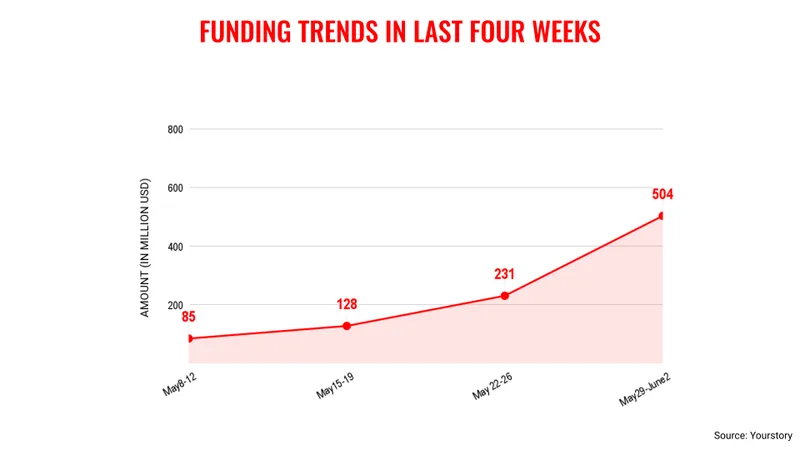

The month of June started on a positive note for the Indian startup ecosystem as the total venture funding crossed $500 million in the first week.

The total venture funding for the week preceding June 2 stood at $504 million cutting across 12 deals. This bump was largely thanks to a single transaction of clean tech startup CleanMax. In comparison, the previous week saw venture funding of $231 million.

Venture capital funding crossing $500 million in a week has become an oddity in the Indian startup ecosystem. However, such a sharp rise in capital inflow is usually attributed to a single transaction.

The Indian startup ecosystem continues to face headwinds as the global economy remains uncertain due to inflationary pressures, rising interest rates, and the Russia-Ukraine war. The challenge on the home front comes through markdowns in valuations of leading unicorn startups such as Meesho, BYJU’S, and Gupshup.

The ongoing funding winter environment continues to expose the weakness of the Indian startup ecosystem. The news about Info Edge taking a decision to audit the books of Rahul Yadav’s 4B Networks is perhaps symptomatic of the present environment.

With startups in the grip of a funding winter, they will continue to face challenges to raise funding with relief not in sight.

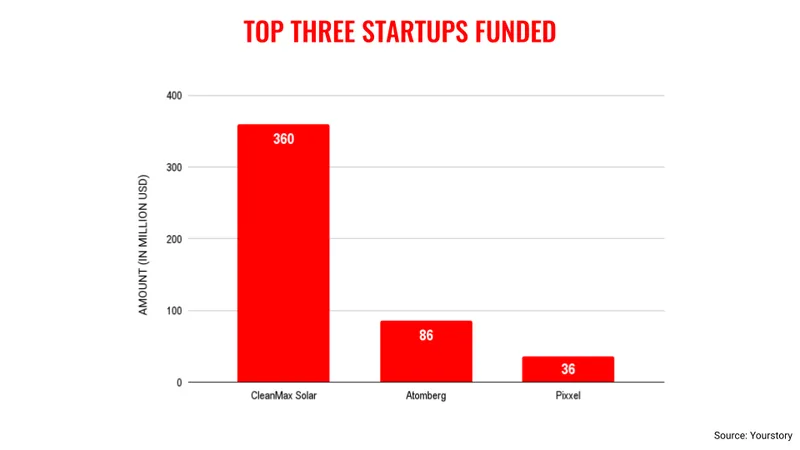

Key transactions

Mumbai-headquartered renewable energy company CleanMax Enviro Energy Solutions raised $360 million from Brookfield Renewable.

Consumer appliances brand Atomberg Technology raised $86 million from Temasek, Steadview Capital, Trifecta Capital, Jungle Ventures and Inflexor Ventures.

Space startup Pixxel raised $36 million in funding and found a new investor in Google.

Climate technology startup Newtrace raised $5.65 million from Sequoia Capital India, Aavishkaar Capital, Speciale Invest, and Micelio Fund.

KarmaLife, a credit solutions provider for gig workers, raised Rs 44 crore from Krishna Bhupal’s family office and Artha Venture Fund.

![You are currently viewing [Weekly funding roundup May 29-June 2] VC funding rises sharply](https://blog.digitalsevaa.com/wp-content/uploads/2022/11/funding-roundup-LEAD-1667575602969-scaled.png)