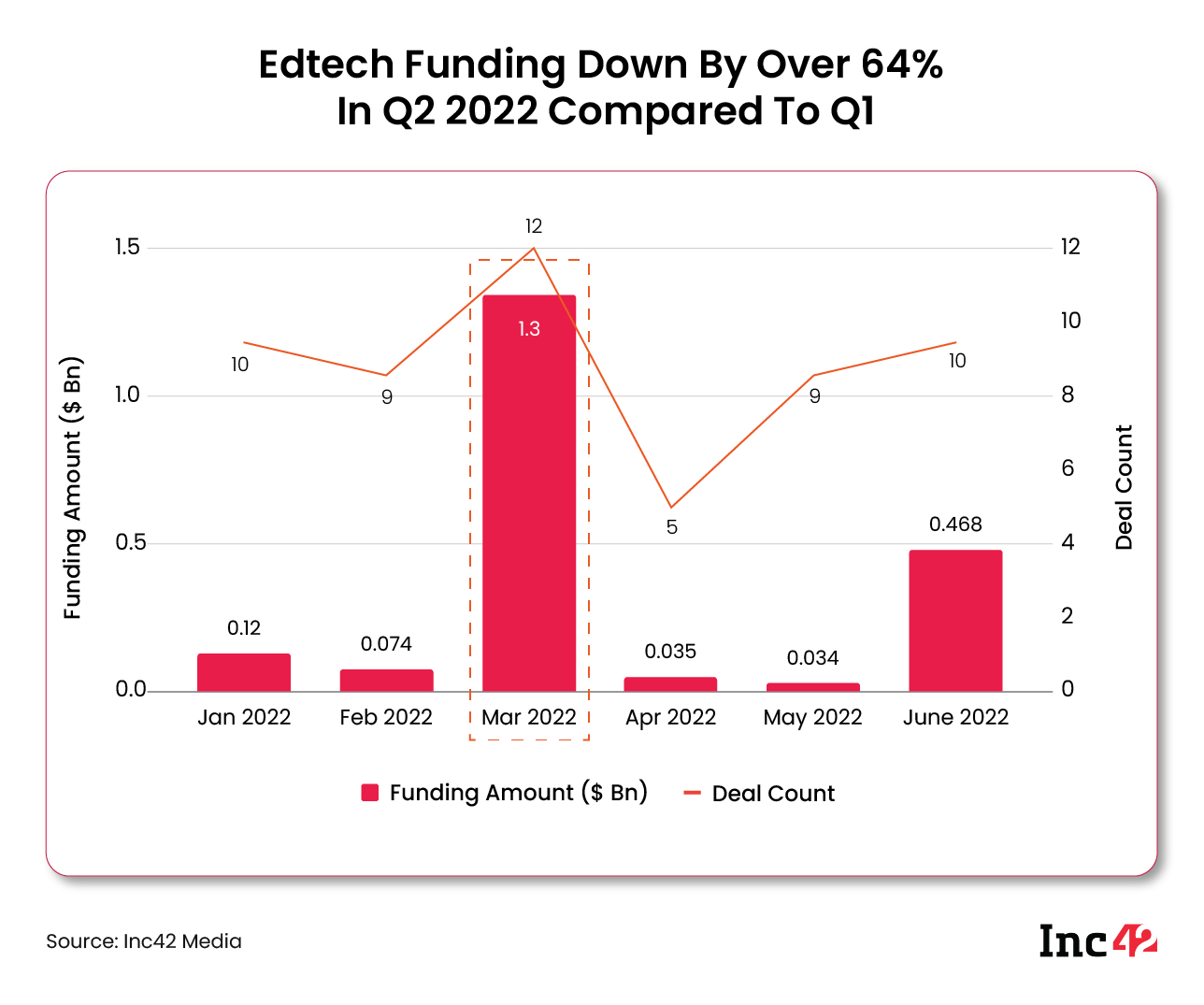

The funding in edtech has plummeted from $1.5 Bn in Q1 to $537 Mn in Q2 2022, a massive gap of 64% between the first and second quarter

