After the boom of 2020 when students and other learners enrolled in online courses in droves, edtech firms are now facing a quieter reality. The frenzy has settled, and a cloud of calm has descended over online classrooms.

Wooing individual learners to offline coaching centres too has become tough and retaining them even tougher. On top of all this are the issues of high customer acquisition cost, profitability pressure, reduced funding, and resultant layoffs.

While the allure of B2C (business-to-consumer) has not worn off completely, edtech players are finding themselves in a tight spot with mounting losses and pending loans. As a result, they have begun to explore the B2B (business-to-business) landscape with greater intensity than before in search of stability, deeper client relationships, and business potential.

Although it is too early to declare that edtech firms are shifting gears, it is safe to say there is growing recognition of the value that the B2B model brings to the table—a captive audience, longer retention period, and greater business value.

Many edtech companies that initially focused on B2C—including Eruditus, Simplilearn, PhysicsWallah and upGrad—are now increasingly engaging in partnerships with enterprises and allocating more time, money and resources towards institutional customers such as schools and colleges.

For instance, Noida-based PhysicsWallah, a rare profit-making unicorn, is planning a phased $10-million investment in Vidyapeeth School Centre, a school-integrated programme.

This initiative provides coaching for CBSE exams, JEE, and NEET in schools, thus doing away with the need for separate coaching centres. Currently, the programme has been rolled out in 45 schools, and the goal is to reach 300 schools by 2025-26.

Emeritus, which is part of the Eruditus group, is collaborating with leading global universities to create online programmes for corporate employees, while upGrad offers diverse programmes tailored to specific business objectives—such as fresher onboarding, digital marketing, leadership, management, and soft skills development.

<figure class="image embed" contenteditable="false" data-id="525598" data-url="https://images.yourstory.com/cs/2/d99b1110116911ed9e63f54395117598/B2BEdtechInfographicsActiveEdtechCompanies-1694260344319.jpg" data-alt="active edtechs" data-caption="

Infographic credit: Nihar Apte

” align=”center”>

Infographic credit: Nihar Apte

Growth of B2B channel

Efforts in the B2B space seem to be paying off with companies witnessing significant growth in institutional and enterprise sales over the past year.

Last year, Emeritus registered a 70% increase in its enterprise segment and expanded in the markets of Asia Pacific and the Middle East. It is also exploring B2B opportunities in Africa and beyond.

Digiaccel—a new entrant to the edtech space, founded by former HUL executives—already generates about 40% of its business from the B2B channel.

