The Reserve Bank of India (RBI) on Thursday tightened norms for personal loans and credit cards in the form of higher capital requirements for banks and non-banking finance companies (NBFCs).

The risk weight—the percentage of capital that banks and NBFCs need to set aside to cover potential losses on loans—on retail loans, covering personal loans and credit card loans, was spiked from 100% to 125% by the RBI. However, this excludes education, vehicle loans, housing, as well as loans secured by gold and gold jewellery, the RBI said.

As higher risk weightage pushes banks and NBFCs to go selective on doling out credit in the unsecured space, their loan distribution ally—Digital Lending Apps (DLAs)—will face the music as the spillover effect kicks in.

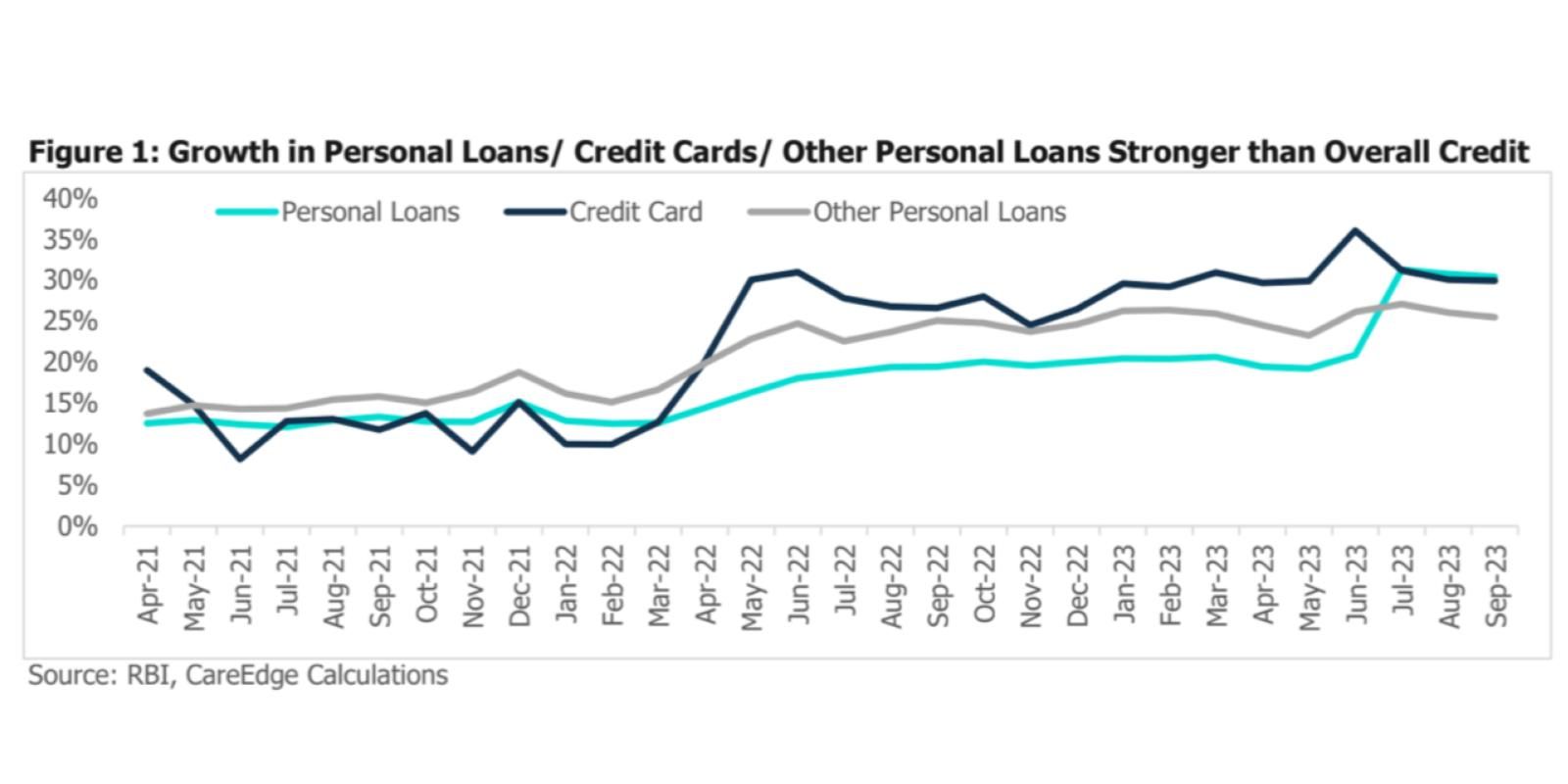

The unsecured loan surge

The directive by the regulator to tighten the nozzle is not surprising as the RBI has struck cautionary notes on several occasions in the past regarding the rapid growth in unsecured lending, especially small-ticket personal loans).

