Till just a few years ago, getting meat delivered to your doorstep was a pipedream. It was a luxury unless you personally knew the butcher or trusted the local retailer enough.

But technology, ingenuity of meat delivery startups and the pandemic have changed this altogether and brought in a new reality for meat shopping in metros and smaller cities. We also have a meat delivery startup in the unicorn club, so how are startups looking to cash in on this opportunity?

Hang on to find out, but first a short detour into these two stories:

Tata Group likely to bring its electronics retail arm Croma to the Tata Digital fold, as part of the super app and D2C push

Vu Televisions has entered the D2C segment with the launch of its online store ‘Vustore.com’, powered by retail tech startup Dukaan

The Meaty Opportunity

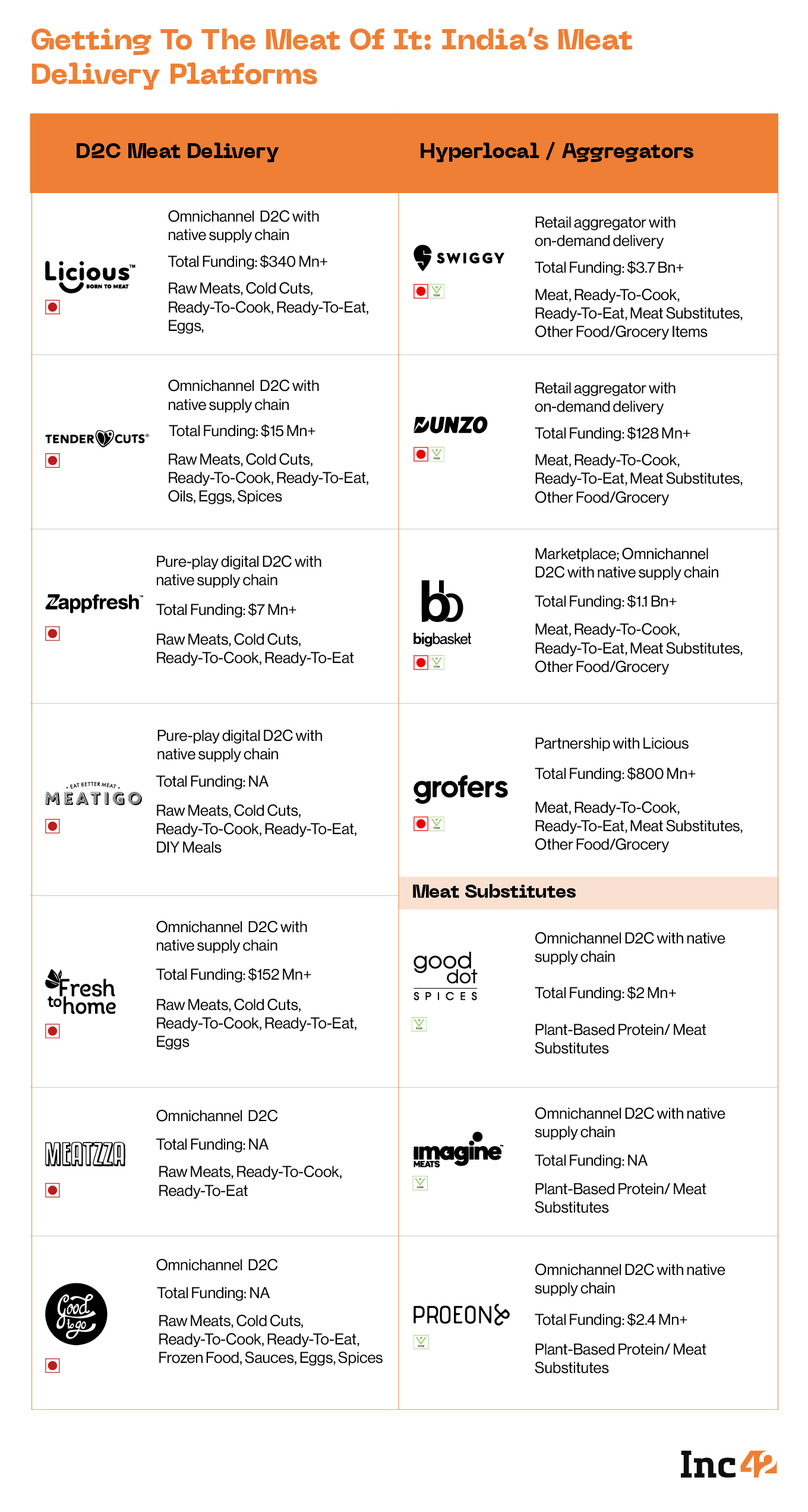

Let’s dive right in. While the online meat delivery industry in India is still growing and largely underpenetrated, startups have paved the path with meat-specific supply chains and quality control chains.

We have seen more than half a dozen startups dedicate themselves to the meat delivery business, while those in the general essentials and grocery segment are also building capability for this.

And that’s not even counting the meat substitutes and alternatives that are also gaining traction in Indian metros.