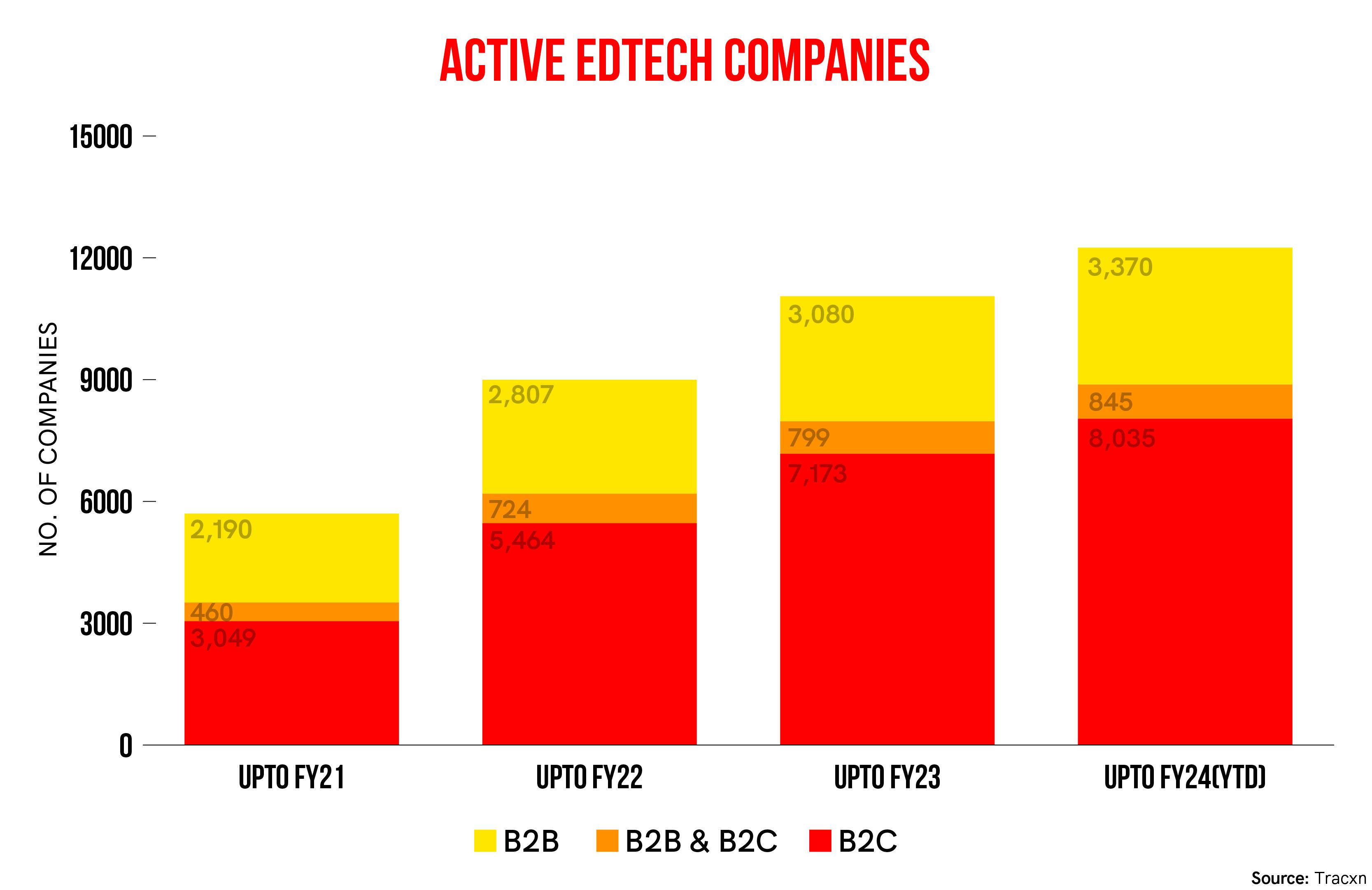

According to data from Tracxn, there were 8,035 edtech companies in the B2C space in FY24 (YTD), up from 3,049 in FY21. In contrast, the count of active B2B edtech companies has risen to 3,370 from 2,190 during the same period.

While these numbers may indicate that the B2C channel is a winner by a large margin, the B2B segment is making steady strides and gradually emerging from the shadows.

In the last three years, the number of companies present in both B2B and B2C channels has increased significantly—to 845 in FY24 from 460 in FY21—suggesting that edtech firms can no longer rely only on one format and B2B cannot remain an afterthought.

“Initially, there was some hesitance. Those well-versed in the B2C market were cautious about venturing into B2B, while those experienced in B2B believed institutional sales were simpler and avoided retail sales,” explains Narayanan Ramaswamy, National Leader of Education and Skill Development at KPMG in India.

This clearcut segmentation is changing now, and B2B can “potentially become more appealing in the short term,” he adds.

Industry players too expect greater contributions from their B2B channel in the near future.

Blackstone-backed Simplilearn, which gets 20% of its revenue from the B2B channel at the moment, anticipates significant traction in FY25, with a projected growth of 60-80%.

Jawahir Morarji, Business Head, Enterprise – Asia Pacific, India, Middle East & Africa at Emeritus, believes the B2B segment will steadily gain momentum.

“A few years ago, we might have thought the enterprise segment would remain small. However, we now believe the enterprise sector will grow significantly,” Morarji notes.

Industry players are increasingly realising that the B2B segment is less affected by market fluctuations and is a more stable revenue stream, given that educational institutions and corporations require consistent and tailored solutions to meet their specific learning objectives and training needs.

In contrast, the B2C channel relies more on supply-driven strategies to attract individual customers, and demand may fluctuate with market dynamics and changing preferences of consumers, who can be fickle.

