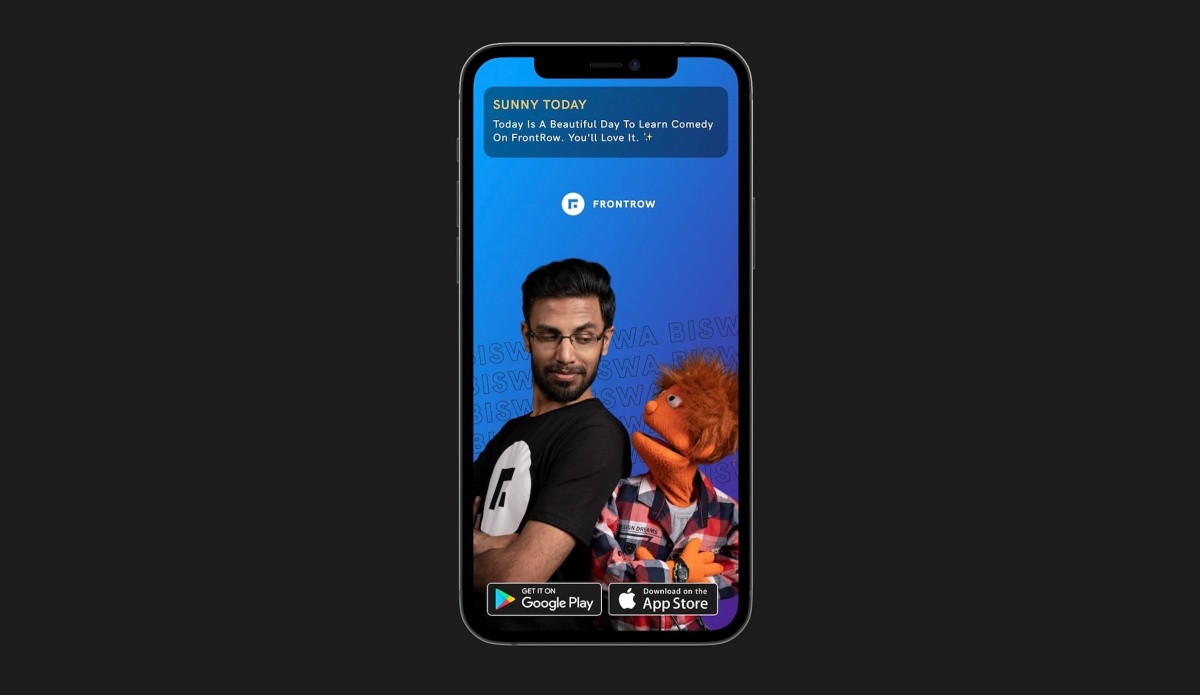

FrontRow, a hobby learning and community platform featuring celebrities in India, has shut down, TC has learned and confirmed.

The three-year-old startup sought to build a community where well-known artists and athletes taught their craft to consumers. The startup had raised about $18 million and counted Elevation Capital, Eight Roads Ventures, Lightspeed Venture Partners and Not Boring Capital among its backers.

Ishaan Preet Singh, co-founder of FrontRow, confirmed the development to TC, adding that the startup is exploring IP acquisition talks and possibility to return the unused capital to investors.

FrontRow had scaled to $3 million to $4 million of annualized revenue, but struggled to scale from there, Singh said. At that point, he said, it became clear that the firm was not venture-scalable. FrontRow cut most of its jobs last year and gave itself a few months to try a few pivots.

In an earlier note, Singh said:

FrontRow went back to being a seed company last year from Nov, with ~35 people on the team while we ran multiple experiments to find PMF in the non academic learning space. We ran 3-4 experiments including career oriented learning for adults and offline holistic development for kids. Some of them, particularly the kids offline piece is encouraging with a lot of user love, but still very early.

We (founders and investors) had always set a June date for taking a step back and reflecting on the pilots we’re running and while we’ve made a ton of progress, and have a CM positive (albeit very small scale business), we’re having multiple conversations on what’s the best place for the company, including whether the market is large enough to support an independent player or whether this fits better within a larger multi category company. We’ll be figuring this out over the next couple of months. We’ve also kept the team in the loop here, and are helping some of them find alternate jobs if they’d like. This isn’t a capital or runway question (we have over 3 years of runway), it’s more about making sure that when you raise capital with a vision of building a large scale business, you are honest on wether that’s doable in a particular market as you learn more.