Having brought in over 400 million users into the digital payments fold in just about eight years, the ubiquitous Unified Payments Interface (UPI) now seems poised to stamp a global footprint.

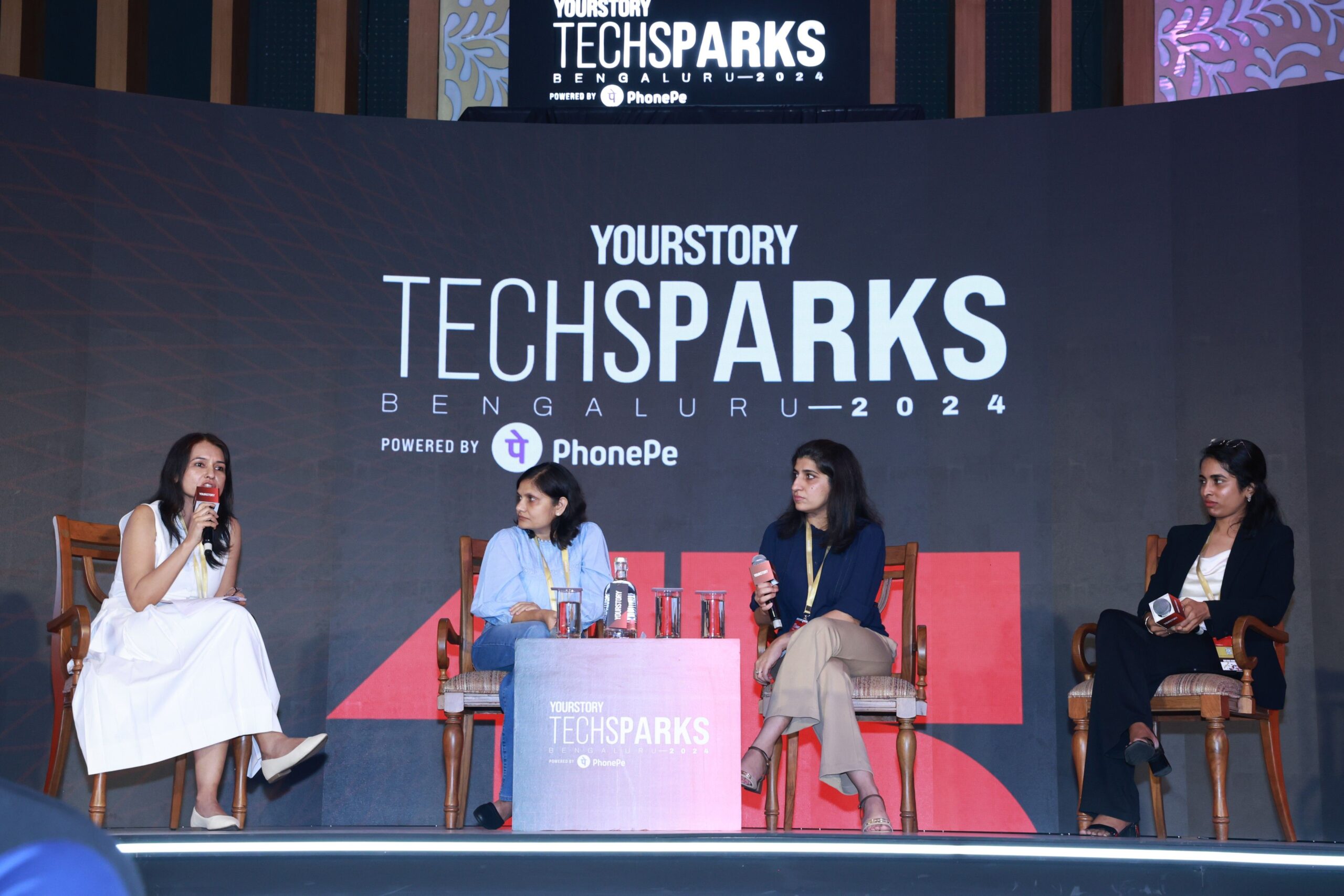

In a panel discussion titled ‘’Building and Scaling Payments for Bharat: The Challenges and Opportunities’’, Nidhi Gupta, Head of Product- Payments and Pooja Gulrajani, Head of Engineering and Sai Sravanthi Pasumarthi, Director- Consumer Payments Growth spoke about the next wave of growth for digital payments from a tech, product and business perspective. The session was moderated by Priya Patankar, Head of Communications.

