India’s stock market has welcomed a record number of new age companies that headed for IPO this year. Rapid growth of technology startups coupled with SEBI’s relaxed norms on startup listing and the COVID-19 pandemic led this digital boost.

According to StartupIndia, there were over 50,000 startups in India in 2018, of which around 9,300 were technology led startups. In 2019, there were 1,300 new tech startups added to the ecosystem indicating that two to three tech startups are on an average incepted every day.

The disruption by these new-age startups was more prominently experienced in the past 12-18 months as companies and households moved to digital during the pandemic. In the past few months, we have seen Zomato, Nykaa, and PB Fintech, among others listed on the market and receive mixed reactions on their performance.

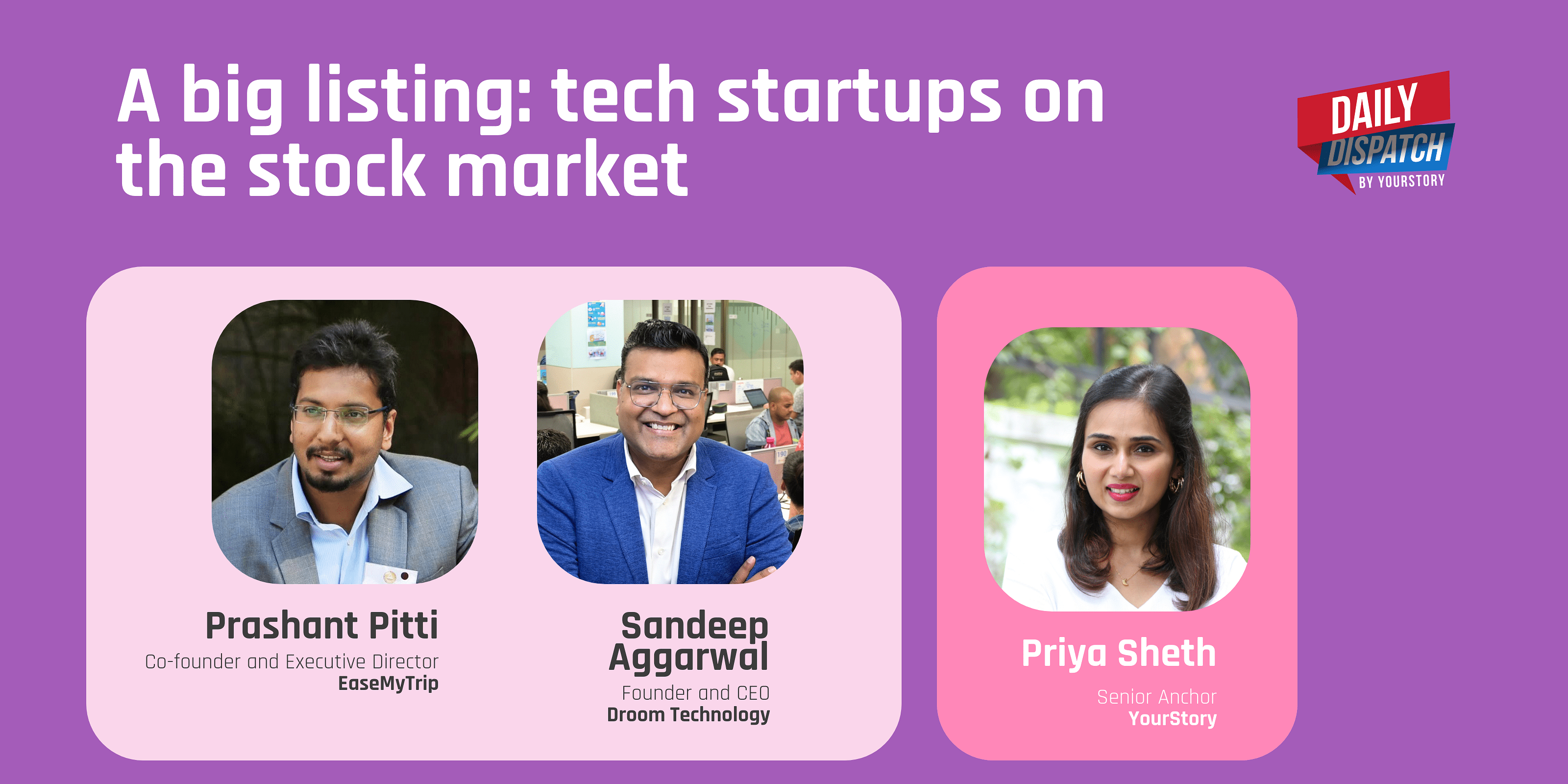

To understand this trend, YourStory’s Daily Dispatch hosted a panel discussion with Prashant Pitti, Co-founder and Executive Director, EaseMyTrip; and Sandeep Aggarwal, Founder and CEO, Droom Technology.

The IPO journey

Online travel booking platform EaseMyTrip listed on the stock exchange earlier this year. The company claims to be profitable since its inception and claims to have never raised funding from external sources over the past 13 years.

Commenting on the IPO journey, Prashant Pitti, Co-founder and Executive Director, EaseMyTrip, says, “We prepared for one and half years to be listed. We started in the middle of 2018 and then Covid happened.”

The Mumbai-based company was expected to hit the stock market in March 2020 but with the COVID-19 outbreak in February 2020, the process was delayed to 2021. Prashant talks about the responsibility of being a public company which includes quarterly reports and shareholder meetings.

“It’s all worth it. Just the feeling of having 100s and 1000s of people being your shareholder and working as a larger group,” he adds.

While EaseMyTrip began its journey earlier this year, automobile ecommerce marketplace Droom Technology recently filed its Draft Red Herring Prospectus (DRHP) with markets regulator SEBI. The startup is looking to raise upto Rs 3000 crore from an Initial Public Offering (IPO).

The scope

Sandeep highlights the rationale behind entering the stock exchange. “If you take a long-term approach and if you build a company or product built to last, I think going public is definitely a milestone,” he says, on the trend of internet companies heading for IPOs.

With regard to Paytm’s performance, he says the stock market is extremely volatile and assessing the fintech giant’s performance would be a short-term horizon.

Echoing the same thought, Prashant adds that new-age companies are very agile. A decade, according to him, is a very long period in which the company can change dramatically. He believes that the market will take some time to understand technology led companies and ascertain how to react to them.

“Companies like us, new age companies- we are disrupting, we are doing something better faster than how it was done traditionally,” adds Sandeep.

Droom Technology filed for its DRHP with SEBI on November 12th. The Gurugram-based company is yet to disclose the date it launches its offering.

EaseMyTrip has fleshed out an acquisition strategy to buy out companies like its category. The brand recently acquired Spree Hospitality after its first acquisition of B2B travel platform Traviate.

![Read more about the article [Startup Bharat] How Indore-based fintech FidyPay processed 14X more transactions in 2021, versus 2020](https://blog.digitalsevaa.com/wp-content/uploads/2021/12/Featureimages-newdeck1-1639661112213-300x150.png)