As per a RedSeer report, the overall GMV in the online meat segment has doubled over the last 18 months, thanks largely to near-constant availability and predictable delivery cycles, along with the hygienic and high-quality nature products, which is a key criteria in this segment, more than vegetables or groceries.

Nevertheless, Licious, Zappfresh, Tendercuts, FreshToHome and others that are solely in meat delivery are confident that their dedicated supply chains and quality control processes will be a large enough moat against the established delivery giants.

Another example that Kadavil gave is the ‘commodities exchange’ electronic trading platform for fishermen, who sell their catch to FreshToHome directly. Such processes need to be put in place for procurement, which makes it a complex operation.

Zappfresh founder Deepanshu Manchanda added that the products that are sourced by aggregators and marketplaces are not the same as the ones available with online meat delivery startups. That’s because the products are just what one might get in the market, where there’s no guarantee of quality.

These nuances are reflected in the market share for sales by vertical meat delivery players, which accounts for 80% of all online sales, according to RedSeer estimates.

Abhishek Sinha, founder of omnichannel ‘vegan meat’ brand GoodDot, said that while in the long-term lab-grown meat might become mainstream in India, at the moment the Indian market is not ready to pay a premium for meat alternatives. So for now plant-based meat, which is more affordable and has a longer legacy in India, will continue to rule the meat substitutes market.