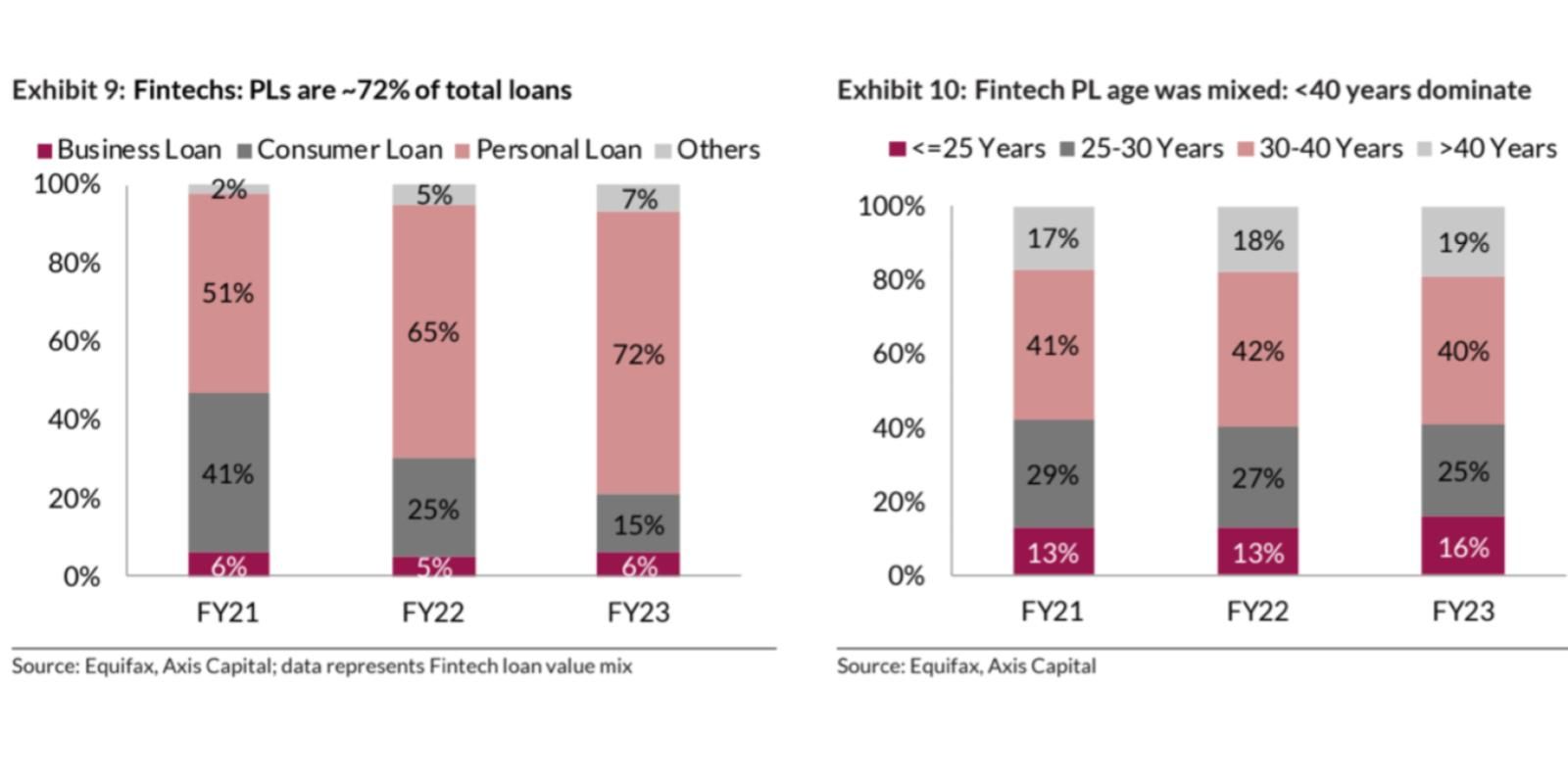

These loans are often targeted towards first time borrowers or ‘new to credit’ segments, which have a higher probability of risk and defaults.

According to the Fintech Association for Consumer Empowerment’s report, fintech lenders, who partner with these NBFCs and banks, disbursed loans of around Rs 30,000 crore in the June quarter, up 32% year-on-year.