Anil Joshi, Managing Partner, Unicorn India Ventures says B2B edtech companies will always offer better predictability on revenue compared to B2C companies.

“B2B edtech segment is more demand-driven than B2C which is more supply driven, hence they are better positioned for growth due to close proximity to their captive audience,” says Joshi.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

Evolving education landscape

Education in India has traditionally revolved around book-and-blackboard-focused teaching methods, and the transition to multimodal education has been slow compared to the markets of US, Singapore and Brazil where most schools have adopted diverse learning pedagogies. The reasons for the slow adoption in India are innovation limitations and affordability challenges.

However, the pandemic highlighted the need for technology and audiovisual learning to overcome the limitations of traditional methods. Consequently, educational institutions and enterprises have started steadily embracing digital learning solutions for students, thus fuelling the demand for B2B offerings.

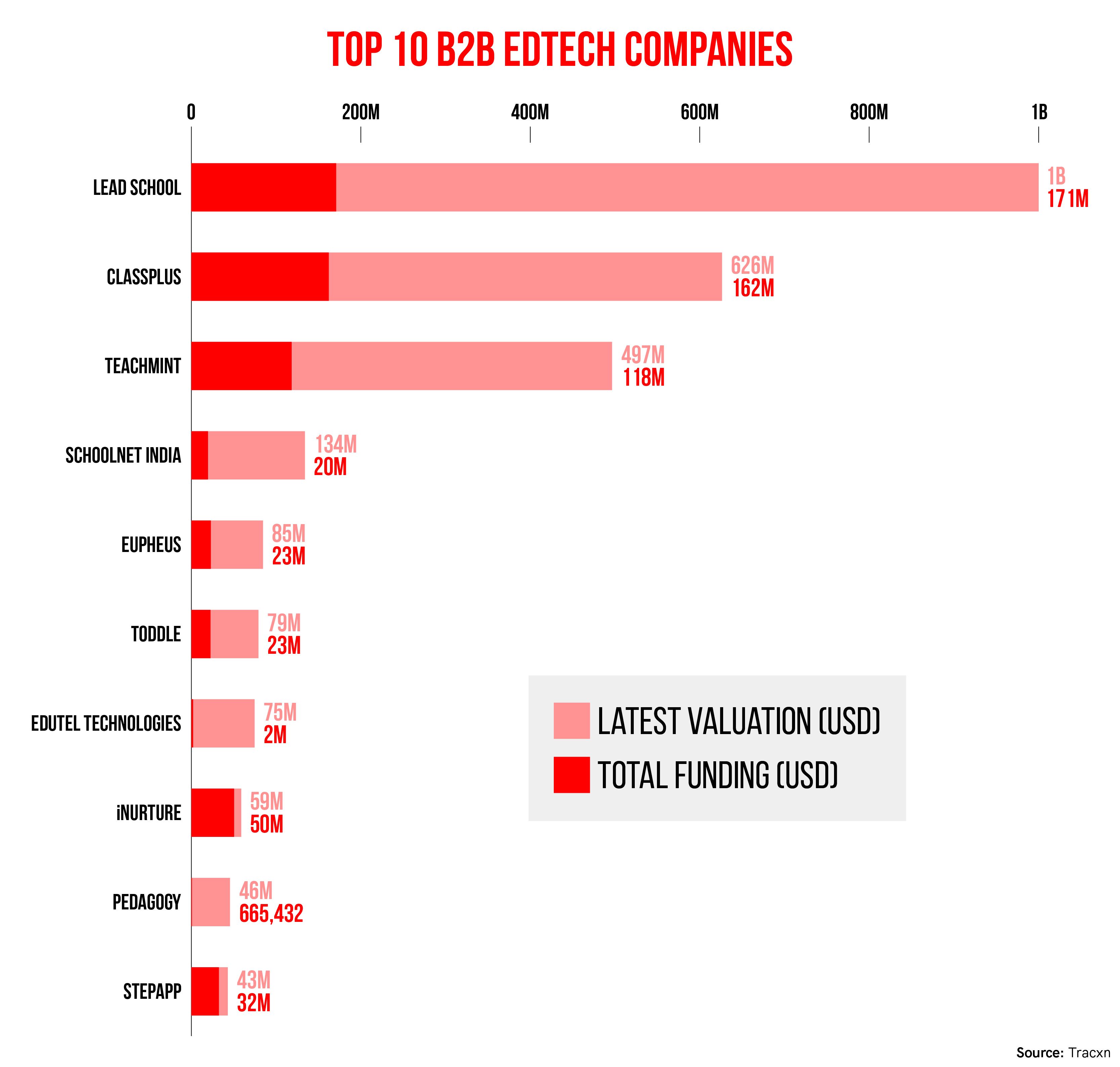

Sumeet Mehta, Co-founder and CEO of LEAD, a Mumbai-based pureplay B2B edtech unicorn that offers digital learning solutions to schools, elaborates his observations.

“In the academic year 2022-2023, we observed a significant return of students to schools. Schools have recouped a portion of the fees from parents, resulting in their improved financial standings,” Mehta says, implying that the financial health of schools directly impacts LEAD’s business.

LEAD offers a comprehensive integrated system encompassing software, hardware, curriculum, books, school kits, and training sessions, serving over 9,000 schools, 50,000 teachers, and 5 million students.

The edtech firm plans to add another 2,500 schools this year.

“Compared to the vast educational network of 1.5 million schools in India, our partnership with 9,000 schools means there’s still plenty of room for growth in the next 5-10 years,” notes Mehta.

Vikram Gupta, Founder and Managing Partner of IvyCap Ventures, a homegrown venture capital fund, believes the education ecosystem in India has shown signs of maturation as schools, both private and public, are progressively investing in technology and innovation.

“We anticipate a surge in infrastructure development and an increase in private initiatives. Consequently, mindsets will undergo significant shifts, creating substantial opportunities for B2B players. However, this transformation is likely to take three to four years to fully evolve. In the long run, the sector is very attractive,” says Gupta.