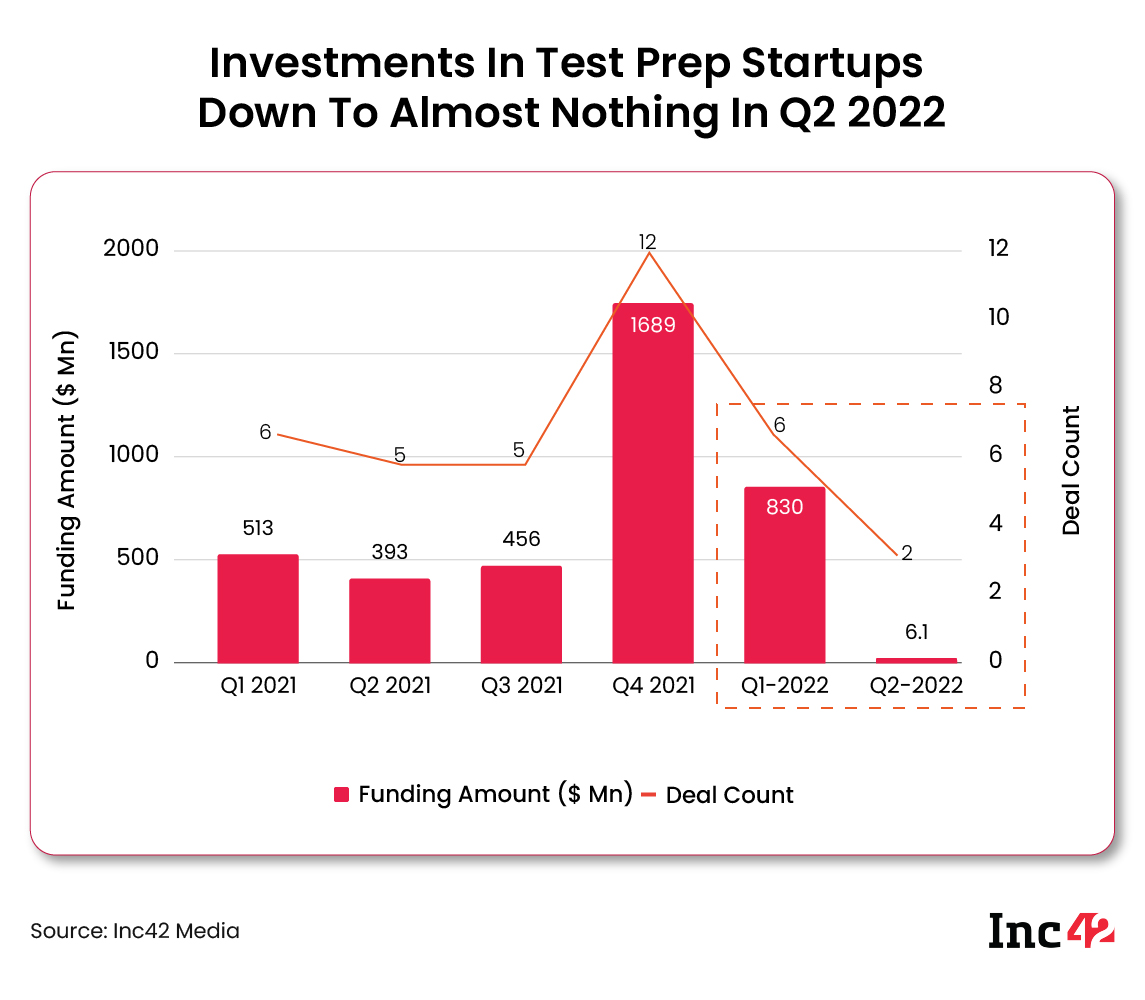

Amid layoffs at many test prep startups, capital inflow into this segment plunged to $6.1 Mn in Q2 2022 from $830 Mn in Q1, an incredible decline of 99%

Another major hurdle could be the focus of the government on regulating edtech players and their partnerships with educational institutions

With six months of 2022 done, we are getting a clearer picture of where certain startup sectors are headed in terms of the funding prospects and the outlook for the rest of the year. And one major trend being witnessed is that edtech startups are caught in a churn and this could destabilise a major sector in the Indian startup ecosystem.

From $32 Bn in H2 2021, the capital inflow for Indian startups fell by 41% to $19 Bn in H1 2022 (January to June). The funding decline is more evident in edtech, where the outlook is more uncertain given the layoffs and restructuring at the largest edtech companies such as BYJU’S, Unacademy, Vedantu and others.

