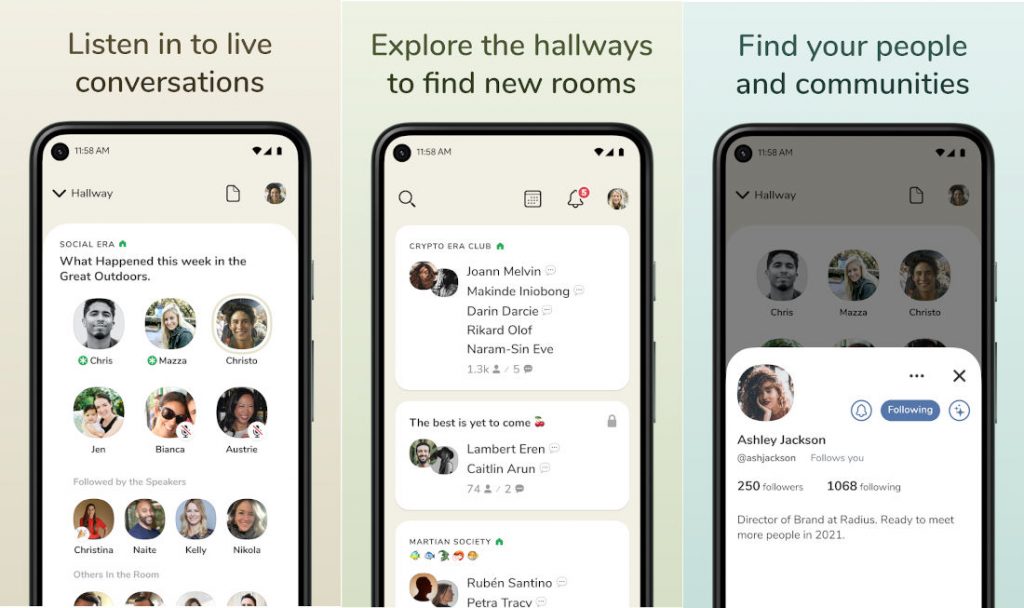

Clubhouse, the viral audio-only social network, has launched its Android app at a time when big social media rivals are busy launching alternatives

With over 95% of the Indian smartphone market using Android, Clubhouse’s success in India is highly dependent on Android app adoption

So far Clubhouse has attracted the Tier 1 iOS audience from India, but it will also need to appeal to India’s massive regional language-speaking audience through localised features

Clubhouse, the viral audio-only social network, has launched its Android app in the US and has opened up pre-registrations for other markets on the Google Play Store. The much-anticipated debut comes after Clubhouse’s popularity spawned multiple alternatives — from big tech companies as well as other startups.

Founded by Rohan Seth and Paul Davison, Clubhouse has been fast gaining global popularity. It is said to have 10 Mn weekly active users as of April 2021 despite being only available on iOS so far.

Clubhouse has clung to its popularity by attracting the big names from the Valley — including SpaceX and Tesla founder, and part-time meme-lord Elon Musk and TV superstar Oprah Winfrey — as well as influencers from Europe and Asia. From Indian founders such as Unacademy’s Gaurav Munjal, Flock’s Bhavin Turakhia, CRED’s Kunal Shah and leading venture capital investors to celebrities, Indian personalities have also built a base on Clubhouse. Well, at least the ones who are using iPhones.

But now one could say that Clubhouse was forced to fast-track its Android app launch since it has already inspired audio-first features in many other social media platforms such as Twitter, which launched Spaces late last year, Facebook, LinkedIn and others. Even Spotify has recently entered the arena through the acquisition of startup Locker Room.

Add to this the wave of Indian apps such as Leher, Bakstage and most recently, Fireside — launched by Chingari founders — which are also looking to compete in this space. It would be an understatement to say that Clubhouse had to ramp up Android development to avoid being sidelined by these launches.

In fact, in recent weeks, the app has seen downloads fall significantly, as per various reports. According to SensorTower data, downloads have fallen from 9.6 Mn in February, 2.7 Mn in March and 900K downloads in April.

