Its shares price fell as much as 18% during the day to hit its all-time low of INR 886.40 per share

On November 15, Policybazaar’s shares listed with a premium of INR 17.35% at INR 1,150

The lock-in period for the anchor investors ended on December 13th, 2021

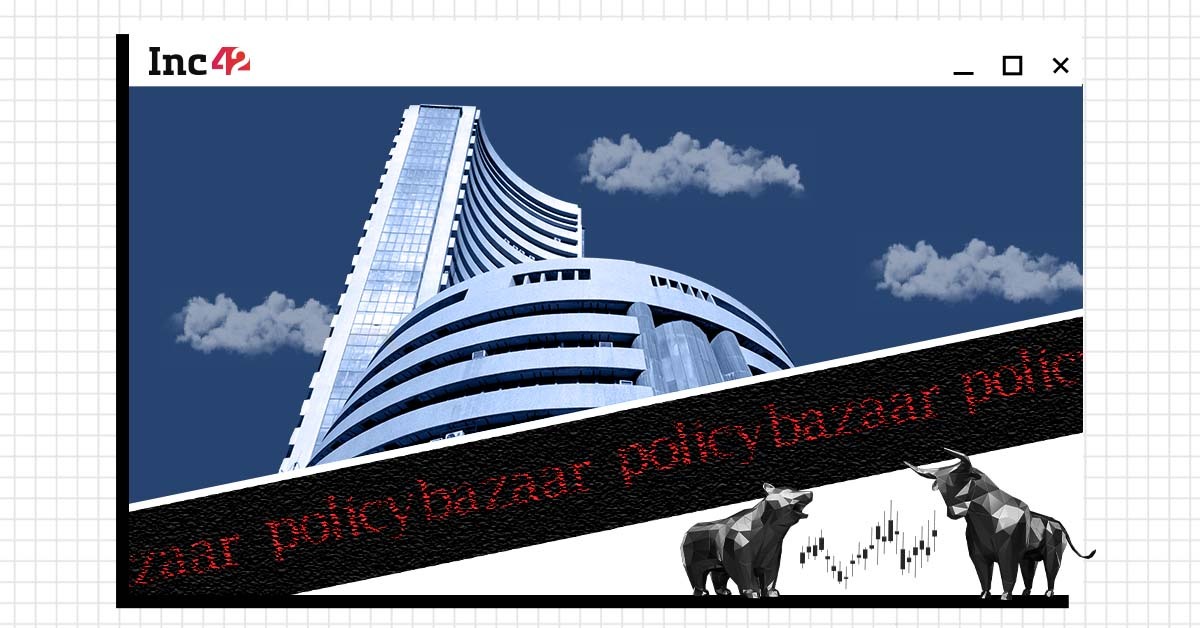

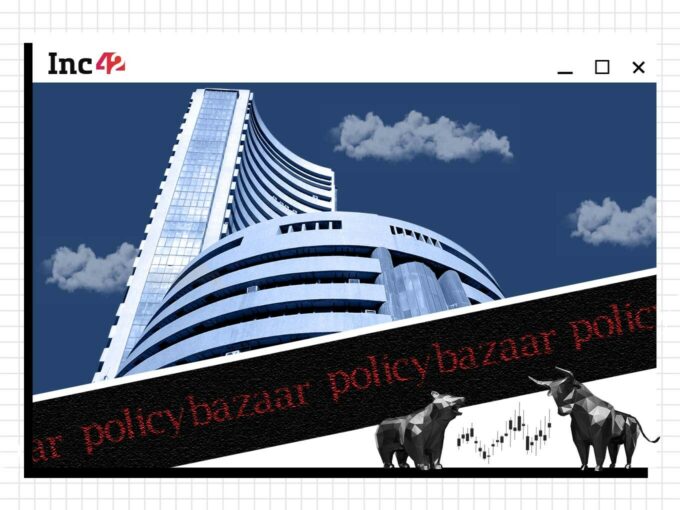

Share price of insurtech unicorn Policybazaar witnessed a freefall today (December 20th, 2021) amid a plunge in the broader stock market.

At the end of trade on Monday, share price of P.B. Fintech, which runs Policybazaar, closed at INR 935.35, lower by INR 145.75 or 13.48% from its previous close.

Its shares price fell as much as 18% during the day to hit its all-time low of INR 886.40 per share. The selloff led Policybazaar’s share price to fall below its issue price and listing price.

The shares price of the startup listed on the BSE and NSE last month was at INR 1,150, at a premium of 17.35% from the issue price of INR 980 Cr.

Analysts were of the view that the Policybazaar stock was under pressure given the overall selloff in the market due to the concerns of the Omicron variant of Covid-19.

The BSE Sensex closed at 55,822.01, lower by 1,189.73 points or 2.09% from its previous close. The National Stock Exchange (NSE) closed at 16,614.20, lower by 371 points or 2.18% from the closing level on Friday.

Rahul Sharma, cofounder of Equity99 was of the view that new retail investors who have entered the equities markets in recent times have not witnessed such a bear run and as market sentiments are weak currently they have taken to panic selling across stocks, including the new age startups.

Prashanth Tapse, vice president (research) at Mehta Equities Ltd, however, was of the view that the recent decline in the shares prices has come due to the end of the lock-in period of anchor investors.

The lock-in period for the anchor investors of Policybazaar ended on December 13th, 2021 and since then the shares have declined nearly 19% with a major fall today.

“The recent selloff can be attributed to anchor book unlocking which brings in some sort of selling pressure in the short term,” Tapse said.

“On valuation per se currently the stock is trading on the higher side due to negative earning status, while we believe new age businesses are valued more on revenue multiples and market share and not of earnings multiples in the initial years, which shows valuations are exorbitant to look at,” he added.

Although the outlook for the startup’s performance is positive with a revenue forecast of 20-25% CAGR growth, analysts said that competition in the online insurance space may pose a risk.

Santosh Meena, head of research, Swastika Investmart Ltd, said that the freefall in shares prices should not be a long term affair and the low hit by the Policybazaar’s shares prices today may act as a support level in the near term.

A recent report by Edelweiss Alternative Research showed that among the IPOs in November 2021, mutual funds invested the most in Policybazaar’s offer with an infusion of INR 1,350 Cr, followed by Paytm.

Founded by Yashish Dahiya, Alok Bansal, and Avaneesh Nirjar in 2008, Policybazaar aggregates insurance policies from a range of providers for use-cases, including life insurance, automobile insurance, health insurance and more.