If you’re a founder who finds yourself in a meeting with a VC, try to remember two things:

- You’re the smartest person in the room.

- Investors are looking for a reason to say “yes.”

Even so, many entrepreneurs squander this opportunity, often because they direct questions or fail to understand their BATNA (best alternative to a negotiated agreement).

“As the venture landscape becomes more a meritocratic environment where resumes and institutional affiliations matter less, these strategies can make the difference between a successful fundraise and a fruitless meeting,” says Agya Ventures co-founder Kunal Lunawat.

Whether you’re already in the fundraising process or plan to be in the future, be sure to read “A crash course on corporate development” that Venrock VP Todd Graham shared with us this week.

“If you’re going to get acquired, chances are you’re going to spend a lot of time with corporate development teams,” says Graham. “With a hot stock market, mountains of cash and cheap debt floating around, the environment for acquisitions is extremely rich.”

Full Extra Crunch articles are only available to members.

Use discount code ECFriday to save 20% off a one- or two-year subscription.

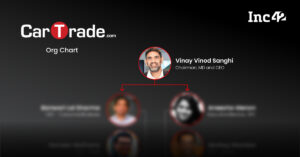

On Wednesday, August 24 at 3 p.m. PDT/6 p.m. EDT/11 p.m GMT, Managing Editor Danny Crichton will host a conversation on Twitter Spaces with Eric Dean Wilson, author of “After Cooling: On Freon, Global Warming, and the Terrible Cost of Comfort.”

Wilson’s book explores the history of freon, a common refrigerant that was later banned due to its devastating impact on the ozone layer. After their discussion, they’ll take questions from the audience.

Thanks very much for reading Extra Crunch this week! I hope you have an excellent weekend.

Walter Thompson

Senior Editor, TC

@yourprotagonist

Apple is changing Mail Privacy Protection and email marketers must prepare

Image Credits: Carol Yepes (opens in a new window) / Getty Images

Apple iPhone, Apple Mail and Apple iPad account for nearly half of all email opens, but the privacy features included with iOS 15 will allow consumers to block marketers from seeing their physical location, IP address and tracking data like invisible pixels.

Email marketers rely heavily on these and other metrics, which means they should prepare now for the changes to come, advises Litmus CMO Melissa Sargeant.

In a detailed post, she shares several action items that will help marketing teams leverage their email analytics so they can “continue delivering personalized experiences consumers crave.”

Let’s make a deal: A crash course on corporate development

Image Credits: Cimmerian (opens in a new window) / Getty Images

Venrock Vice President Todd Graham has some frank advice for founders at venture-backed startups: “It would be wise to generate a return at some point.”

With that in mind, he authored a primer on corporate development that lays out the three most common categories of acquisitions, tips for dealing with bankers, and explains why striking a partnership with a big company isn’t always the best way forward.

Regardless of the path you choose, “you need to take the meeting,” advises Graham.

“In the worst-case scenario, you’ll get a few new LinkedIn connections and you’re now a known quantity. The best-case scenario will be a second meeting.”

When VCs turned to Zoom, Chicago startups were ready for their close-up

Image Credits: Nigel Sussman (opens in a new window)

The pandemic failed to slow the momentum of venture capitalists pouring money into startups, but Chicago stands out as an “outlying benefactor of accelerating venture capital activity and the rise of remote investing,” Alex Wilhelm and Anna Heim write for The Exchange.

When the world shut down and it didn’t matter if you were in NYC or SF (because everyone was on Zoom), the Windy City was ready to present itself as the venture champion of the Midwest.

What does Brazil’s new receivables regulation mean for fintechs?

Image Credits: Priscila Zambotto (opens in a new window) / Getty Images

The Brazilian Central Bank made a major reform to the way payments are processed that may throw the doors open for e-commerce in South America’s largest market.

Historically, merchants who accepted credit card payments had two options: Receive the full payment distributed over two to 12 installments, or offer a deep discount to receive a smaller sum up front.

