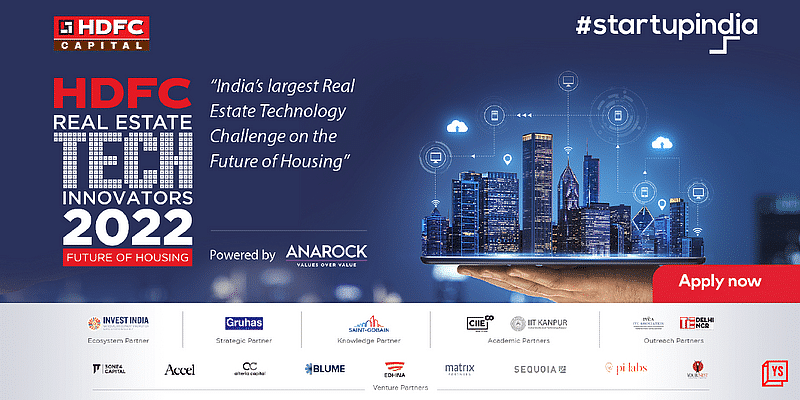

Real estate private equity investment manager – HDFC Capital and The investment promotion agency of Government of India – Invest India recently launched India’s largest proptech platform – HDFC Real Estate Tech Innovators 2022 – to identify, recognise, and award disruptive innovations within the affordable housing ecosystem in the construction, sales, fintech, and sustainability tech verticals.

To know more, you can visit: https://techinnovators.hdfccapital.com or HDFC Capital Website

Tech solutions for real estate

Launched under HDFC Capital’s H@ART (HDFC Affordable Real Estate and Technology) platform, HDFC Real Estate Tech Innovators 2022 is a thought leadership initiative where the shortlisted companies can leverage this platform to exhibit their innovative solutions to investors and stakeholders within the affordable housing ecosystem.

Despite having access to multiple funding options and smart solutions, startups always face scarcity within the domain of real estate tech innovations. This platform will help in bringing together relevant decision-makers and innovative solution providers, along with aiding startups to gain timely access to end-user businesses.

HDFC Capital has also committed to investing in at least three of the most innovative companies/solutions forming the cohort of HDFC Real Estate Tech Innovators 2022.

This year’s HDFC Real Estate Tech Innovators is being powered by Anarock and supported by leading ecosystem stakeholders like Sequoia, Matrix Partners, Accel, 3One4 Capital, Blume Ventures, Alteria Capital, YourNest, Pi Labs, Gruhas PropTech, Edhina, Saint Gobain, CIIE @ IIM Ahmedabad, IIT Kanpur along with IVCA and TiE Delhi NCR.

“HDFC Capital seeks to address the demand-supply gap in affordable housing in India through a combination of innovative financing, partnerships, sustainability and technology. The HDFC Real Estate Tech Innovators 2022 will showcase the future of affordable housing in India and will enhance the adoption of real estate tech innovations. Under the aegis of our H@ART Platform, we will also invest in real estate tech companies and foster their collaboration with leading real estate developers, thereby creating value across the entire affordable housing ecosystem,” said Vipul Roongta, Managing Director and CEO, HDFC Capital.

What’s in store for the shortlisted innovators?

Applications to partner with HDFC Capital’s USD 3 billion real estate funding platform have been opened up for innovators from across the country. Applications received will be evaluated on a rolling basis with the shortlisted applicants being provided the opportunity to present their innovations at the main showcase event to be held in Mumbai in the third week of November 2022.

Apart from the funding, the cohort comprising the shortlisted innovators will also receive awards and be considered for future investments. Additionally, the cohort will also have the opportunity to showcase their innovations to the real estate and technology ecosystem, comprising top government representatives, promoters, and CEOs of leading real estate developers and marquee global investors.

The challenge will have the following focus areas:

1. Construction and Project management- Innovations to enhance productivity and efficiency of construction and project monitoring.

2. Sales- Innovations to assist the buying and selling of real estate and other allied services.

3. Fintech- Innovative financing options for the built world ecosystem.

4. Sustainability technology– Innovations focused on sustainability in real estate and enhancement of societal outcomes.

Applicants would have to go through various stages of selection, post which they will be evaluated by the jury comprising domain experts and industry stalwarts who will assess the innovativeness of the solution. Applications close on October 16, 2022.

“Policy initiatives taken over the past few years have made India a global player and resulted in a significant inflow of foreign investments in all areas of the economy. Through HDFC Real Estate Tech Innovators 2022, we are aiming for increased cooperation between different stakeholders to provide the right market opportunities to startups in the proptech sector,” said Deepak Bagla, Managing Director and CEO, of Invest India.

![Read more about the article [Funding alert] Beauty startup Believe raises $55M in Series C led by Venturi Partners, IIFL AMC](https://blog.digitalsevaa.com/wp-content/uploads/2022/04/Believeankit-1650521268644-300x150.png)