The Edtech Funding Winter Is Real

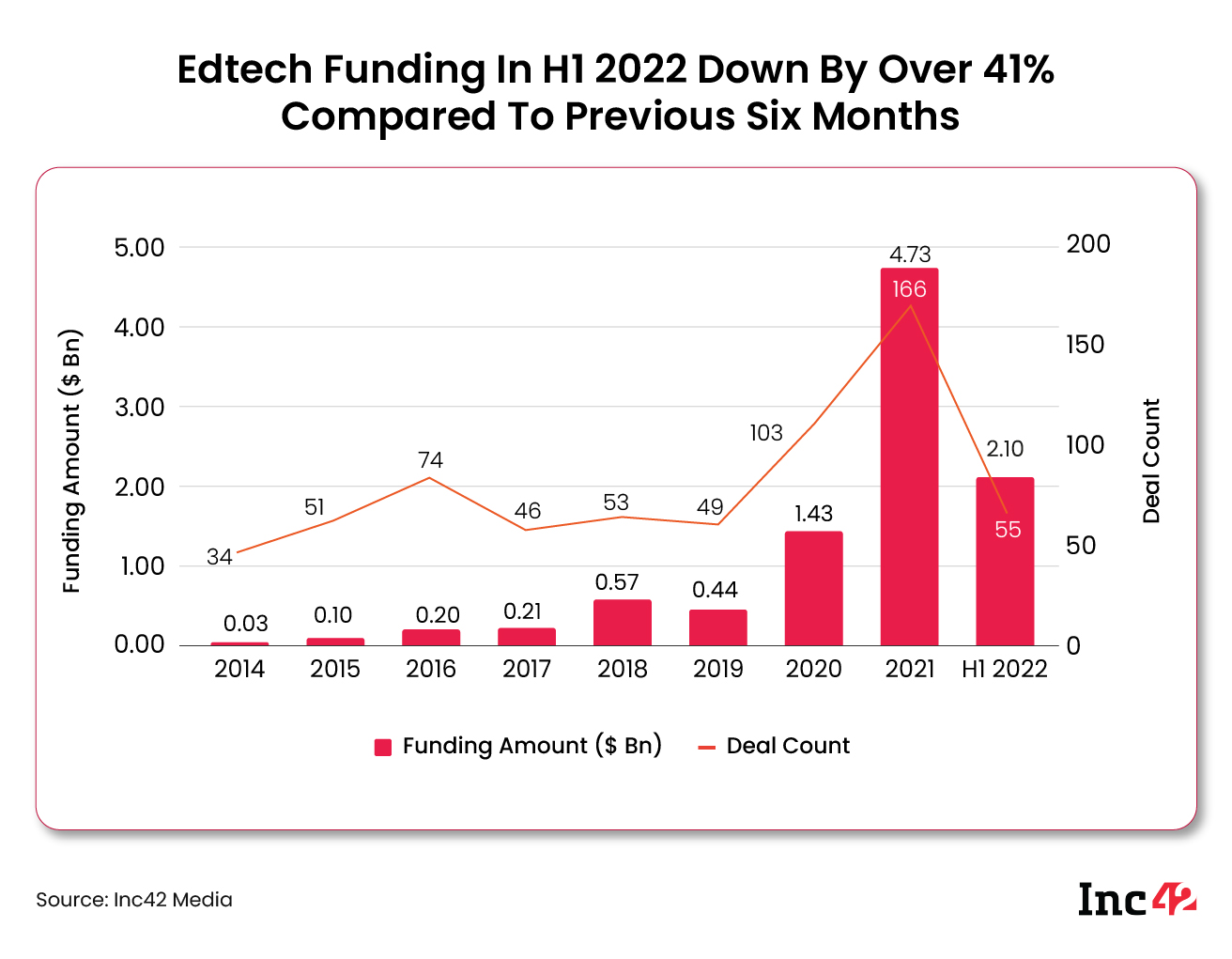

In H1 2022, the edtech sector raised a total of $2.1 Bn, which is less than half of what was raised in the preceding six-month period or H2 2021, when over $4.73 Bn was raised. In fact, excluding the $800 Mn outlier round for BYJU’S, the total funding is significantly low for the edtech sector at just $1.3 Bn in the first six months of 2022.

Ecommerce, enterprise tech and fintech were the top-funded sectors in terms of deal count, and the same three sectors featured among the sectors with the most funding as well, and media and entertainment are two sectors that continued to garner funding, but edtech funding makes for bleak reading.

Further, on a quarterly basis, the funding in edtech has plummeted from $1.5 Bn in Q1 to $537 Mn in Q2 2022, a massive gap of 64% between the first and second quarter.