Patankar started the session by talking about UPI its scale and growth. UPI processed over 14 billion transactions in August’24 driving over 20 Trillion in value. Patankar started by asking about the primary challenges in taking digital payments to the next 300 million users with digital payments and how will the playbook differ for this new set of users.

“If there are a billion adult Indians, there are naturally about 400 million people under the age of 18 – the Gen Z – with access to smartphones. So there is definitely a need to build products that are custom-crafted for this cohort which comprises about 100 million users,” said Pasumarthi.

Further, the UPI for Her initiative—a partnership between the NPCI and Women’s World Banking—revealed that 200 million women in India are ready to adopt digital payments, provided certain core requirements are met.

“One of them is a perceived lack of control in digital payments. A lot of women have echoed that they feel in a more control of their spends if they are spending via cash. So there is an urgent requirement for building products and solutions that address some of these core perceptual gaps,” she observed.

And then there’s the entire feature phone base. “This is perhaps the toughest of the cohorts to chase, but there’s a whopping 300 million users here,” Pasumarthi noted.

One underlying problem statement while building products for the under-served cohorts is ensuring that they get onboarded on to the digital payments ecosystem in a safe and secure manner with minimal risk of fraud.

“Both the Reserve Bank of India and the NPCI have been focusing on onboarding the three cohorts without a bank account, through interoperable wallets and UPI Circle,” she said.

UPI Circle is being built to solve multiple use cases for digital payment needs for different members in a single family, with one bank account.

Gulrajani then went on to speak about ensuring user trust in digital transactions.

User trust, according to Gulrajani, comes from four pillars:

01. Security: Today, anyone who uses digital payment solutions – whether through their bank account, UPI, cards or merchant websites – want to be doubly sure that the instrument can only be accessed by them to ensure there are no fraudulent activities.

02. Availability: The ability to use a payment instrument whenever you need it is important. The expectation is ‘anytime, anywhere.’

03. Speed: Therefore, speed in processing payments in just a few seconds is integral.

04. Reliability: UPI is an interoperable protocol. Digital payments are made through third-party apps. The constructs around multi-factor authentication and how the UPI pin is still authenticated by the bank and encrypted through have all ensured trust in the ecosystem.

“At PhonePe, we have built proprietary fraud detection platforms. to ensure that fraud is not an afterthought.’’ Gulrajani said.

Customer adoption in new UPI features

Over the last two years, UPI has evolved from being a single payment instrument linked to a bank account to a rail now supporting multiple instruments on it, Pasumarthi noted.

“Two products I am looking forward to in terms of driving consumer adoption are credit on UPI and international expansion,” she said.

RuPay credit card usage on UPI, Pasumarthi believes, has unlocked merchant acceptance through the quick-response (QR) network pretty much overnight. “When RuPay credit cards opened up on UPI and players like PhonePe opened up merchant acceptance, the number doubled or tripled overnight,” she said.

India still drives a lot of its retail consumption through the mom-and-pop stores and kiranas where the QR code is the most accepted form factor. “So I think it goes a long way in driving affordability and retail consumption in the country,” she said.

While several countries’ regulators and merchants are partnering with India to develop UPI-like payments system, the UPI from India can now be used to facilitate overseas digital transactions in select overseas markets.

To manage and support the overall growth at PhonePe, Gulrajani said, “We have been able to incrementally augment our data centres to support the volume. Apart from incremental changes, we have built our own proprietary core processing engine, which we continue to augment with multiple features.”

![Read more about the article [Funding alert] Social investment startup StockGro raises $32M in Series A round](https://blog.digitalsevaa.com/wp-content/uploads/2021/08/Imagevjig-1628055178521-300x150.jpg)