BharatPe Group has rebranded PAYBACK, one of the largest multi-brand loyalty programmes in the country, to Zillion. This rebranding initiative aligns with the company’s vision to establish Zillion as a widely recognised name in the realm of loyalty and rewards throughout India. The objective is to cater to customers across all age groups and enhance their shopping experience by offering a diverse range of benefits across various categories and brands.

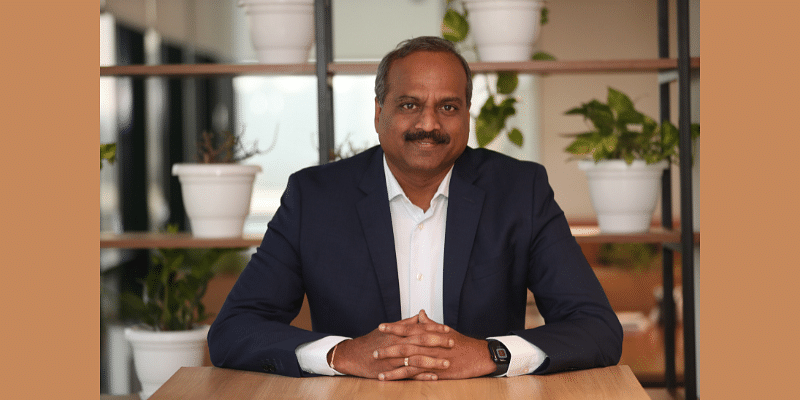

YourStory spoke to Rijish Raghavan, CEO of Zillion, to know more about the rebranding, understand how Zillion differentiates itself from other loyalty programmes, and learn more about its plans for the future.

Edited excerpts from the interview:

YourStory (YS): What was the thought behind rebranding PAYBACK India as Zillion?

Rijish Raghavan (RR): It has been a remarkable journey for us, building PAYBACK as India’s largest loyalty programme with over 120 million customers. We wanted to take it a step further and make Zillion synonymous with loyalty and rewards across the country for a diverse set of age groups.

The rebranding reflects our vision to offer a broader range of partners and categories, transforming Zillion into an all-encompassing loyalty platform. Additionally, the new brand identity enables us to connect better with a wider range of customers, including Gen Z and millennials, who are crucial demographics in today’s market.

YS: How does Zillion differentiate itself from other loyalty programmes?

RR: Zillion stands out by providing customers with an extensive network of partners, both online and offline, where they can earn and redeem Zillion coins. Our aim is to create a delightful shopping experience for customers across various categories and brands, by giving them a chance to earn more every time they shop/spend or get an additional discount by redeeming their Zillion coins.

We have an entrenched network of partners, including renowned names in retail, fuel, banking, payments, entertainment, hospitality, and travel. Zillion provides unparalleled opportunities for customers to benefit from their routine spending by offering multiple avenues to earn and redeem rewards.

YS: How do you plan to engage with a wider customer base, including Gen Z and millennials?

RR: Zillion has been strategically designed to resonate with the customers of today — young, bold, and energetic. Our aim is to add a spark of joy to their lives every day when they go out and shop.

To engage with a wider customer base, we will leverage targeted marketing campaigns to raise awareness about Zillion and its unique offerings amongst Gen Z and millennials. Our app is available on both Android and iOS. We believe Zillion will become the preferred loyalty programme for millions of customers by delivering a seamless and rewarding experience. We will also explore our presence and partnerships at relevant events and forums, with the objective of building awareness across audience groups.

YS: What are your expectations for Zillion in the coming months?

RR: Our objective is to make Zillion a de-facto customer delight tool for retailers across the country. We anticipate significant growth in customer engagement and participation with the expanded partner network and a user-friendly app. We aim to establish Zillion as the go-to loyalty programme in India, offering unparalleled benefits and experiences. We are confident that Zillion will emerge as the preferred choice for loyalty and rewards for customers across categories, in times to come.

YS: What is the shift from a business standpoint?

RR: Zillion is not just a brand name change. It has a lot to do with refreshing our focus, in line with what we believe will help us get the next level of growth for the brand. As a part of the renewed strategy, we will expand our partner portfolio to make this loyalty programme more ubiquitous to all categories of customers.

We will also focus on empowering mid-sized and small merchants to attract more footfall as well as build a more engaged and loyal customer base. For these merchants, loyalty is a distant dream and they miss out on retaining or attracting customers as they don’t have any loyalty or cashback offers.

This also goes well with our overall BharatPe Group strategy, which is committed to positively impacting the businesses of small and medium-sized merchants.

YS: Can you share more on the plans for small and mid-sized retailers?

RR: We have plans to launch a couponing system, to roll out offers for this segment of merchants and appeal to customers who visit them. Merchants can generate their own coupons, enabled by Zillion.

YS: Is there any specific reason why BharatPe has decided on this approach now?

RR: When we were not part of the BharatPe family, building a network amongst the small and medium retailers across the country seemed like an uphill task as we didn’t have the distribution muscle power to be able to reach out to this widely distributed merchant base. Today, BharatPe brings with itself the distribution bandwidth that can enable us to attract a large base of merchants and demonstrate the larger USP that we have to offer. BharatPe itself has a network of one crore plus merchants across 400+ cities in the country. This will give us a great head start.

YS: What will be your focus markets?

RR: We will target the top 10 cities in the country, to begin with. In the second phase, we will move our focus to the next 20-25 cities. Our focus will be to target the top 10% of the targetable merchant base (in small and mid-sized segments) and add them to our partner ecosystem.

YS: What are your high-frequency categories?

RR: Our high-frequency categories are retail, F&B, and healthcare. Travel is also one of the key categories for us. We will focus on having a good blend of categories for our customers to choose from.

YS: Are there any specific targets?

RR: We aim to get our merchant base up by 3x in the current fiscal. We also want to grow our customer base steadily, with a greater focus on enhancing engagement levels.