But in June 2021, the BCB created new “registration entities” that permit “any interested receivables buyer/acquirer to make an offer for those receivables, forcing buyers to become more competitive in their discount offers,” says Leonardo Lanna, head of payment products at Monkey Exchange.

The new framework benefits consumers and sellers, but for the region’s startups, “it opens the door to a plethora of opportunities and new business models, from payments to credit.”

As its startup market accelerates, Brazil could be in for an IPO bonanza

Image Credits: Nigel Sussman (opens in a new window)

An inflow of VC dollars, notable acquisitions and rising unicorn counts are all features of the Brazilian tech startup market, Anna Heim and Alex Wilhelm note in The Exchange.

“The IPO market in Brazil is changing,” they write. “TC noted last year that in the decade leading up to 2020, just two of the 56 IPOs in Brazil were technology companies. More recently, the number of technology companies listed in the country has swelled to at least 16, up from just four in 2019.”

Insider hacks to streamline your SOC 3 certification application

Image Credits: Andriy Onufriyenko / Getty Images

“For good reason, security certifications like the SOC 3 really put you through the wringer,” Waydev CEO Alex Cercei writes in a guest column.

Waydev, a Git analytics tool that helps engineering leaders measure team performance automatically, just attained the SOC 3 certification.

“We learned so much from the process, we felt it was right to share our experience with others that might be daunted by the prospect,” Cercei writes.

“So here’s our advice on how teams can smoothly reach an SOC 3 while simultaneously balancing workloads and minimizing disruption to users.”

Dear Sophie: Tips on EB-1A and EB-2 NIW?

Image Credits: Bryce Durbin/TC

Dear Sophie,

I’m on an H-1B living and working in the U.S. I want to apply for a green card on my own. I’m concerned about only relying on my current employer and I want to be able to easily change jobs or create a startup. I’ve been looking at the EB-1A and EB-2 NIW.

I’m not sure if I would qualify for an EB-1A, but since I was born in India, I face a much longer wait for an EB-2 NIW.

Any tips on how to proceed?

— Inventive from India

How to establish a health tech startup advisory board

Image Credits: Cordelia Molloy Science Photo Library (opens in a new window) / Getty Images

Most startups could use an advisory board, but in health tech, it’s a core requirement.

Founders seeking to innovate in this area have a unique need for mentors who have experience navigating regulations, raising capital and managing R&D, to name just a few areas.

Based on his own experience, Patrick Frank, co-founder and COO of PatientPartner, shared some very specific ideas about who to recruit, where to find them and how to fit them into your cap table.

“You want to leverage these individuals so you are able to focus on the full view of the company to ensure it is something that both the market and investors want at scale,” says Frank.

Crypto world shows signs of being rather bullish

Image Credits: Nigel Sussman (opens in a new window)

There’s no shortage of tech news to analyze, Alex Wilhelm notes, but this week, he took a fresh look at crypto.

How come?

“Because there are some rather bullish trends that indicate the world of blockchain is maturing and creating a raft of winning players,” he writes.

4 common mistakes startups make when setting pay for hybrid workers

Image Credits: kentoh (opens in a new window) / Getty Images (Image has been modified)

In one recent survey, 58% of workers said they plan to quit if they’re not allowed to work remotely.

Startups that don’t offer employees work-from-home flexibility are at a competitive disadvantage, but figuring out how to pay hybrid workers raises a complex set of questions:

- Should you localize salaries for workers in different areas?

- How should you pay workers who have the same job when one is WFH and the other is at their desk?

- Are you being transparent with your staff about how their compensation is set?

![Read more about the article [Funding alert] Robotics startup Miko raises $28M in Series B from IIFL AMC, others](https://blog.digitalsevaa.com/wp-content/uploads/2021/08/Miko-robot-1618462334336-300x171.jpg)