When Amazon Pay entered India in 2016, the country’s digital payments landscape had just begun to transform. The Unified Payments Interface (UPI) system had started picking up and demonetisation had forced many citizens to adopt digital payment methods.

Its initial play in India was limited to facilitating payments to its marketplace and solving for 2-3 problem statements. First, with global payment volume nearly doubling between 2016 and 2017 on Amazon, the ecommerce giant wanted to reduce the number of failed payments through Amazon Pay. It also wanted to bring down the number of cash-on-delivery orders, which were complicated and expensive for the company.

Thirdly, it aimed to expand access to credit. It now wants to double down on penetrating the credit landscape.

“We started integrating [payments] both in online and offline merchants, allowing customers to pay very seamlessly using our Amazon Pay products, and from there we built functionalities like lending and financial services on top of it,” Vikas Bansal, Whole-time Director of Amazon Pay India, tells YourStory.

He has been with the company since 2016 when he joined as a founding member of Amazon Pay, and is now leading its expansion. Prior to joining Amazon Pay, Bansal was Vice President and General Manager of credit solutions at banking tech provider Finserv. He also earlier headed the card solutions team at Visa.

Credit expansion

Amazon’s focus on credit comes at a time when an increasing number of Indians are opting for credit cards. In February 2024, credit cards in circulation crossed 100 million for the first time, as per RBI data. The central bank also noted that online credit card spends in India crossed the Rs 1 lakh crore mark in March this year at 20% growth from Rs 86,390 crore recorded a year ago.

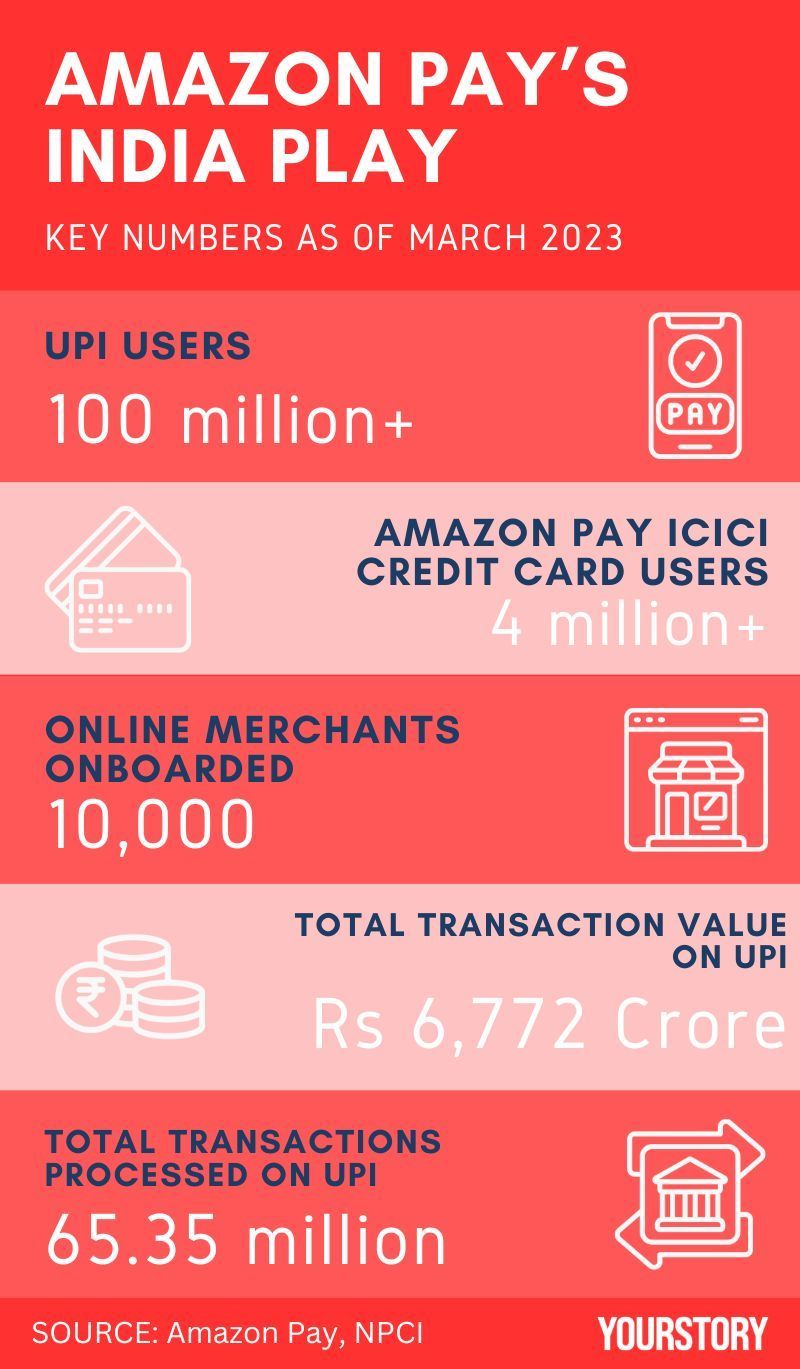

In 2019, it launched Amazon Pay ICICI Credit Card, which has over 4 million customers. It offers up to 5% cashback to shoppers with a Prime membership and up to 2% cashback for non-Prime users.