<figure class="image embed" contenteditable="false" data-id="525600" data-url="https://images.yourstory.com/cs/2/d99b1110116911ed9e63f54395117598/B2BEdtechInfographicsTop10B2BEdtech-1694260656569.jpg" data-alt="b2b edtech" data-caption="

Infographic credit: Nihar Apte

” align=”center”>

Infographic credit: Nihar Apte

The transformation is not limited to schools alone; colleges too are upping their digital game with specialised curriculum and supplementary modules to help students improve their skills and fill knowledge gaps.

byteXL, an edtech startup based in Hyderabad, works with engineering colleges in the country to integrate curriculum and content with hands-on learning to improve students’ employability.

The startup offers a comprehensive platform with a learning management system, student analytics, real-time dashboards for tracking performance, access to coding challenges, and an online compiler for complex coding tasks. It has helped engineering curriculum align with industry needs and built a network of educators with a corporate background.

“We offer a clear teaching methodology through a tech-powered learning platform,” says Karun Tadepalli, Founder and CEO of byteXL.

byteXL has signed over 90 colleges, reaching more than 1 lakh students in the past year. It has set itself an ambitious target for the future and is eyeing to serve a large portion of the 15 lakh engineers who graduate in India every year.

Vadodara-based Parul University, which has engaged the services of byteXL, had a good campus placement season this year with over 500 students receiving salary packages in excess of Rs 6 lakh per annum—up from 70-80 students securing packages of Rs 5 lakh – 6 lakh last year.

Santosh Nair, Managing Director (Global) – Industry Collaborations & Academic Strategies, Parul University, attributes this rise to the industry-readiness and employability of the university’s students.

Over the last year, the university has ramped up its digital offerings and introduced industry-embedded and short-term certification programmes for students through the online mode.

Frequent assessments are done over the digital platform to ensure the curriculum outcomes match industry expectations, says Nair, adding that around 10% of the university’s annual budget goes into digital initiatives.

Enterprise segment

Apart from schools and colleges, some edtech firms are also serving enterprise customers, capitalising on the rapid digitisation wave.

Emeritus’ programmes for enterprises cover diverse areas such as data science and analytics, supply chain and operations, product design and innovation, digital transformation, finance, artificial intelligence, and machine learning.

