Technology has transformed the insurance sector by making policies cheaper, easier to buy, pay into, and even manage; but when it comes to creating products tailored to a customer’s needs, it has fallen short, said Saurabh Tiwari, CTO at insuretech firm PolicyBazaar.

Specialised fintech firms and neobanks are increasingly taking to customer-focused personalisation of products and services — whether it is suggesting investment instruments as per a consumer’s funds inflows and outflows, creating a basket of diversified investment instruments as per the amount of money one is willing to commit, offering options as per the user’s risk appetite, or even prioritising bill payments, among other things.

But that has been absent from the insurance space largely because insurance companies prefer to issue homogenous policies as they’re easier to track, as well as easier to service.

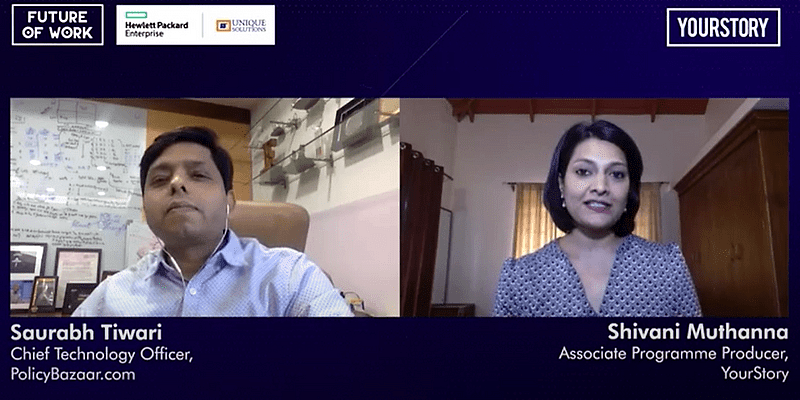

The need of the hour in the insuretech and insurance space is for customised insurance policies that depend entirely on the customer and their financial and environmental variables, such as their salaries, how much they’re willing to and can afford to pay in premiums, what Tier city they live in, etc, Saurabh said, speaking on the sidelines of YourStory’s Future of Work 2021, the country’s largest product and tech conference.

“For example, if you are looking to buy car insurance and you’re living in a Tier-II city, and I’m living in Tier-I city, or I’m living in a place where there’s a lower risk of me meeting with an accident, why should you pay the same amount of premium, which I am paying. What we need to do right now is start thinking about how we can build insurance products that are very customer-centric in nature. And to facilitate this transformation, I think digital is going to be the real theme,” he added.

Using technologies such as artificial intelligence, machine learning, and big data can help make the journeys users have on the platform more personalised and targeted, and translate directly into increased buying.

“The pandemic has helped us realise that one product doesn’t fit all, and what we need to basically move towards as an industry are micro-payment options where people need not pay hefty sums to get insurance, the ability to pause insurance payments, personalise their usage of the policy and premium-pay ins even further, as well as cater to people across all economic backgrounds,” Saurabh said.

Those paradigm shifts in the way insurance products are created and sold will need to be backed by a strong tech infrastructure that can not only help sell those personalised products but also ensure safety from online frauds.

A big shout out to our Future of Work 2021 Co-presenting Sponsors Hewlett Packard Enterprise and Unique Solutions; Digital Excellence Partner, Google Cloud; Associate Sponsor HP and Intel; and Sponsors: Atlassian, Freight Tiger, Archon I Cohesity, TeamViewer, and Pocket Aces.