On a year-on-year basis, from 75 deals in H1 2021 and the fourth position on the sector-wise funding charts, edtech has slipped to 8th place in H1 2022 with 55 deals. That’s just over 6% of all deals, in comparison to 12% in H1 2021. This shows just how much the capital inflow has slowed down relative to the boom last year.

Test Prep Funding Crashes By 99%

Among the sub-categories, K-12 is the most affected, as parents are sending children back to school and back to offline coaching centres. This has led to edtech platforms losing many users. However, the belief among investors is that professional certification based models will be less impacted than K-12 operations or indeed test-prep, which has been badly hurt.

When you look at the data for edtech sub-sectors, the gloom and doom being talked about is very real for test prep startups. In terms of funding, from $830 Mn in Q1 2022, funding for test prep startups has plunged to $6.1 Mn in Q2 2022 — an incredible decline of 99%.

This indicates that funding for test prep has completely dried up, which cannot be said often for any sector. Notably, of the $830 Mn in the first quarter, 96% or $800 Mn came from one round for BYJU’S.

Even amid this flux, a new playbook is unfolding where vernacular languages, microtransaction-based courses, cohort-based targetted learning and hybrid or phygital operations are gaining traction. But all these new models would require resource and budget allocations, which would be tough to pull off at the moment especially for new bets.

Dark Clouds Over Unicorns

It is not only the funding winter or schools reopening or indeed the move to hybrid solutions that have impacted startups in edtech suddenly. Uncertainties such as lack of profitability and heavy acquisition costs have always existed in this sector, but were put on the backburner as the focus turned to scaling up in the past two years.

Now those problems have come to the foreground and are making life harder for even the likes of BYJU’S, Unacademy, Vedantu and others which have recently raised billions in funding. The flawed growth strategy of acquiring customers at any cost without thinking about long-term sustainability is blowing back on these startups.

In the past few months, edtech unicorns such as Unacademy, Vedantu, Eruditus, BYJU’S-owned WhiteHat Jr have laid off employees besides FrontRow and Yellow Class, Lido learning and others. Some startups such as Udayy and Superlearn have even shut shop.

Edtech as a sector is in a short-term crisis of sorts as access to funds needed for pivots is harder and reaching students is just as costly as it used to be. Some larger edtech startups can afford a wait-and-watch policy and conserve cash, so now they are scaling back from capital-intensive models and others are going through layoffs.

The Way Forward Amid Regulatory Scrutiny

Experts and investors believe that the pendulum shift is happening towards offline learning. After the exceptional growth for online learning in metros during the pandemic, now there are plenty of opportunities for vernacular edtech solutions.

Further, while so far the likes of BYJU’S, Unacademy and others have made the most of their user base in urban India, now the focus is on diversifying to students from small towns and rural areas who often find it difficult to access quality educators. Here too, the companies have to reevaluate their learning content and distribution.

The recent fundraising for the likes of upGrad and PhysicsWallah (the latest edtech unicorn) indicates that investors have not discarded edtech’s potential for the long term. Many think online learning is going to co-exist with the traditional model. However, edtech platforms need to focus on affordability, content quality and, most importantly, profitability instead of burning cash on marketing and aggressive expansion.

The key to success will lie in creating value among customers either through pricing or outcomes and building a sustainable business model with a path to profitability. And only those edtech startups that get there through innovation or strategy will stay the course for the long term.

Another major hurdle could be the focus of the government on regulating edtech players if these startups do not submit a self-regulation code. Cracking the whip on edtech players, a central government official warned edtech startups against relying on unfair trade practices in June this year.

If self-regulation does not curb unfair trade practices, then stringent guidelines would be formulated for ensuring transparency, consumer affairs secretary Rohit Kumar Singh said in a meeting with industry body India Edtech Consortium (IEC).

The meeting comes weeks after the government formed a panel to probe exorbitant claims made by edtech platforms. Besides this earlier this year, the University Grants Commission (UGC) had also issued a diktat to higher educational institutions (HEls), calling them to withdraw any degree or diploma programmes offered in partnership with edtech companies.

In January 2022, Education Minister Dharmendra Paradhan also hinted that the government was working on an edtech policy to regulate the space. In December last year, the education ministry issued an advisory urging parents, students, and all stakeholders to be cautious while deciding on opting for online learning or coaching through edtech platforms

Any potential policy decisions will make life more complicated for edtech startups in India, and the lack of funds at this critical time could lead to significant value erosion in the edtech sector.