San Francisco and Bengaluru-based Simplilearn offers master’s programmes in digital skills and technology, delivered through corporate partnerships, addressing the learning needs of global organisations.

There is a rising demand for these programmes from IT services companies and multinational corporations, says Krishna Kumar, Founder and CEO of Simplilearn.

“Both current and prospective clients are showing a growing interest in investing to upskill their workforce, especially in the field of digitisation,” Kumar notes.

He believes the B2B domain will continue to grow with a robust order pipeline.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

Challenges and opportunities

As edtech companies navigate the B2B space, they have to tackle the huge challenge of margin sustainability. This involves negotiating prices with clients to maintain profitability, unlike the B2C channel where pricing control lies largely with the edtech firms, based on market conditions.

Profitability has also been a challenge. For instance, LEAD’s revenue grew to cross Rs 250 crore in FY23 from Rs 133 crore a year ago. However, its EBITDA is -120% of revenue. It aims to achieve a “very low double-digit negative” in FY24 and become profitable in the following fiscal.

On the other hand, byteXL experienced a substantial revenue growth—to Rs 17.5 crore in FY23, from Rs 5 crore in FY22. Its projected revenue for FY24 is Rs 60 crore. Its EBITDA too showed improvement, rising to Rs 3.5 crore in FY23 from Rs 50 lakh in FY22. It is expected to increase to Rs 6 crore in FY24.

The outlook for the B2B segment appears positive as educational institutions have resumed full operations. However, edtech companies operating in this space must stay updated with rapid technological changes and respond to the client’s unique educational and training needs.

Do B2B edtech companies appear to be a safer bet for investors in the current scenario, as they promise greater stability than pureplay B2C companies?

“If the large B2C players can effectively retain their customers and reduce customer acquisition costs, B2C would likely remain the preferred choice. However, if these conditions are not met and investors cannot wait indefinitely, then, in the education sector, B2B appears to be the more favourable option,” KPMG’s Ramaswamy remarks.

