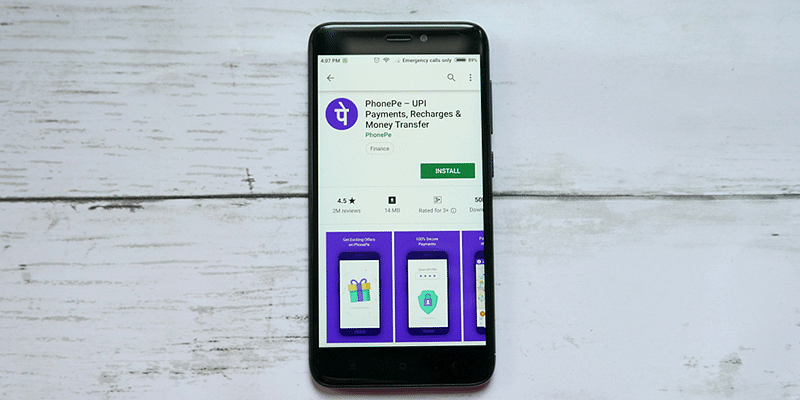

has reportedly decided to scrap the acquisition of after months of negotiations.

The fintech company has called off the merger, and the corporate boards and investors of the companies were made aware of this news recently, The Economic Times reported.

After months of due diligence, it added that PhonePe has decided not to proceed with the transaction.

The report noted that failures with due diligence, conflicts over valuation, company viability, and ZestMoney’s ownership structure were among the reasons the discussions failed to materialise.

YourStory could not independently verify this report.

YourStory has reached out to PhonePe and ZestMoney for comments. Both company have not responded to the queries sent. This copy will be updated to reflect their comments.

This comes as a setback for the cash-strapped buy-now-pay-later (BNPL) platform when the whole technology ecosystem—particularly fintech—is experiencing a capital constraint.

In November, YourStory reported that PhonePe was in the final stages of acquiring ZestMoney for $200 million to $300 million.

The BNPL startup was last valued at $470 million after its latest funding round when it raised $70 million in a Series C round in September last year.

Founded in 2015 by Priya Sharma, Ashish Anantharaman, and Lizzie Chapman, ZestMoney offers BNPL plans of ticket sizes Rs 50 to Rs 5 lakh payable over 30 days to 24 months. It has partnered with 25 banks and non-banking lenders and works with large merchants, including Amazon, Flipkart, Google Pay, Apple, and Xiaomi, to offer its services to customers.

BNPL companies such as ZestMoney and its peers LazyPay, Uni Cards, Slice, etc., are grappling with uncertainty ever since the Reserve Bank of India released guidelines around digital lending, essentially making it hard for fintech startups to extend personal credit lines via a card.