Bengaluru-based venture capital firm has announced the close of its Fund III at $300 million. The new fund will continue to lead seed and Series A investments across 25 to 30 startups over a period of three years.

The new fund brings Stellaris’ total assets under managed (AUM) to more than $600 million. The new fund saw participation from existing Limited Partners (LPs) as well as new commitments from global investors including university endowments, foundations, pension funds and reputed fund of funds.

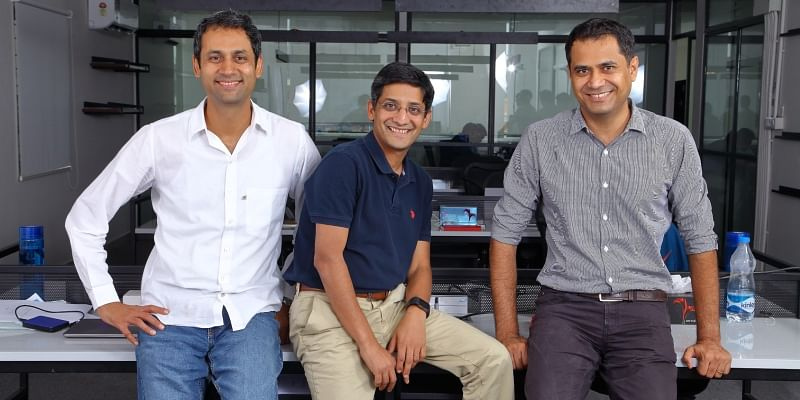

Stellaris had last raised $225 million as part of Fund II in August, 2021. Founded in 2017 by Alok Goyal, Rahul Chowdhri and Ritesh Banglani, Stellaris has backed 44 startups across two funds. It was an early investor in consumer brand , as well as Digital Adoption Platform (DAP) player . It is also an investor in consumer brand , bags and accessories brand , credit-on-UPI platform , among others.

Stellaris will continue to focus on key sectors in keeping with its investment thesis including consumer tech, AI, SaaS and financial services, according to a statement shared by the firm.

“India’s startup ecosystem has transformed since we started our fund, with a 4x growth in the deal flow and a rise in repeat entrepreneurs and founders from successful startups. With this new fund, we’re excited to back founders using technology to solve deep problems in large markets,” Rahul Chowdhri, Partner at Stellaris Venture Partners, said in the statement.

The sector-agnostic firm has also backed startups in B2B commerce, education, mobility and healthcare sectors.

The fund also announced key leadership changes, with Naman Lahoty being elevated to the role of Partner. Chetan GMS, who was previously the Senior Vice President at Stellaris, is the firm’s new CFO appointee, while Praseedha Premnath was promoted to the role of General Counsel at the firm. The firm has also on-boarded Vardhan Dharnidharka as Principal to join the firm.

Ritesh Banglani, Partner at Stellaris, added that investor interest in India was due to the growth in the market and the scale it offers. “A combination of unique public digital infrastructure, a young population, mass adoption of smartphones and receptivity of public markets to technology startups makes India an attractive destination for venture capital,” he added.

![Read more about the article [Funding alert] Hygiene and wellness brand Pee Safe raised Rs 25 Cr in Pre-Series B round](https://blog.digitalsevaa.com/wp-content/uploads/2021/06/Image7elb-1623330292556-300x150.jpg)