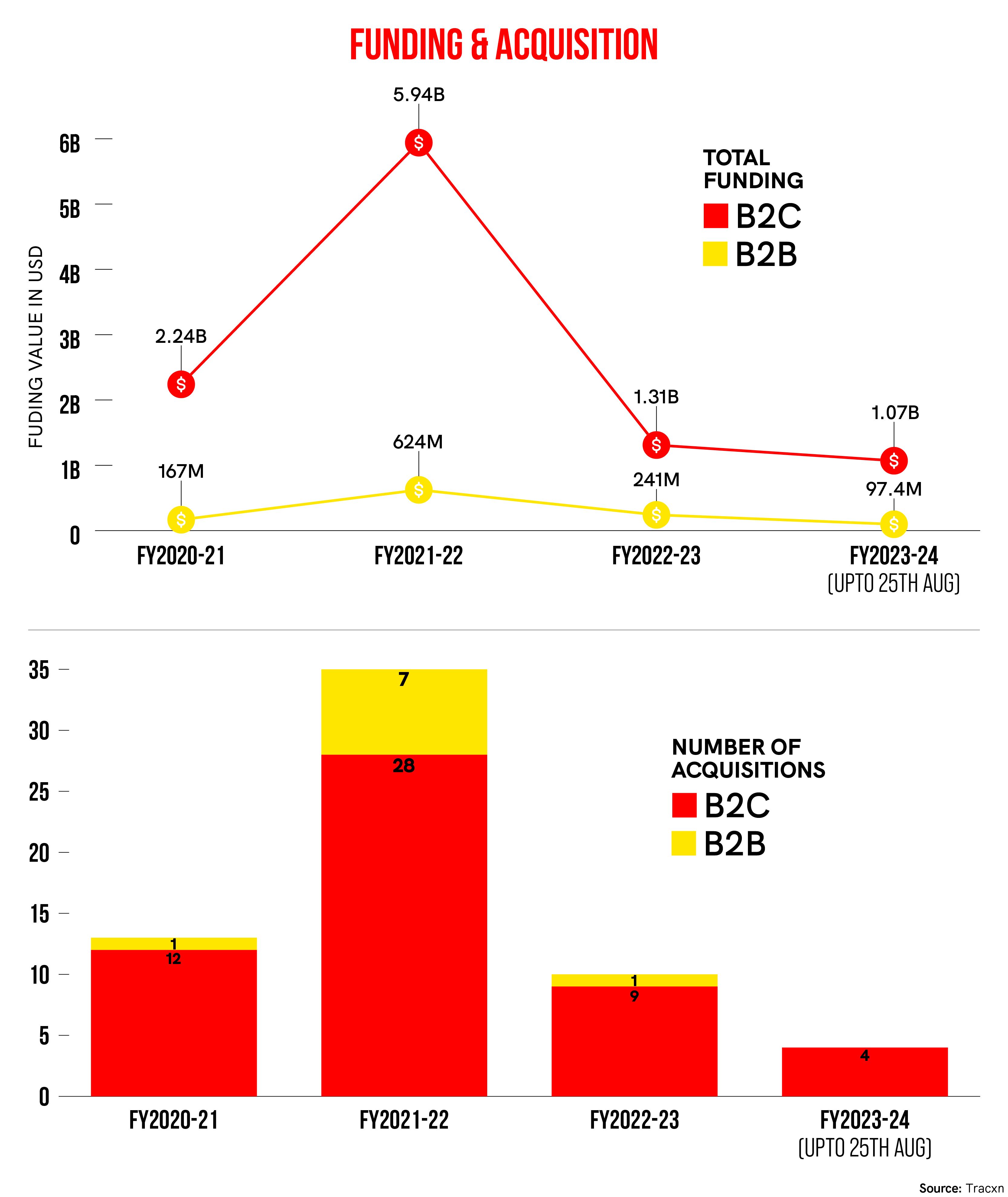

Tracxn Co-founder Neha Singh agrees, stating that, in the current landscape, where the demand for online education has significantly declined with the reopening of schools and universities, B2B enterprises hold an edge over B2C startups.

She says, “The funding winter has had a significant impact on B2C edtech startups and many of them have been forced to cut costs and lay off employees in order to extend their runway. Comparatively, the funding for the B2B edtech space has not experienced a very large impact, recording an 11% year-on-year decrease, as against 48% in the B2C edtech sector.”

LEAD raised $20 million in debt in January, following a $4.2-million debt round from Alteria Capital in December. Bengaluru-based Toddle, an education SaaS company, secured $17 million, in January, in a Series A funding round led by Sequoia Capital India, while Uolo, an edtech platform that works with private K-12 schools, raised $22.5 million in December in a Series A round, with Winter Capital as the lead investor.

<figure class="image embed" contenteditable="false" data-id="525599" data-url="https://images.yourstory.com/cs/2/d99b1110116911ed9e63f54395117598/B2BEdtechInfographicsFundingAcquisition-1694260428750.jpg" data-alt="edtech funding acquisition" data-caption="

Infographic credit: Nihar Apte.

” align=”center”>

Infographic credit: Nihar Apte.

Path ahead

In the long term, industry observers foresee a lot of action in the B2B segment with mergers and acquisitions and the emergence of more unicorns as well.

There will be a consolidation of B2B platforms, offering a broad geographic coverage and a comprehensive range of products and solutions, says LEAD’s Mehta.

To be B2B or B2C? This appears to be a futile argument in current times, and the ideal solution is to engage in a judicious mix of the two.

KPMG’s Ramaswamy advises aspirants to start with the reliable B2B approach to establish a foothold in the market and slowly expand market share. However, solely focusing on enterprise clients may hinder scalability and profitability.

“A serious B2B provider should consider adopting a more inclusive approach that goes beyond just serving institutions,” he says.

“Those with the necessary resources would tend to lean towards B2C, while others who perceive B2C as an expensive proposition would try B2B but will ultimately aim to expand into B2C.”

As the education and training landscape evolves, there will be more and more companies exploring both avenues to diversify their revenue streams, maximise impact, and cater to several types of users with different needs and objectives.

(Cover image by Winona Laisram; infographics by Nihar Apte)

Edited by Swetha Kannan