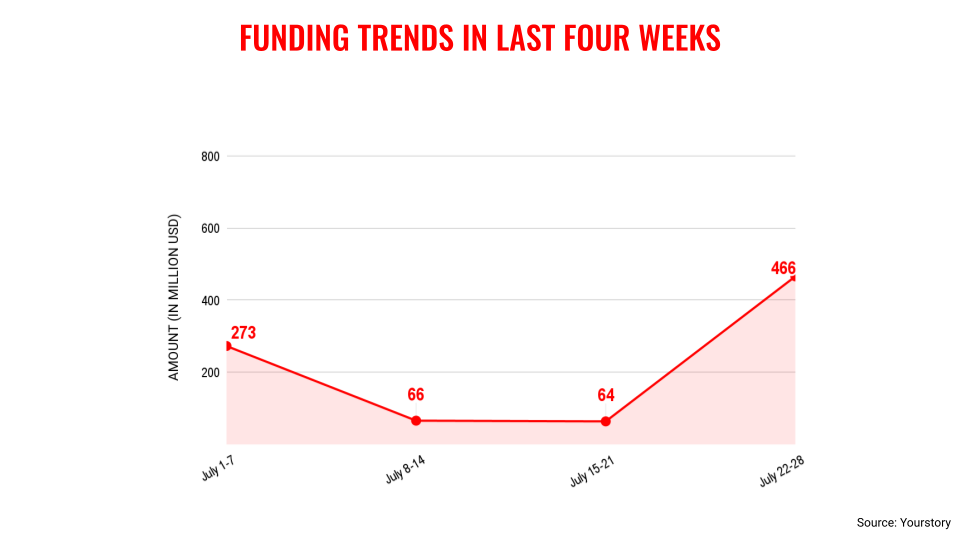

The last week of July saw a sharp rise in funding flowing to Indian startups, in what is a much-needed relief to the entire ecosystem. But this shouldn’t be read as a note of optimism as a large component of this money has come in through the debt route.

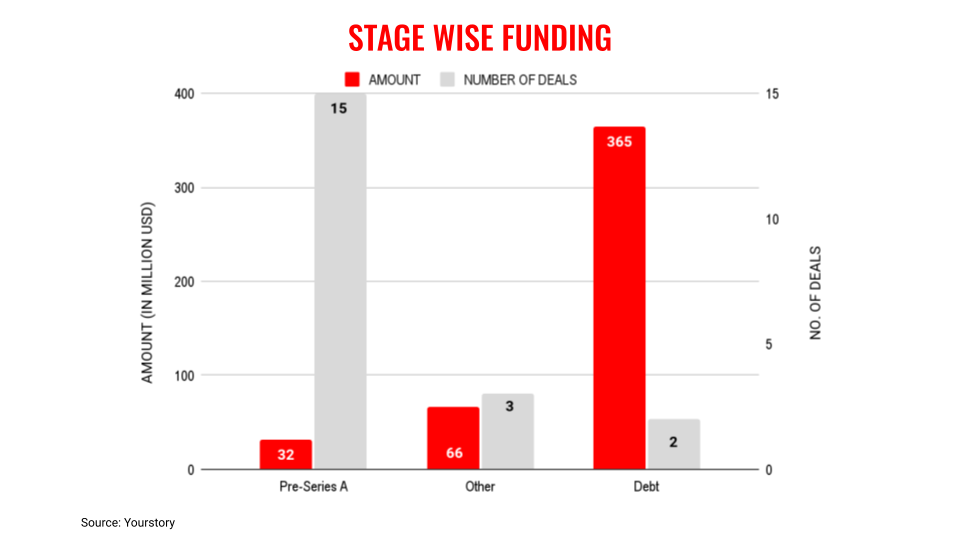

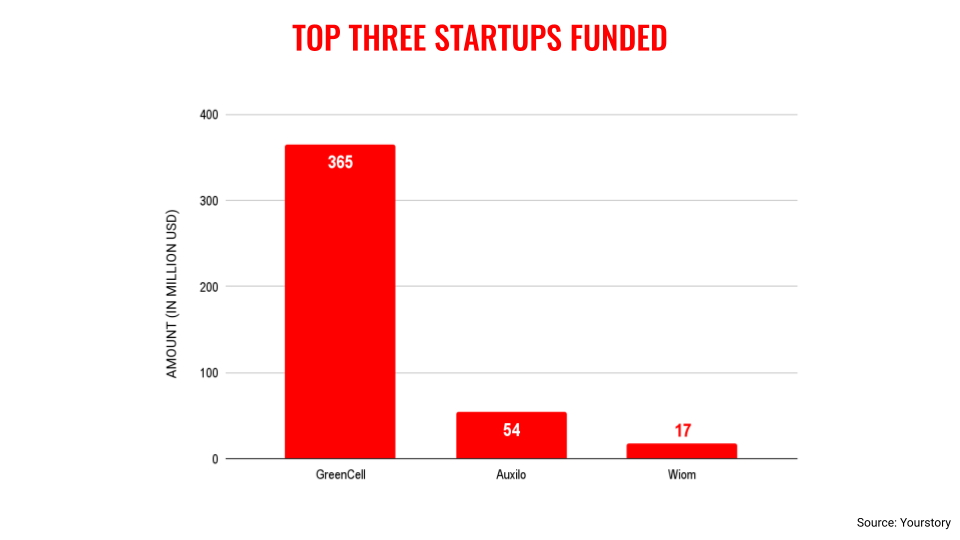

The week saw total venture funding of $466 million cutting across 22 deals. A large component of this was due to the debt transaction of $364 million from GreenCell Mobility. Compared to the previous week, Indian startups received a total amount of just $64 million.

Debt forms an important component of funding into startups, but the real strength of the ecosystem comes from equity fundraises.

The Indian startup ecosystem continues to face funding challenges. It is likely to continue for the remainder of the year given the tough global macroeconomic environment. The recent decision of the US Fed to hike interest rates is likely to have a bearing on the money flow across the world.

Given these conditions, the only strong area of funding activity for the Indian startup ecosystem continues to remain the early-stage segment. While the quantum of money flowing into this segment remains low, the number of deals is high. This trend has been quite evident from the second half of 2022 and it has continued till now.

As seven months of the year have passed, the total funding for 2023 is unlikely to touch anywhere close to the figure of 2022. The only hope remains now in 2024.

Key transactions

Shared e-mobility company GreenCell Mobility raised Rs 3,000 crore ($364 million approx.) in debt from Rural Electrification Corporation (REC).

Tech startup Wiom raised Rs 140 crore (~$17 million) from RTP Global, YourNest, Omidyar Network India, Global Brain, Blume Founders Fund, and others.

Hardware startup Ethereal Machines raised $7.3 million from Peak XV, Blume Ventures and angel investors.

Tech startup Effectiv raised $4.5 million from Better Tomorrow Ventures and Accel.

SaaS startup Kapture CX raised $4 million from Cactus Venture Partners (CVP).

Edited by Akanksha Sarma

![You are currently viewing [Weekly funding roundup July 22-28] Debt deals provide boost to capital inflow](https://blog.digitalsevaa.com/wp-content/uploads/2023/07/Weekly-funding-roundup-1670592545805.png)

![Read more about the article [EXCLUSIVE] Chingari’s Sumit Ghosh on controversies, pivots and why the Salman Khan ad was a mistake](https://blog.digitalsevaa.com/wp-content/uploads/2023/06/ChingariFeatureIMG-1687933675634-300x150.jpg)