Unsecured retail loans, which do not need any collateral, have grown at a CAGR of 47% from the quarter ending March 2021 to March 2023.

From a delinquency perspective, there was an uptick in the small ticket personal loans of less than Rs 50,000 that were unpaid for over 30 days during the first six months of a loan at 10.24% in December 2022 as against 7.56% in December 2019, the CIC report said. Further, UBS Securities warned of ‘increasing default risks in retail unsecured loans of banks, which is likely to push up their credit losses by 50-200 bps.

The likes of , , Cred, and , among others, have been eying a large piece of the segment and striking co-lending partnerships with NBFCs to disburse personal loans.

Impact on volumes & profit margins

The major concern among digital lenders is the loan cost, which is expected to increase marginally by 5-8% across the sector, acknowledges Chintan Panchmatiya, Founder of Switch My Loan, a lending aggregator.

The figure may vary for fintechs depending on the yearly deal they have with their partner NBFCs who offer a fixed rate of interest in consumer lending for retail, and mostly unsecured lending.

Fintechs often rely on a mix of equity and debt financing to fund their lending activities. As the risk weightage on credit card and personal loans increases, the cost of debt financing for fintechs may rise, directly impacting their profit margins as they may need to pay higher rates on the funds borrowed from banks and NBFCs.

They would further pass this increased cost to customers in the form of high interest rates—directly hitting the loan volumes as demand drops, explains Krishnan Vishwanathan, Executive Director and Co-founder, RING, a fintech lender.

Having said that, Vishwanathan doesn’t feel a strong pinch, and will continue to look for any tightening of debt-liquidity and pricing in its segment and will take measures on growth as required.

“We do not think the impact will be significant as most banks have low exposure to consumer credit and most NBFCs do not operate close to CAR margin,” he says.

Panchmatiya expects a moderate decrease of around 10-15% in loan disbursals industry-wide.

Nevertheless, it will lead to responsible lending practices in the long term, he echoes.

Meanwhile, analysts at global brokerage CLSA believe RBI’s latest move could marginally impact the growth rates of fintech intermediaries like Paytm. However, Jefferies says banks raising interest rates may hurt Paytm earnings. The brokerage said that higher funding costs and increased capital requirements for Paytm’s lending partners will affect product profitability in buy now, pay later (BNPL).

In its base case earnings, the brokerage forecasts consumer loan disbursal growth to normalise from 90% in this fiscal (FY24) to 40% in FY25 and 35% in FY26.

Choose wisely before lending

‘Choose wisely before lending’ is expected to remain the motto for the majority of fintechs moving forward.

“Longer term expansion would be affected for fintechs. We plan our journey year-on-year expecting the cost of funding would go down so that we can offer better credit to customers. But the cost is increasing and so does the difficulties for us,” shares Ajay Chaurasia, Vice President, Marketing, Product & Business, RupeeRedee.

“We will have to strengthen our risk and control our NPA, which would be bad news for customers as today fintech gives loans to consumers to lower credit score as well, also to underserved category. With such changes lending would be difficult and we will have to choose wisely before lending,” he adds.

Meanwhile, Sanjeev Kumar, Co-founder, Executive Director & CEO, Spice Money, a fintech company, remains concerned about the impact on borrowers in rural areas, where access to financial services is critically significant.

“A thoughtful approach is essential to strike a balance. We’ll need to observe how these events progress and assess whether they will affect customers in rural areas,” he says.

Good tidings

Many feel that the latest move will have fintechs re-evaluate frivolous lending practices and shift towards more secure lending products.

“Although the overall impact of bad loans in this segment might not be significant in monetary terms, the sheer number of citizens who are attracted to easy credit for non-productive purposes like gadgets is huge. This measure will curb lenders who may have followed lenient practices in loan appraisal, a trend that historically led to adverse outcomes in the past,” says Jaya Vaidhyanathan, CEO at BCT Digital, a RegTech firm which provides risk management tools to the BFSI segment.

Weighing in on the long-term impact, Mahesh Shukla, CEO and Founder at PayMe, believes fintechs may undergo significant transformation in their business models to adapt to new norms.

This could include incorporation of advanced risk assessment technologies, or an altogether diversification into different financial services to reduce reliance on credit card and personal loan revenue.

“Fintechs may invest in technological innovations to enhance efficiency, reduce operational costs, and improve risk management. This could involve use of advanced data analytics, ML, and AI to better assess borrower risk and make more informed lending decisions,” he says.

Edited by Megha Reddy