TV and more, which resembles a super app, where the company’s proprietary and third-party apps exist.

Again, keeping users glued to just one app for all their needs makes it a high-stakes game. With numerous options and choices out there, engaging users for the longer term and preventing them from switching to competitors are often considered a mission impossible. Given this scenario, super apps are still tricky to operate, especially in widely diversified markets like India.

Consider this. Tata Neu had a good start during its launch week, recording more than 2.2 Mn downloads. According to App Annie data cited in their report, the app saw around 11 Mn downloads in April and May across Apple App Store and Google Play Store.

However, it managed to clock just $120-150 Mn in gross sales in the first month, missing out on the internal target of $200 Mn. App downloads also fell to 2.1 Mn in June compared to more than 6.6 Mn in April during the IPL season, according to market intelligence firm Sensor Tower.

As the Zomato CEO said, the super app is still uncharted territory, and only time will tell who gets the chance to leap ahead.