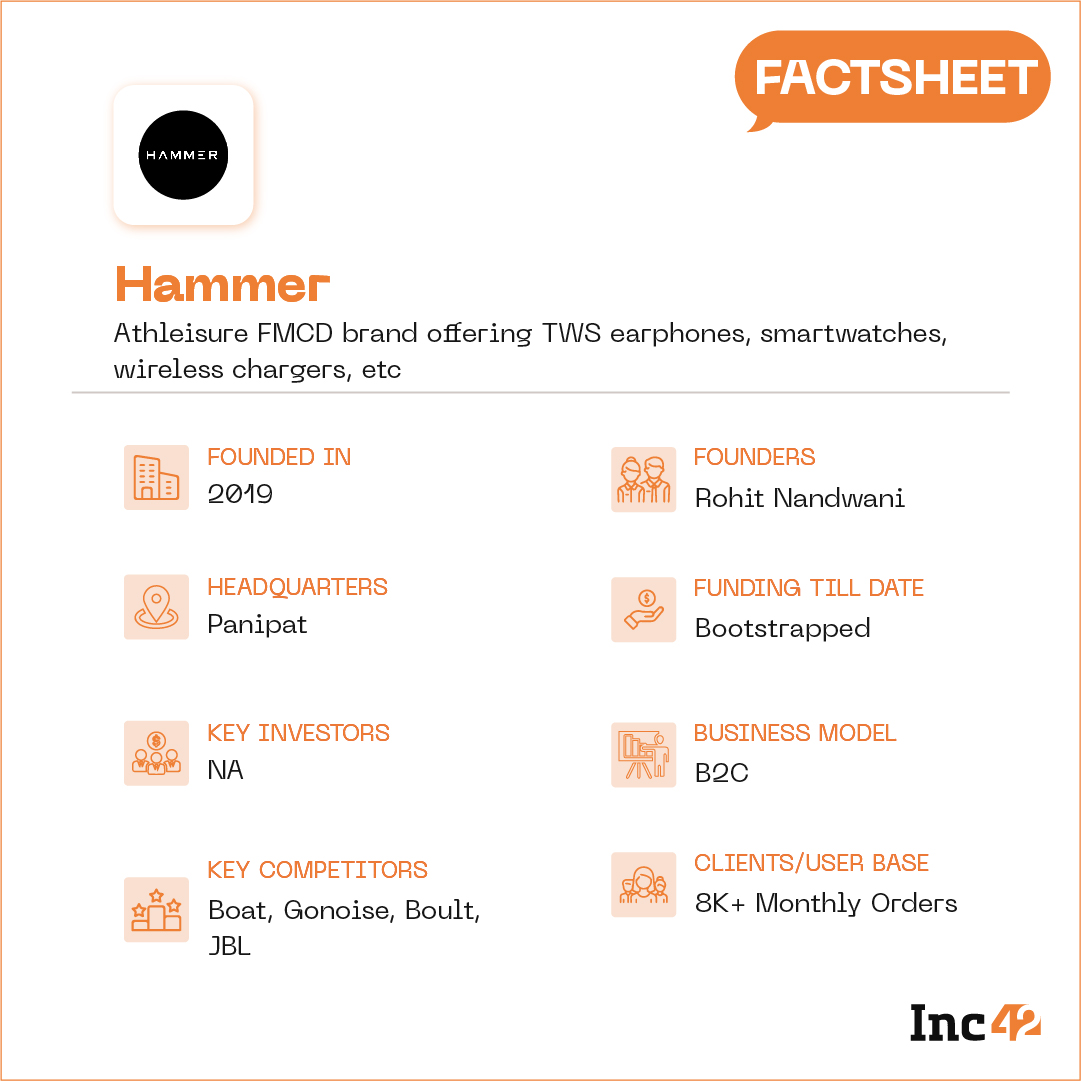

D2C Discovery: Hammer

No matter the category, D2C brands in India have to find the right balance of price, design and functionality, and often new products come up when there’s a gap in this trifecta.

Panipat-based Hammer, which launched its first SKU — a wireless earbuds pair — in 2019, has sensed a gap in the electronics and wearable market, where it’s looking to introduce the concept of fast electronics, similar to how fashion startups work.

The company says it has a current production capacity of 10K-12K units per month, scalable to 40K units, and clocks monthly sales of 8K products on an average. It claims to have earned INR 12 Cr in revenue in FY21, which is double of what it earned in 2020, and is targeting revenue of INR 40 Cr by FY24.

The D2C Summit Recap: Thrasio’s Carlos Cashman Spills The Beans

The D2C Summit Recap: Thrasio’s Carlos Cashman Spills The Beans

How did Thrasio grow from an ecommerce startup to a global sensation that has spawned several clones and off-shoots. Founder and CEO Carlos Cashman was at The D2C Summit by Inc42 Plus last week to reveal this and more. The Thrasio journey began like most startups when Cashman and his team found a gap in the ecommerce space — smaller brands that don’t have deep pockets could not capitalise on ecommerce.

Speaking at Inc42’s The D2C Summit, Cashman revealed, “We started thinking how we could help them [small brands] become successful, because all we had to do was invest cash! The parameters on which we were working — driving sales through ecommerce, Facebook and Instagram — were already simplifying the online journey for brands. So we started thinking about rolling them up.”

Revisit Cashman’s super insightful session and others from The D2C Summit at The D2C Academy.

More D2C Buzz

More D2C Buzz

Investors Go Green: VCs backing D2C startups are now looking at environmental, social, diversity and inclusion metrics with a keener eye. Here’s why

D2C Watchlist: Like every month, we released our pick of 30 startups to watch in November too, but with a completely D2C lens. Take a look

Fast42 Awaits: Join the race for Inc42’s Fast42, our platform to identify and recognise India’s fastest-growing D2C brands. Applications open till December 15, 2021!

That’s all we have for now. We’ll be back next week with another look at the latest from the world of D2C.