Platform Exclusivity Rarely Works For Social Media

While launch timing is critical, Clubhouse has some viral fuel in its reserves to overcome a slight delay. It has managed to become the darling of Silicon Valley in a short time. But Silicon Valley tries out and dumps social media platforms like most people change clothes.

One of the reasons for the hype around Clubhouse is the exclusivity and the invite-only system, which makes it seem like crossing the velvet ropes into the VIP section of a night club. You need to know someone to get in. It’s also why Clubhouse has often been called out for being “elitist” with its focus on celebrities, influencers, big tech CEOs and investors.

But social media platforms geared towards exclusive invitations rarely have the success that more open platforms get. Let’s hark back to the famous story of Facebook starting as exclusive for students in Harvard University — it eventually was forced to open up to grow faster and become the giant that it is today.

Secondly, the Android launch helps Clubhouse shed its elitist image as it brings access to more affordable devices. This segment of users, who are primarily casual consumers of online content and sometimes participants, is more likely to drive engagement than a CEO who keeps a packed daily calendar.

You Need Android To Win In India

Of course, the USA is one of the few markets where iOS outperforms Android in terms of market share — in Europe (69% market share) and Asia (83% market share), Android dominates. In India, the number is even more skewed — Android holds a share of 95.77% (as of April 2021) of the mobile operating system market, with iOS accounting for just 2.97% of the market.

It’s clear that in much of the world, the user growth success of a consumer social media product would be determined by the Android adoption, but it is more true of India than any other large market. India is the fastest-growing smartphone market where tech giants have more or less open access to the market, unlike in China.

Before its regulatory troubles, TikTok showed that winning in India can be a roadmap for global success, as its major growth in the US market soon after it became a raging sensation in India has proven. TikTok grew to 400 Mn users in India before it was banned — that kind of reach is simply not possible in any Western market, let alone for a product that excludes Android.

Clearly, there is a big upside to succeeding in India, but one needs Android to do it. Twitter realised this and has jumped on the gap to launch Twitter Spaces globally in a matter of months. Will Clubhouse’s belated entry cause it to fall back in the race?

Will Clubhouse Get That Indian Touch?

While the threat from Twitter or Facebook is definitely one to take notice of for Clubhouse, it cannot afford to ignore the handful of Indian alternatives that have sprouted up in recent weeks.

Short video app Chingari founders Sumit Ghosh and Aditya Kothari launched an audio-only social media app called Fireside last week. Available on iOS and Android, the app has been launched as a separate business entity from Chingari and will be closing a funding round soon, said Ghosh.

Another competitor is Bengaluru-based startup Leher, which also has video support, but not the base of international influencers, startup founders and business leaders that Clubhouse boasts. Founded in 2018, Leher was started by second-time entrepreneur Vikas Malpani (who had earlier founded Commonfloor) and is backed by Orios Venture Partners. In April, Bakstage, another audio social networking platform, was launched in India by Flyx Entertainment, a Delhi and New York-based OTT platform.

This at a time when the podcast industry — with more than 40 startups and over 200 Mn monthly active users (MAU) — has seen listenership rising by 30% over the past year, according to a KPMG report. Among the popular content startups operating in this space are Tencent-backed Pratilipi (20 Mn MAU), Hindustan Times-Backed Hubhopper, Fosun RZ-backed Headfone, IVM Podcasts and Suno India, among others. Pratilipi acquired Mumbai-based IVM Podcasts last November.

The Indian market has the appetite to support an audio-only platform, however, Clubhouse would need to localise its features for the Indian market, particularly from the language point of view, as shown by the success of TikTok in the past or even Twitter in recent times as a Covid helpline where messages are being passed in a variety of Indian languages.

So far Clubhouse has attracted the Tier 1 audience from India. It will need to appeal to India’s massive social media audience through localised features. If Clubhouse can manage to equally grab the attention of the English-speaking mainstream internet users in India as well the ‘Bharat’ audience which predominantly converses in regional languages, it might actually be able to create a meaningful social media platform that is more than just a fad.