Navigating the tax landscape can feel like sailing through turbulent waters. However, the new tax regime introduced in India for FY 2023-24 (AY 2024-25) aims to simplify tax planning for salaried individuals, offering potential savings that can amount to lakhs. Let’s dive into the specifics of how this new regime benefits salaried individuals and showcase a comparison table illustrating tax differences under the old and new regimes.

Key Features of the New Tax Regime

Streamlined Tax Slabs

The new tax regime introduces simplified tax slabs, reducing the complexity of tax calculations. Here are the current slabs under the new regime:

- Income up to ₹3,00,000: Nil

- ₹3,00,001 to ₹6,00,000: 5%

- ₹6,00,001 to ₹9,00,000: 10%

- ₹9,00,001 to ₹12,00,000: 15%

- ₹12,00,001 to ₹15,00,000: 20%

- Above ₹15,00,000: 30%

This structure offers lower tax rates and simplifies tax compliance for many taxpayers.

Standard Deduction

The new regime retains the standard deduction of ₹50,000, benefiting all salaried individuals. This deduction helps lower the taxable income, directly reducing the tax liability.

Tax Rebate

A significant feature is the tax rebate available for incomes up to ₹7,00,000, effectively making them tax-free. Combined with the standard deduction, this means individuals with an income up to ₹7.5 lakhs pay zero tax.

Simplified Deductions

While the new regime limits certain deductions available under the old regime, it still allows key deductions such as:

- Employer’s contribution to NPS under Section 80CCD(2)

- Contributions to the Agniveer Corpus Fund under Section 80CCH

Flexibility to Switch

Salaried individuals can choose between the old and new regimes annually, providing flexibility to optimise tax savings based on personal financial circumstances.

Comparative Tax Calculation

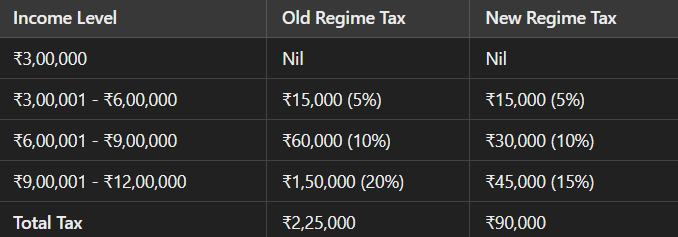

To illustrate the tax-saving potential of the new regime, let’s compare the tax liabilities for a salaried individual earning ₹12,00,000 annually under both the old and new regimes.

Tax Saving: ₹1,35,000

In this example, switching to the new regime results in a tax saving of ₹1,35,000. Such savings can significantly impact personal finances, enabling better financial planning and investment opportunities.

The new tax regime is designed to simplify tax calculations and reduce the tax burden on salaried individuals. By offering streamlined tax slabs, significant rebates, and standard deductions, it presents an attractive option for many. The flexibility to switch between regimes annually further enhances its appeal, allowing taxpayers to optimise their tax liabilities based on their specific financial situations.

In conclusion, the new tax regime offers a breath of fresh air for salaried individuals, helping them save substantial amounts and ensuring a more straightforward approach to tax planning. Make sure to analyse your financial situation carefully and consult with a tax professional to maximise your benefits under the new regime.

Happy tax planning!

Edited by Rahul Bansal

![Read more about the article [Funding alert] Fintech startup CredFlow raises $2.1M in seed round; to strengthen tech capabilities](https://blog.digitalsevaa.com/wp-content/uploads/2021/04/Image60n1-1618383062919-300x150.jpg)