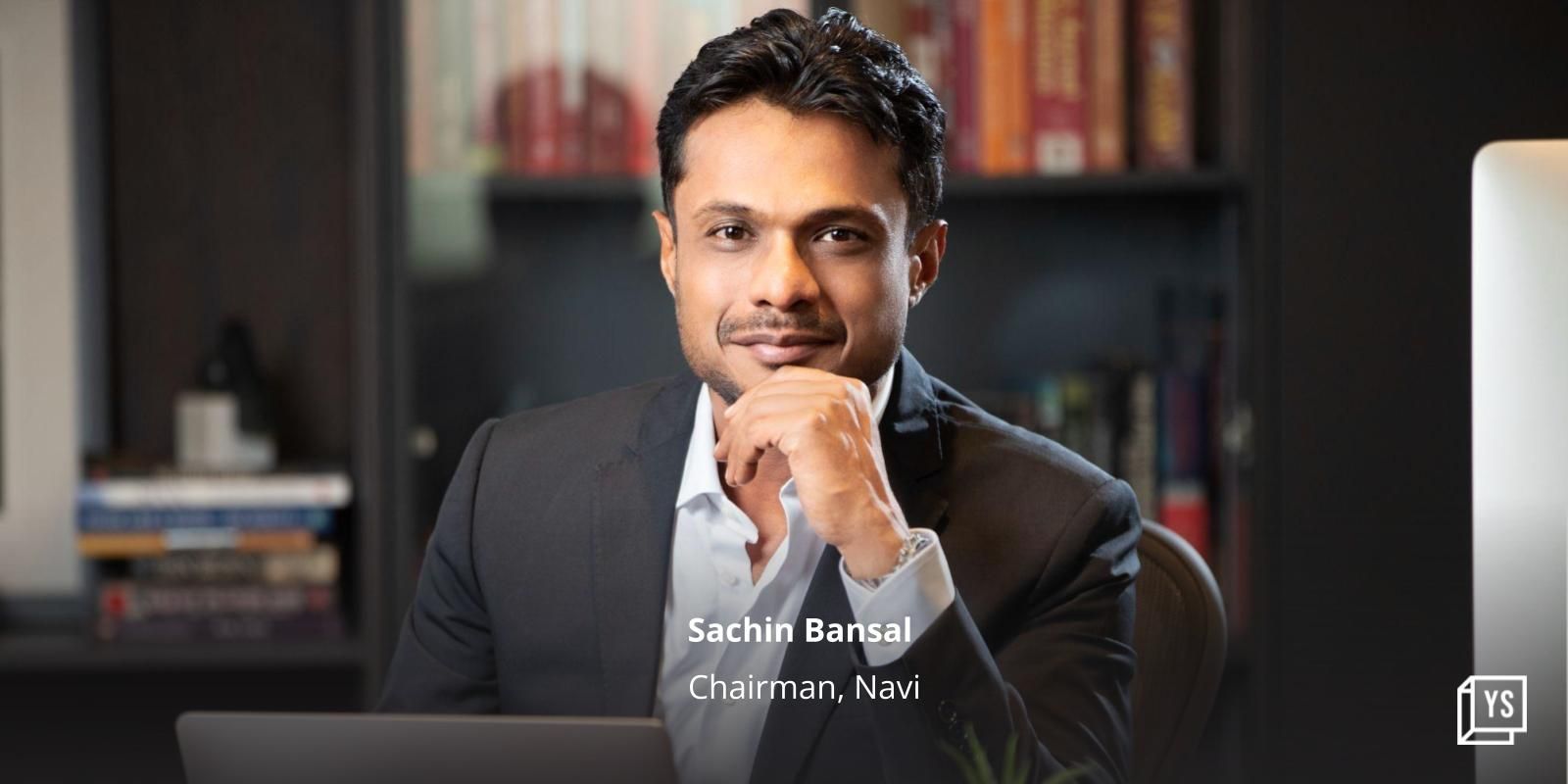

Navi Finserv pulled the plug on a bond sale slated for Monday’s bidding session amid orders to pause lending operations from the Reserve Bank of India (RBI).

Navi Finserv had planned to raise Rs 100 crore through bonds maturing in 2.25 years, offering quarterly payments at 10.40% interest, according to a Reuters report.

“Navi Finserv maintains a healthy liquidity position, and after careful consideration, we determined that there was no immediate need for external funding at this point, leading to this development,” Shobhit Agarwal, Head of Lending, Navi Finserv said, in a statement to YourStory.

The RBI ordered four lending companies—Asirvad Microfinance, Arohan Financial Services, DMI Finance, and Navi Finserv—to stop giving new loans from October 21, 2024.

This action was taken because of extremely high interest rates charged to borrowers, which violated RBI’s rules. The companies also failed to properly check borrowers’ income and repayment ability, especially for small loans.

While the companies can’t disburse new loans, they can continue collecting payments from existing customers. The RBI will allow these companies to resume lending only after they resolve the violations and follow proper guidelines, particularly regarding interest rates and customer service practices.

“Navi Finserv is currently reviewing the circular received from the RBI and is committed to addressing all concerns raised by the regulator promptly and effectively, prioritising what’s right for our customers. The company remains dedicated to maintaining the highest standards of compliance, transparency, and customer care in its operations,” a Navi spokesperson had said after the initial notice was circulated.

![Read more about the article [Startup Bharat] This home décor startup is keeping Indian handicrafts alive by working with artisans from remote parts of India](https://blog.digitalsevaa.com/wp-content/uploads/2022/01/ImageBranding-Amisha2-1642074728191-300x150.png)