Finance Minister Nirmala Sitharaman on Tuesday said the government will set up 75 digital banking in 75 districts of the country via scheduled commercial banks to boost the penetration of formal financial services and serve the underbanked population of India,

About 1.5 lakh post offices in India — which will join the core banking system — will also play a part in enabling financial inclusion by offering people access to their bank accounts via net banking, mobile banking, and ATMs. They will also enable the online transfer of funds between post office accounts and bank accounts, the budget stipulated.

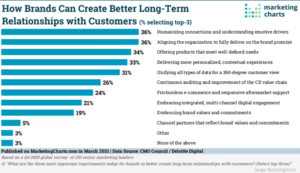

Sitharaman added the government is continuously encouraging the digital banking, payment, and fintech innovation sector to ensure people in every corner of the country can access financial services in a consumer-friendly manner.

The financial support the government had announced for the digital payment ecosystem last year — including a Rs 1,500 crore scheme to develop, promote, and accelerate digital payments in India, and a ‘world-class’ fintech hub at GIFT City (Gujarat International Finance Tec-City) aimed at encouraging and developing innovative financial technology services and products, to name a few — is also expected to continue in 2022-23, she said.

“This will encourage further adoption of digital payments. There will also be a focus to promote use of payment platforms that are economical and user friendly,” the finance minister added.

Finance Minister Nirmala Sitharaman presenting Union Budget 2022. Source: PIB

Financial inclusion has been an important target for the government, especially since the 2016 Demonetisation when reliance on digital payment enablers drastically increased. Since then, the government has extended support to innovative financial players in the form of incubations, grants, and sandboxes to test products.

“Bringing core banking services to post offices can pave the way for deeper digital access for the country’s largely untapped market. This being supplemented by the building of 75 new digital banking units will help in accelerating the shift to digital even further,” said Navin Honagudi, Partner at Kae Capital.

Echoing Navin’s sentiments, Ketan Patel, CEO, MSwipe, said, “Setting up of digital banking units to mark 75 years of Independence is not just a symbolic honour but also recognition of digital-first banking approach the government is keen to pursue to help the larger part of the population, which is new to digital or new to banking, find it easy to access financial services.”

![Read more about the article [Funding alert] DevOps startup Esper raises $30M in Series B round led by Scale Venture Partners](https://blog.digitalsevaa.com/wp-content/uploads/2021/05/Imagemord-1621514156709-300x150.jpg)