Credited with taking industrialisation to the rural parts of the country, micro, small and medium enterprises (MSMEs) are one of the major growth engines of the Indian economy. The 2021 Union Budget too laid down several provisions for such enterprises to boost their capabilities and increase ease of business. Given that they contribute roughly 30 percent to the country’s GDP, the government has been vocal about the support it is extending to help MSMEs scale ahead. This is especially in the case of digitisation as it has helped companies strengthen their organisational efficiency and avoid delays in compliance protocols such as paying taxes. However, several enterprises are yet to join the digital bandwagon, raising questions about their reluctance around digital adoption and compliance.

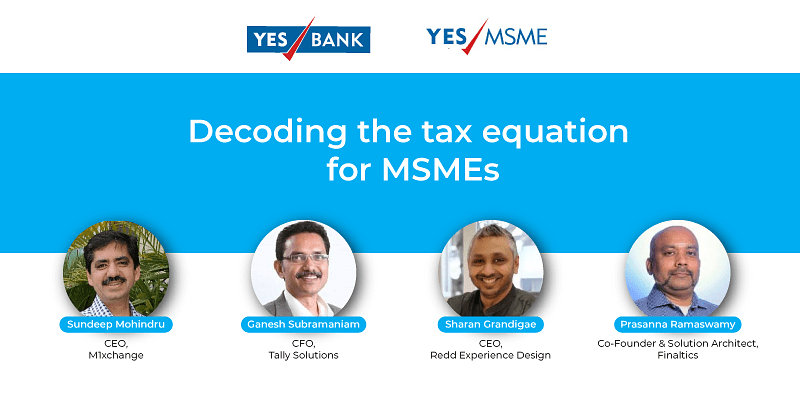

To understand MSMEs’ approach towards going digital for tax compliances and the need for related advisory services, YourStory, powered by YES BANK, organised a roundtable discussion with Sundeep Mohindru, CEO M1xchange, Sharan Grandigae, CEO, Redd Experience Design, Ganesh Subramaniam, CFO, Tally Solutions and Prasanna Ramaswamy, co-founder and solutions architect at Finaltics to discuss ‘Decoding tax equation for MSMEs.’

Here are the key takeaways from the discussion:

Digitisation is the new theme

On the lines of the Digital India initiative, the government has aggressively sought to boost the medium’s usage pan-India. “Digitisation in Indian economy is the new theme which the government has picked up and retained in the Union Budget,” Sundeep Mohindru, CEO of M1xchange said, citing instances of the government raising the turnover required for an MSME’s tax audit to Rs 10 crore from Rs 5 crore if 95% of their transactions use digital means. He also highlighted pre-filled editable forms for GST and IT returns being on the block, which is another step for simplification of business through digital means. “These tools will simplify business and turn them into a more formal economy. In the last Budget, the allocation for the MSME sector was around Rs 7,500 crore, which was doubled this year. It’s a big boost to MSME investment.”

Sensing the pulse of the community, YES BANK has introduced a slew of initiatives that will help MSMEs along their digital journey. YES BANK’s YES MSME is enabling small enterprises to undergo a digital transformation through product partnerships and API integrations with partners like Zoho Books, Zaggle, Bank Open and Cash free, among others. It has its own suite of digital products like YES MSME Application which simplifies GST payments. To know more about the initiative, click here.

YES BANK has partnered with Clear Tax to offer discounted assisted tax filing services to MSMEs and has created digital platforms for business and compliance advisory which is headed by a panel of SME experts. If you want to know more about YES BANK’s tax advisory services, click here.

Indirect means to help MSMEs

Given that the government has made transactional compliances like GST and TDS digital, it is important for MSMEs to be on top of such mechanisms. “The tool or system for digital transformation plays a pivotal role in ensuring a seamless transaction flow and it can help bridge the gap between a business owner and tax compliance without relying on a tax practitioner or a chartered accountant. The cost of non-compliance is higher than that of being compliant,” says Ganesh Subramaniam, CFO, Tally Solutions.

Moreover, M1xchange’s Sundeep also said the Production Linked Investment (PLI) scheme which is meant for production and manufacturing in multiple industries, will boost investment and in turn more business will flow to the MSME community.

Why accounting data is important

Panellists underscored the purposes behind digitisation and said that it not only enables MSMEs, but also helps the government track the segment’s transactional data through machine learning and coding patterns. “While scanning the (MSME’s) invoices, it is going to recognise patterns to find out if they’re genuine or not. Only then, the government goes ahead to help the MSME with a digital transformation … MSME owners should understand their financial transactions and then integrate them with bank transactions to correlate them,” says Prasanna Ramaswamy, co-founder and solutions architect at Finaltics.

Sharan Grandigae, CEO of Redd Experience Design hailed digitisation as it helps companies assess compliance implications on a transactional level. “There’s no major cash flow that you have to assess at the end of the year and make a payment annually or even quarterly. As a business owner, I see this as a huge advantage. But I also see some loopholes in the use of technology. There have been times when I have been advised incorrectly by tech, but correctly by a professional.”

Battle of bots vs bots in future?

Highlighting how data can provide affordable analytics to the MSME community and help it grow, Ganesh says that aspects such as privacy also need to be taken into account.

“While the government is deploying artificial intelligence, as a service-led company I will be fighting it with my own AI tools. I think it will be a battle of bots vs bots in the future,” quips Sharan.

TReDS headed for a new wave

Experts on the panel opined that the next wave of upbeat developments will be visible on the TReDs (Trade Receivables Discounting System). “If you are supplying to a large corporate or a B-rated enterprise, your invoices get discounted. But, if you are supplying to a C-rated company then your invoices may not be discounted as the firm might not be eligible for a line of credit from a bank. The government is changing the Factoring Regulation Act to allow NBFCs to enter the factoring business and they will all be available on TReDS in a few weeks now. As a result, the receivables of even corporates with a low rating will be discounted. This will lead to an increase in liquidity, thereby benefiting MSMEs,” explains Sundeep.

However, the lack of awareness might limit the growth of small businesses, one of the panelists said. “The government needs to enable its marketing strategies and should leverage social media to inform everyone about its policies,” he adds.

![Read more about the article [Funding roundup] Organic Kitchen, Humalect, Kennect, DPhi etc raise early-stage deals](https://blog.digitalsevaa.com/wp-content/uploads/2022/03/Image5wy1-1630828923435-300x150.jpg)