- Pando, a supply-chain SaaS tech startup got its first customer with just a minimum viable product and a plan to build an end-to-end platform based on AI, no code, and collaboration.

- Currently, it has over 50 large customers including Godrej, Honda, Johnson and Johnson, Accuride, Philips, Nestle, and ITC across the world.

- With $4.4 million in annual recurring revenue in 2022, the company is looking at its next growth stage: to become operationally profitable by the end of the year, as it hires 150 more people and focuses on the North American markets.

For Nitin Jayakrishnan and Abhijeet Manohar, Co-founders of supply chain software-as-a-service (SaaS) startup Pando, the name perfectly encapsulated their vision—a complex labyrinth of interconnected systems with a single root.

Pando, which means “I spread” in Latin, is a famous quaking aspen clone in central Utah. The grove of the 47,000 individual “trees” are genetically identical and connected by a single root system.

Similarly, the Chennai-based startup, founded in 2018, strives to connect various stakeholders in the supply chain—manufacturers, warehouses, distributors, retailers, retail stores, consumers, factories, and their suppliers.

The rebirth

The idea for Pando emerged while Jayakrishnan and Manohar were working on another venture—a digital freight marketplace called iDelivery Tech Solutions Private Limited in 2016. Back then Manohar had joined the company as a Chief Technology Officer.

iDelivery aggregated carriers, truck owners, transporters, and shipping companies, and connected them to enterprises to fulfil their supply demands. The startup also offered digital services to large companies.

While iDelivery found many takers, including the likes of Philips and ITC Limited, customers began requesting features that could be integrated into some of the existing supply chain products they used.

These requests gave the co-founders some food for thought and eventually led to the birth of Pando in 2018.

The new business idea was in stark contrast to the freight brokerage model as it meant high gross margins (say, 70-80%) and low capital requirements (and, therefore, high capital efficiency). Given that large legacy players, which focused on multiple areas, were the main players in this space, the new venture could differentiate itself by targeting specific pain points in the space and also with its SaaS model of delivery.

“It was important that we had a rebirth, if you will,” says Jayakrishnan, Co-founder and Chief Executive Officer (CEO) of Pando.

Pando started its journey as a separate company after closing iDelivery in July 2017.

“It was looking more and more like a data problem, which is what got me excited. Everybody has acquired multiple systems over time, and the information from the outside is siloed and available in different formats. So, this is what we set out to do as well–to make data, which is the most critical lever for change–an asset,” explains Manohar, Co-founder and CTO, Pando.

L to R: Co-founders of Pando, Abhijeet Manohar (CTO) and Nitin Jayakrishnan (CEO)

First customer

From the beginning, Jayakrishnan and Manohar were focused on selling to enterprises. This is in contrast to the more common SaaS playbook developed by some of other Indian companies, which typically start by selling to the small and medium businesses (SMB) and eventually expand to the mid-sized and large enterprises segments.

“If eventually enterprise is the real prize, then why should we build for SMB, then reinvent ourselves for mid-market, and eventually rebuild for enterprise? We thought, ‘Why don’t we just build for enterprises from Day 1?’” says Jayakrishnan.

Both Jayakrishnan and Manohar cold-called the CEO of Philips India and managed to get a meeting with him to pitch their idea.

It was not a typical pitch. The duo told their first potential customer that they didn’t have a full-blown product, a team, or funding, but that they needed Philips India to subscribe to them for three years and pay Pando annual recurring revenue (ARR), a metric SaaS companies track to indicate future business potential.

The Co-founders also said their potential customer should be comfortable with the way they approached and solved the problem.

Philips India agreed to build the product with Pando. The startup’s CEO attributes their first customer success to three tenets that Pando is built on: artificial intelligence (AI) capabilities, no code approach, and networks, which means the platform is a system of collaboration rather than just a system of records.

Tech-stack building

Pando’s initial growing pains included developing solutions for customers who wanted multiple specific features.

And, if the Co-founders had to customise the solution for each customer, then the product they were building would not suit the SaaS model of delivery.

“Each stakeholder in the industry has unique needs–one prefers data to be used for analytics and actions, and some others expect a system that helps automate their complex operations across the complete ecosystem. So, we had to build a flexible platform that allows data to be used for all purposes,” explains Manohar.

Pando’s team solved this issue by building a platform based on processes rather than creating piecemeal solutions for different requirements.

“The aim was to be deeply entrenched into the business catering to all the stakeholders, a value-added technology partner who empathises with them and has skin in the game rather than just being looked at as a technology partner that handles transportation,” adds Manohar.

This meant building an end-to-end platform that also interacts with internal and external systems and “be the single source of truth” for all the stakeholders involved.