Amazon Pay launched Pay Later in April 2020 to enable instant credit access with repayment options for up to 12 months. It has so far onboarded over 9 million customers. It has also enabled access to RuPay credit cards on UPI. It also offers personal loans.

During the first 48 hours of the Amazon Great Indian Festival in 2023—one of the busiest periods for Amazon—EMIs emerged as the most preferred payment mode with one in four shopping orders placed in instalments, as per the company.

However, Amazon has a long way to go in the credit domain as India remains an underpenetrated market.

Credit underserved and unserved consumers represent a significant portion of India’s population, a study by credit rating agency TransUnion CIBIL showed, with over 160 million underserved and about 50% unserved.

While there has been progress in increasing credit inclusion over the past four years, with a rise in the number of credit-served consumers, the challenge remains substantial. Many individuals lack a credit history, making it difficult for them to access credit products from traditional lenders who rely on credit scores for assessment.

India: Amazon’s playground

Over the years, Amazon has expanded its offerings and added more features beyond serving the payment requirements of its more than 100 million shoppers.

In 2019, it added features such as bill payments, payments for utilities, and booking for trains, flights, hotels, and even movie tickets. These payments are now the main source of revenues for Amazon Pay than payments directed towards the marketplace, it said.

The ecommerce giant has also worked with investment startups, including Smallcase and Kuvera, to provide investment options such as mutual funds and fixed deposits.

UPI has always been a bigger fish to fry. When Amazon launched Amazon Pay UPI for the Indian market in 2019, Google Pay had already taken the lead in the UPI transactions space and was clocking payments worth Rs 43,000-45,000 crore a month. So far, Amazon has about 100 million users on its UPI platform transacting values of more than Rs 6,700 crore in total.

However, it still has a tall ladder to climb. Amazon Pay UPI ranks sixth in terms of volume of transactions, as per National Payments Corporation of India (NPCI) data. Its American peers Google, with Google Pay, and Walmart-backed PhonePe facilitated more than Rs 1.7 lakh crore worth of transactions as of March 2024.

India in some ways has been the playground for Amazon Pay to experiment and innovate. High penetration of digital payments meant an opportunity for Amazon to build payment products for large-scale usage—a domain where it does not have equivalent depth globally.

“The scale and the scope of payment operations is much larger in India today than it is anywhere else in the world,” Bansal notes.

In major markets like the US and the UK, Amazon Pay services are limited to the B2B domain, where user payment details are used to enable smooth checkouts on other websites like Shopify and Chargebee.

While it doesn’t directly sell insurance in those markets, its involvement in India is far more extensive. In 2018, the company invested in insurance company Acko, which cross-sells some policies through Amazon Pay. It obtained its corporate agent license from the Insurance Regulatory and Development Authority of India the next year, which enabled it to offer free health insurance to its sellers in India during the pandemic, with Acko managing the policies, claims, and reimbursements.

Doubling down

Amazon Pay is now working on setting up credit lines on UPI.

Credit lines on UPI are pre-sanctioned borrowing limits that users can link to their UPI apps, allowing them to make payments without switching to a different app. So far, banks, including Axis Bank, HDFC Bank, ICICI Bank, Punjab National Bank, and State Bank of India, have gone live with the feature.

“We’re working very closely with NPCI, as well as the banks, to figure out how we can do credit lines on UPI. I think credit lines are a very exciting, very large opportunity but also very complex. Unlike credit cards, which are simpler credit lines, there’s different ways all banks do it,” Bansal notes.

Working with merchants is another avenue of growth Amazon is now exploring. It has boarded over 10,000 online merchants like Uber, Zomato, Dominos, redBus, BookMyShow, NetMeds, MakeMyTrip, and others to let customers pay using Amazon Pay wallet.

It now also has a payments aggregator license in its arsenal. The company hopes the license will help expand digital payment services to its network of brick-and-mortar merchants.

“We want to use this opportunity to both expand on the customer side and also merchant side franchising, and we are investing very heavily in it,” Bansal added.

Its Amazon Pay for Business app, which also lets merchants make payouts to vendors and customers, has over 5 million downloads on the Google Play Store.

(Feature Image by Nihar Apte)

Edited by Kanishk Singh