There are many companies bringing one-click checkout to the direct-to-consumer marketplace, but few are developing similar tools for the business-to-business marketplace. B2B payment volume is five times the size of business-to-consumer retail payments, yet much of those payments are not being done online.

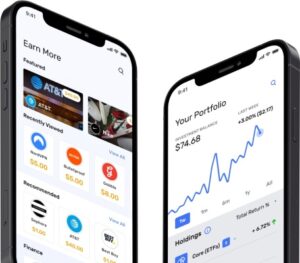

That’s where Balance comes in. The company, co-founded by former PayPal employees Bar Geron and Yoni Shuster, supports B2B e-commerce merchants and marketplaces by digitizing those capabilities through one-click checkout payment tools so companies can get paid instantly, process any payment method and offer flexible terms.

We profiled the two-year-old company last year when it raised $25 million in Series A funds, led by Ribbit Capital. Now Balance is back with $56 million in Series B funding, this time led by Forerunner. The new investment gives the company $87 million in total funding raised to date.

“For years, the consumer has led the charge in modernizing how we transact, but innovation in B2B commerce has lagged far behind the B2C space,” said Kirsten Green, founder and managing partner at Forerunner, in a written statement. “There is incredible potential to modernize wide-ranging aspects of how B2B commerce is conducted in the digital age, and the market opportunity is enormous — only 7% of the $120 trillion B2B payment volume is conducted digitally today.”

Joining in on the new round are Salesforce Ventures, HubSpot Ventures, Lyra Ventures, Gramercy Ventures and a group of B2B e-commerce leaders as angel investors, including former Shopify CMO Jeff Wisener and Faire co-founder and CTO Marcelo Cortes. Ribbit, as well as other existing investors Lightspeed Ventures, Avid Ventures, Upwest and Jibe, also participated in the Series B.

“The momentum in the business is being felt in real time,” CEO Geron told TC. “Even though we raised a big Series A round, with the new economy and challenges, we did the right step of doing another round sooner rather than later. Now we have the longevity to cross that next step.”

Last year, Balance was still in its early days, though my colleague Mary Ann Azevedo reported the company had 30 employees and experienced growth of about 500% to 600% since launching its operations in February 2021.

Today, the company has nearly 70 employees and is working with hundreds of merchants and dozens of B2B marketplaces — a 10-time increase since last year, Geron said. It targets legacy industries not as digitally savvy in payments, including lumber, chemicals, steel, retail and food.

Some of its customers include lumber marketplace MaterialsXchange, chemical supply marketplace ChemDirect, wholesale retail marketplace Abound and restaurant ordering platform notch.

Balance will use this funding for customer acquisition and to grow its team across go-to-market, engineering, sales, customer success, product and engineering and operations. Geron plans on growing the workforce to about 100 by the end of the year.

Overall, the checkout space is reflective of a new stage of the economy, Geron added. Commoditized goods are now trading online, but face an inefficient market.

“It’s not like B2C, you can’t go online and find thousands of steel suppliers,” he said. “We are taking the next step in e-commerce and doing it for the entire supply chain. Now with Balance, you can do self-serve transactions in ways that were only previously available in B2C channels.”