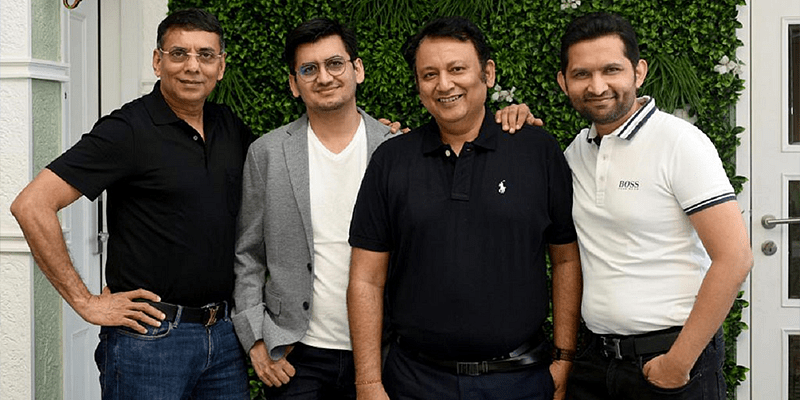

While the startup ecosystem in India has given young entrepreneurs a chance to follow their dreams, it has also brought forward several startup developers that provide these upcoming businesses with the capital, knowledge, and networks to help them grow. Founded in 2016 by Dr Apoorva Ranjan Sharma, Anuj Golecha, and Gaurav Jain, Venture Catalysts (VC) has been tirelessly working towards providing entrepreneurs with these resources.

Having invested in 178 unique startups in 2021, the Venture Catalysts Group has doubled its growth this year and has emerged as the largest investor in India. India’s first integrated incubator invests nearly $250000-$1.5 million in early-stage startups that have the potential to make it big over a long period of time.

Apart from providing startups with access to continuous capital from funds, investors’ networks, Tier I founders and CXOs, the sector-agnostic group also co-invests with marquee VCs like Sequoia Surge, DSG Consumer Partners, Earlsfield Capital, Kunal Shah, Nikhil Kamath, and more.

Strengthening the startup ecosystem

With a focus on strengthening the ecosystem in smaller Indian towns and cities, Venture Catalysts has been known to have democratised the process of investing in startups in the country. The group has made it to the list of the Top 10 global most active accelerators and incubators for the second year in a row.

Having closed 207 deals in 2021, Venture Catalysts stands only behind YCombinator, which leads the way with 841 consolidated deals. Talking about the milestone, Dr Apoorva says, “The pandemic has created many gaps in service deliveries that are being delivered by startups. We envisage a huge blue-ocean opportunity in backing such businesses in their early stages of growth. Considering the stage of investing, the valuations help us realise lucrative exits, thereby contributing to our business growth by many folds.”

According to the investment group, the most prominent investments for the year included names like BluSmart, Dukaan, Klub, Melorra, Kala Gato, Mitron TV, Rage Coffee, Power Gummies, Coutloot, Resolve AI, Toch, Zingbus, RoundLabs, Stage, and more. When it comes to sectors, deeptech, B2B SaaS, fintech, insurtech, F&B, healthtech, and media dominated investments.

Speaking on the vision of taking over various sectors, Dr Apoorva adds, “We will continue investing in sectors such as fintech, Edutech, agritech, FMCG, e-commerce, logistics, and supply chain management. Deeptech is another sector that we are bullish on since businesses will continue to be online in the post-pandemic world as well.”

Expansion and impact

Even as the pandemic has put the world in the middle of a socio-economic crisis, Venture Catalysts remained insulated from the crisis and witnessed 62 cumulative exits and liquidity events in 2021. The most successful exit for the year was made by BharatPe with 80X returns, while there were other significant exits like Dukaan, ImpactGuru, and Rooter.

With a robust network of over 5,000 angel investors across Tier-II and Tier-III cities, Venture Catalysts has expanded its domestic and global footprint aggressively to over 70 Indian cities and nine countries. Over the course of the year, VC invested in 15 startups from Tier II cities, which included 33 founders and 28 women, and constituted about 15 percent of the overall investment portfolio.

Other unique investments made by Venture Catalysts Group this year include Basic, Numadic, Vital, Reevoy, and Castler from the fintech sector; ANS Commerce and Nimblebox.ai from the SaaS sector; Healofy and Fembuddy from the femtech sector; Ethereal, Cynlr Robotics, Botsync from the deeptech and robotics sector, and Optimize Electrotech from defencetech.