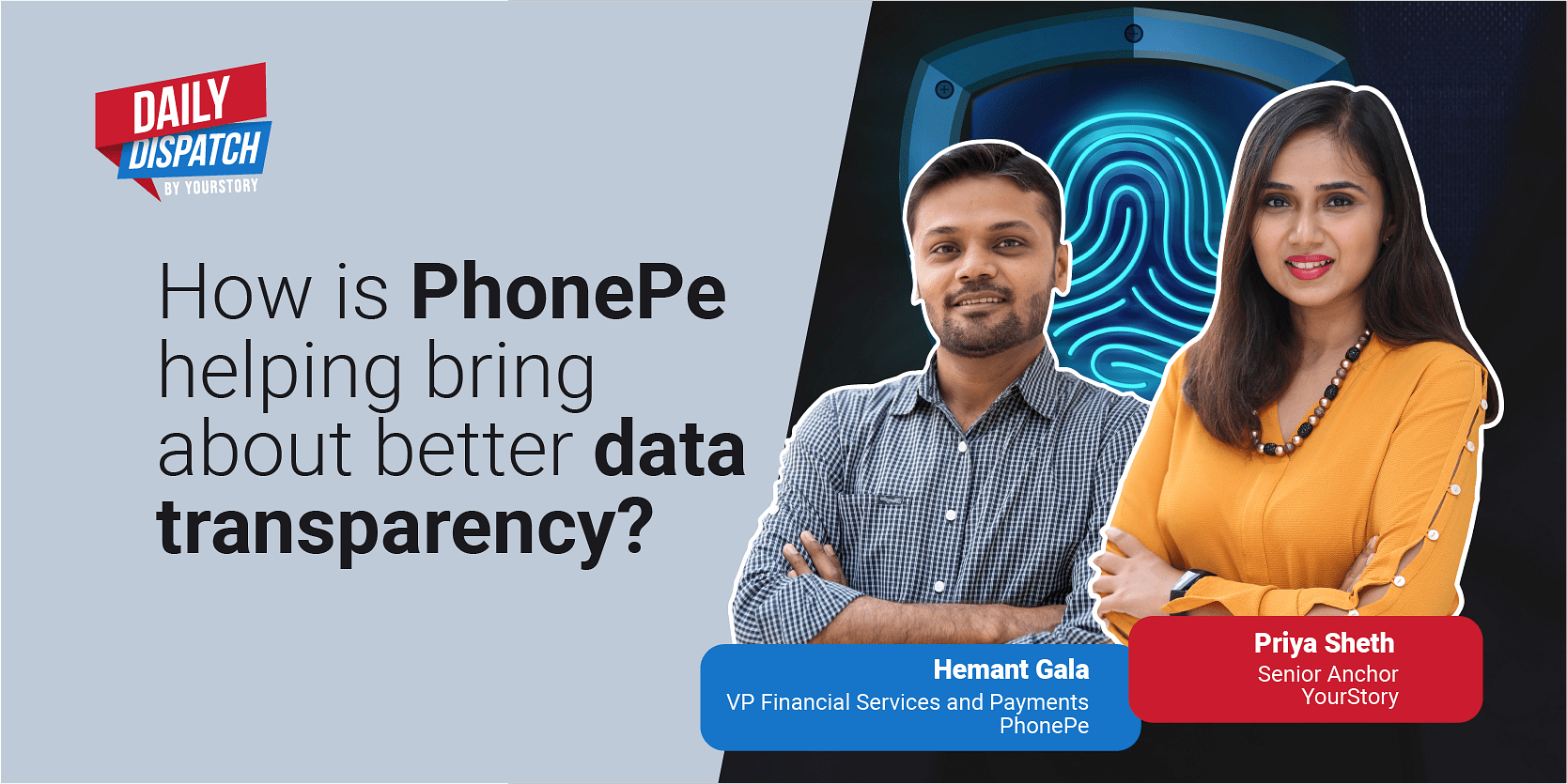

Founded in 2015, is a leading digital payment and financial services platform headquartered in Bengaluru. It recently launched PhonePe Pulse, which is an interactive website that provides transparent data and insights on digital payments in India via PhonePe.

In a conversation with YourStory, Hemant Gala, Head of Financial Services and Banking, PhonePe mentions that the data shows a good amount of penetration throughout the entire country for the payments space. It also shows participation from more than 20,000 pin codes across the country, including Tier-II cities and beyond. In addition to that, the data indicated that merchant penetration has gone deeper with over 20 million merchants across the country.

“We’ve seen a significant amount of participation and digitals reach the hinterlands,” he says.

There has been continuous growth in the digital payments space. Presently, there are over 300 million registered users on the platform, and the user base is continuously growing, shares Hemant. The platform is presently witnessing close to 60 million transactions a day. Additionally, there are over 130 million active users on the platform.

“What’s really interesting is that customer engagement is deepening and they’re moving beyond multiple categories and engaging with us across diverse use cases,” says Hemant.

Hemant says that being in the financial services space has been a very good journey for PhonePe. The company created a deep trust with customers on payments in the first one-and-a-half years of the business through transactions, linking bank accounts, UPI, etc. “Financial service is not about selling one product or giving one solution to the consumer, it is a lifelong journey which generates with trust,” he adds.

He adds that PhonePe’s focus has been on creating a comprehensive platform. Currently, their platform on insurance offers a wide range of products. The company launched simple products in the insurance space that are easy to understand for customers across a wider spectrum.

The company also has a very strong structure up and running for mutual funds, he says, adding that participation was noticed from Tier-II and III areas of the country, with people now looking beyond the traditional investment avenues. He adds that PhonePe’s focus has been on creating the right and simple products for customers and get them to learn and understand mutual funds. “Starting the journey with very simple products and then moving into a complicated product with a focus around SIPs (Systematic Investment Plans),” says Hemant.

Hemant mentions that India is an underpenetrated market when it comes to digital payments. The primary focus for PhonePe is going to be about launching evolved products that will help the customers simplify their journey. “The idea is going to be about trying to widen the scope of insurance with large scale products,” he says.

The company aims to reach 500 million customers and is heading steadily towards that goal. PhonePe’s focus will also be on getting customers engaged in multiple categories, shares Hemant.

YourStory’s flagship startup-tech and leadership conference will return virtually for its 13th edition on October 25-30, 2021. Sign up for updates on TechSparks or to express your interest in partnerships and speaker opportunities here.

For more on TechSparks 2021, click here.

Applications are now open for Tech30 2021, a list of 30 most promising tech startups from India. Apply or nominate an early-stage startup to become a Tech30 2021 startup here.