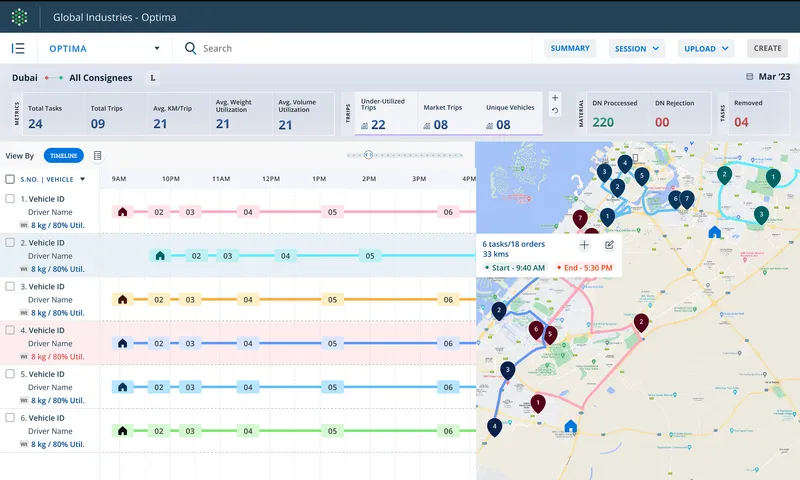

The different needs of their large clients led them to build a no-code platform, which was done in 2020. This gave customers freedom to choose the variations best suited to their businesses and also helped Pando avoid re-building the tech stack for each client they onboarded.

A screenshot of Pando’s platform

Business model

The startup targets large enterprises that may not be happy with their enterprise resource planning (ERP) providers in fulfilling supply chain demands. Once potential customers are convinced of the value they are likely to derive, Pando integrates with their existing ERP solutions.

Multinational software companies such as SAP and Oracle as well as new-age firms such as Blue Yonder top Pando’s list of competitors.

Powered by an outbound sales development representative engine in India, the startup also has co-marketing and co-delivery arrangements with software service providers such as TCS, Accenture, and Genpact. Under this, the IT companies help market Pando to some of their customers for which they earn fees for product delivery while the startup gets the licensing revenue.

Pando also gets clients on its own and in some cases, it banks on the IT companies to do product delivery where the revenue deal is the same as explained above.

To extend its capabilities, the startup also integrates its platform with other players in the space such as logistics technology company Project44 for last-mile visibility and optimisation and supply chain intelligence platform FourKites.

Geographical expansion and growth

Pando initially focused its energy in selling to Indian companies. In the last 18 months, the company has expanded to other Asia Pacific regions and in the last year or so, it set foot in North America.

“Traction is through the roof in the US,” says Jayakrishnan. “American manufacturers see the value of a fully built out product and the experienced professional services and support teams.”

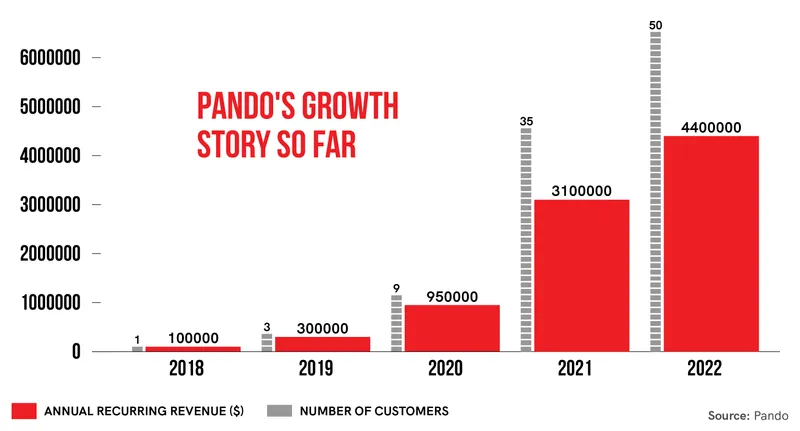

With just one customer in its first year, Pando grew to three in its second year, nine in the third, 35 in the fourth, and by 2022, it had 50 customers.

Its ARR has increased from $100,000 in its first year to around $4.4 million by the end of 2022.

With an average sales cycle of six to eight months, Pando’s average deal size is $300,000 in the US and $100,000 in Asia Pacific. It currently counts Procter & Gamble, The Kraft Heinz Company, Johnson & Johnson, Nestle, Godrej, Danaher, and ITC as some of its customers.

Largely due to the nature of being an enterprise business with long-term contracts (typically, five-year deals), the startup has not seen any churn so far.

Of its 50 customers, six are Fortune 10 and 30 are Fortune 500 companies.

Business growth

The company expects to continue to expand three times in the next 12-18 months and believes that majority of its growth would come from its global accounts and its US customers.

“So, the two big goals are the revenue growth number (3X) while keeping gross margins at the current levels (70-80%), and the net burn ratio at 1X. Growth and profitability are not at odds – we want to build a high-growth, high-margin business. Keeping both in check, month on month, quarter on quarter, is critical, and we’re heading there,” says the two-time-founder who spends about seven months a year in the Bay Area.

Currently, it earns about half of its revenue from Asia Pacific and the rest from the US.

Going forward, in the next couple of years or so, global accounts headquartered in the US are likely to account for 80-90% of its growth, given its huge total addressable market (TAM). However, Pando is clear about not losing sight of the Asian market as its TAM growth is likely to be higher than that in the North American regions.

A third each of its customers use the platform for their global operations, multiple geographies and in one particular region they started with.

Pando has raised a total of over $11 million in two early-stage funding rounds–about $2 million in seed in 2018 and the rest in Series A in January 2020—from investors including Nexus Venture Partners, Chiratae Ventures, and Next47.

The company currently has 250 employees and is looking to hire another 150 people by the end of 2023.

“We are at a 1:1.5 burn ratio today, which means that for every dollar we add, we spend $1.5, and we will get to 1:1 by the end of the year. Profitable growth is the goal – we are building a business that will outlast us,” says Jayakrishnan, indicating that Pando will become operationally profitable in the next eight months.