Nuvama Wealth and Investment Limited has acquired shares worth Rs 100 crore in ‘s parent firm Oravel Stays Limited at Rs 53 per share on behalf of its investors, a clutch of family offices, through a secondary market transaction, sources told PTI.

The share sale at Rs 53 apiece translates to a valuation of $4.6 billion for the travel tech unicorn.

“These shares are being offered by OYO’s early investors, presenting an opportunity for partial exits while potentially introducing new strategic investors to the company’s cap table,” a source told PTI.

A cap table (or capitalisation table) is a document, like a table, that details who has ownership in a company. It lists all the securities or the number of shares including stock, convertible notes, warrants, and equity ownership grants.

According to sources, discussions are also at an advanced stage with other potential buyers, including Incred, who are exploring stake purchases in the hospitality major at prices ranging between Rs 53-60 per share in the secondary market, translating to a potential valuation of up to $5.2 billion.

While the valuation has been on the upswing, it is still a far cry from the $10 billion valuation OYO commanded at its peak, a source said.

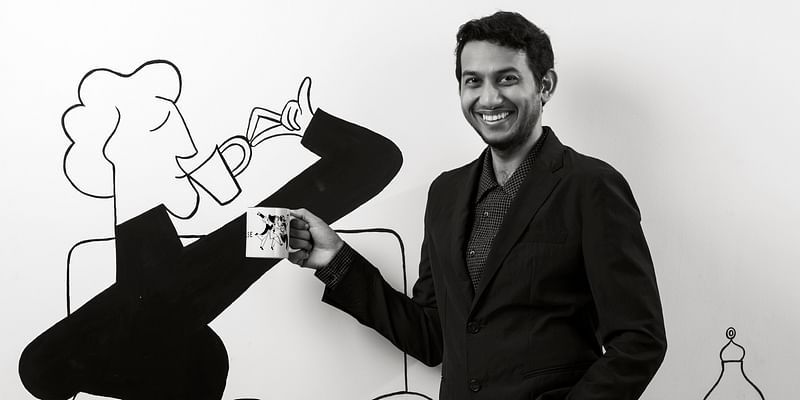

OYO had reported a profit for the first quarter of the fiscal year 2025. Ritesh Agarwal, the Founder and CEO of OYO, shared the company’s provisional net profit number in an employee town hall.

According to Agarwal, OYO achieved a net profit of around Rs 132 crore in Q1 FY 2025, a turnaround from the nearly Rs 108 crore loss reported in the same quarter of the previous fiscal year.

OYO recently announced plans to acquire G6 Hospitality, the operator of legacy brands Motel 6 and Studio 6 in the US, for $525 million in an all-cash transaction. The company also acquired Paris-based CheckMyGuest for $27 million.

Moody’s Ratings has upgraded the corporate family rating (CFR) of Oravel Stays Limited—the travel tech platform OYO’s parent firm—and the rating on the senior secured term loan issued by its wholly-owned subsidiary OYO Singapore to B2 from B3, and maintained the stable outlook.