Let’s face it, nobody wants to be the Grinch when it comes to their financial future. Imagine opening your investment statement and seeing a big, fat lump of coal – depressing, right? The same goes for relying on a single investment.

Portfolio Management 101: It’s Not Rocket Science (But It Can Be Rewarding!)

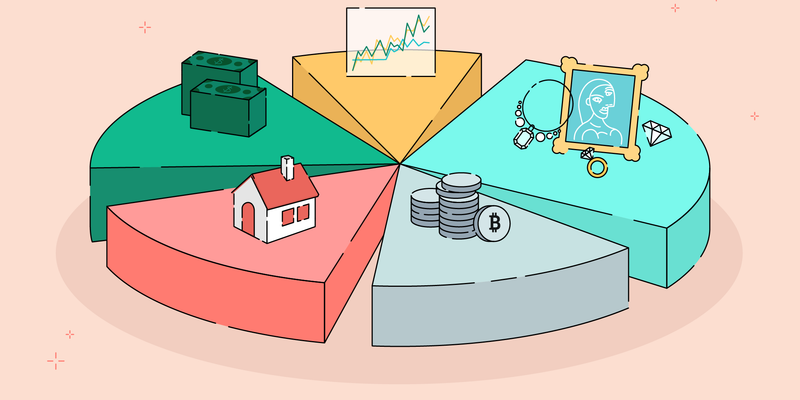

Think of your portfolio as a collection of all your investments – stocks, bonds, real estate assets, etc. Portfolio management is the art (and a little bit of science) of choosing the right mix of investments to achieve your financial goals while keeping risk in check. Diversification is the golden rule of portfolio management – it’s like spreading your investment bets to minimise the impact of any single misstep.

Diversification Done Right: A Recipe for Success

Here are 9 ways to diversify your portfolio and become an investment maestro:

- Asset Class All-Stars: Don’t stick to just one kind of investment. Spread your money around in stocks, bonds, and real estate to even out risk and up your chances for gains.

- Industry Icons and Hidden Gems: Dive into different areas within each type of investment. Put some money in big, well-known companies and also in new, promising ones for a full mix.

- Location, Location, Location (in Your Portfolio): Look beyond your borders! Putting money in foreign markets can open up new chances and protect against money value changes.

- Big Players and Small Caps: Big companies are stable, but small ones have room to grow. Having both can make your investment steadier.

- Value vs. Growth: A Balancing Act: Some stocks are steady earners while others are growing fast. Having a bit of both can keep things balanced.

- Bond Bonanza: Bonds are your safe bet, bringing in steady money. Make sure to have bonds of different lengths and reliability to keep things safe.

- Alternative Investments: Spice Up Your Portfolio (Literally!): Look into other ways to invest, like in buildings through REITs or in goods like crops or metals. But be careful, as these can be tricky.

- Rebalance Regularly: Like a car needs a check-up, so does your portfolio. Adjust your investments now and then to keep in line with how much risk you’re okay with.

- Know Your Risk Tolerance: Know how much risk you can handle. Are you in for a wild ride or more for playing it safe? Knowing this helps pick the right mix for you. Don’t be shy to ask for help if you need it.

The Takeaway: Diversification is Your Investment Superpower

By using these tips, you can make a mixed bag of investments that match your wants and how much risk you can handle. Keep in mind, that mixing up your investments isn’t about dodging risk all the way; it’s about spreading it to build a stronger and more rewarding path of investing. So, step up and diversify your investments like a champ – your future self will be thankful!

Edited by Rahul Bansal

![Read more about the article [Funding alert] Fitness tech startup Insane AI raises $873K seed round led by pi Ventures](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/Imagedj8p-1627448785369-300x150.jpg)