Flipkart and Accel-backed truck operator has filed draft IPO papers with the Securities and Exchange Board of India (SEBI) to raise Rs 550 crore through a fresh issue of shares.

According to the draft red herring prospectus (DRHP) filed with SEBI and BSE, the float includes an offer for sale (OFS) of 21.6 million shares by existing shareholders.

The company plans to use the majority of the funds, about Rs 200 crore, for sales and marketing. It will inject Rs 140 crore in its NBFC, BlackBuck Finserve, for financing the augmentation of its capital base to meet its future, and will use about Rs 75 crore for product development.

.thumbnailWrapper{

width:6.62rem !important;

}

.alsoReadTitleImage{

min-width: 81px !important;

min-height: 81px !important;

}

.alsoReadMainTitleText{

font-size: 14px !important;

line-height: 20px !important;

}

.alsoReadHeadText{

font-size: 24px !important;

line-height: 20px !important;

}

}

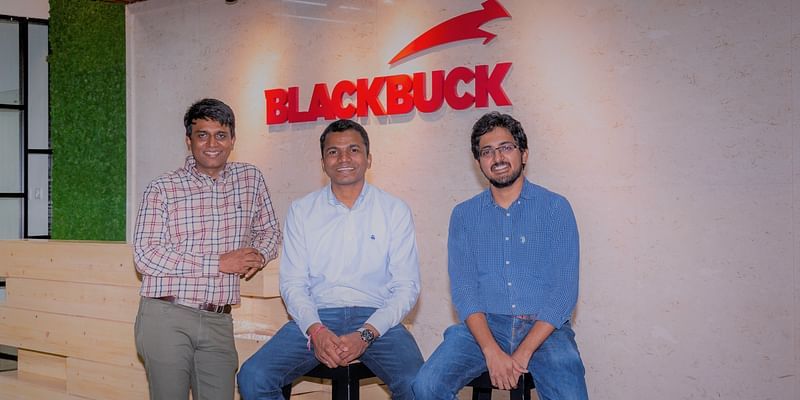

BlackBuck founders Rajesh Yabaji, Chanakya Hridaya, and Ramasubramanian Balasubramaniam will sell 2.2 million, 1.1 million, and 1.1 million shares, respectively in the offer for sale. Initial investor Accel, through its Accel India IV (Mauritius), will sell up to 4.3 million shares and another 923,282 shares through its Accel Growth Fund V L.P fund.

While World Bank-backed International Finance Corporation and IFC Emerging Asia Fund will sell 1.7 million and 628,315 shares, Quickroutes International will sell 3.9 million shares and VC fund Tiger Global Management will sell 883,322 shares. Other investors like Peak XV Partners and B Capital will sell 640,409 and 529,993 shares in the float.

Bengaluru-based Blackbuck, which allows truckers to book a load and move at capacity through its marketplace and enables shippers to have access to trucks, logged revenue of Rs 296.9 crore from continuing operations against a loss of Rs 166.9 crore in the fiscal year 2024.

In fiscal year 2023, it posted Rs 175.6 crore revenue with a loss of Rs 236.8 crore. The company logged EBITDA loss of Rs 138.7 crore in fiscal 2024, lower than EBITDA loss of Rs 213 crore it posted a year ago.

Edited by Megha Reddy