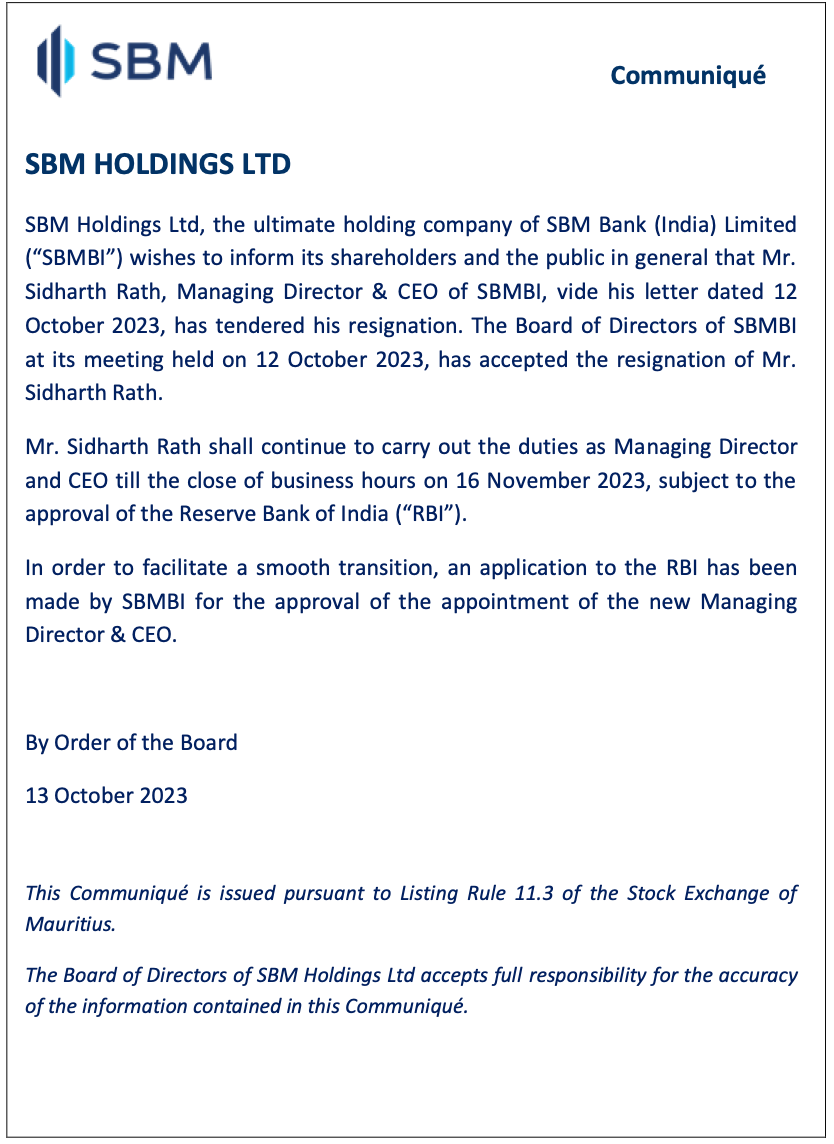

Sidharth Rath, Managing Director and Chief Executive Officer of State Bank of Mauritius (India) has resigned from his position, the group’s stock exchange filing said.

The development was confirmed via a communique on the Stock Exchange of Mauritius, from the bank’s holding firm, SBM Holdings Ltd.

“SBM Holdings Ltd, the ultimate holding company of Limited (SBMBI), wishes to inform its shareholders and the public in general that Mr Sidharth Rath, Managing Director & CEO of SBMBI, vide his letter dated 12 October 2023, has tendered his resignation. The Board of Directors of SBMBI, at its meeting held on 12 October 2023, has accepted the resignation,” it read.

It also said, “Rath shall continue to carry out the duties as Managing Director and CEO till the close of business hours on 16 November 2023, subject to the approval of the RBI.”

Further, it informed that an application has been made by the bank to the RBI for the approval of the appointment of the new managing Director & CEO, which remains unknown as of now. Meanwhile, the bank has appointed Dipak Agarwal, the head of corporate banking, as the deputy CEO and head of business.

According to Agarwal’s LinkedIn profile, he took up the new position four months ago in August.

Changes in the offing

Interestingly, Rath’s exit comes a year ahead of the expiry of his tenure. Having worked with Axis Bank for over 17 years, the banking veteran joined SBM in 2018 as MD and CEO. His tenure was set to expire in November 2024.

A founder of a fintech firm, which had previously partnered with the bank, said the group is looking at a complete overall in leadership, and changes are expected in the near future.

Once a favourite choice among over 40 fintech firms for co-lending, credit cards, BNPL, and foreign stock investments partnerships, SBM Bank has been marred with controversies since last year, affecting its tie-ups.

The regulator came down heavily on its operations, starting with SBM Bank’s suspension from enabling international transactions under the Liberalised Remittance Scheme, affecting the likes of fintech partners like . The order was based on certain “material supervisory concerns” observed in the bank. A partial relaxation was later given.

SBM Bank was recently pulled up for the re-KYC issue on some corporate credit card accounts it backed via its fintech partners, including , , , , X, , , and .

Further, it offered its prepaid payment instruments (PPI) licence to fintech firms like , Uni, for their wallet and card services. The partnerships came under stress last year after the RBI’s new digital lending norms, forcing many firms to relook at their tie-ups with the sponsor bank.

Edited by Swetha Kannan