There has been a meteoric rise in the number of D2C food and nutrition brands in India post-pandemic, with the market now poised to hit $61.3 billion by FY27 (1Lattice and Sorin Investments report). Foodtech platforms like and are crowded with snacking brands and quick-service restaurants wanting to one-up each other. However, D2C brands are also more prone to failure.

There is never a single reason behind failure. Many D2C food brands often face the challenge of inadequate understanding of customers, inconsistent brand identity, failure to differentiate, and the inability to attract repeat purchases.

Rinka Banerjee realised there was a crucial underlying factor behind any failure—research and development. While bigger companies enjoy extensive R&D resources, smaller firms often lack the business know-how to market their products.

“In India, as compared to some of the other parts of the world, there wasn’t that much of an access to high-quality R&D apart from the large organisations,” says Banerjee, who has served 16 years at as the Director of R&D for Foods in South Asia. She also has experience launching products for FMCG companies Knorr, Kissan, Hellmann’s, and Lipton across the Indian subcontinent, and has developed ice creams for Haagen Dazs’ international market.

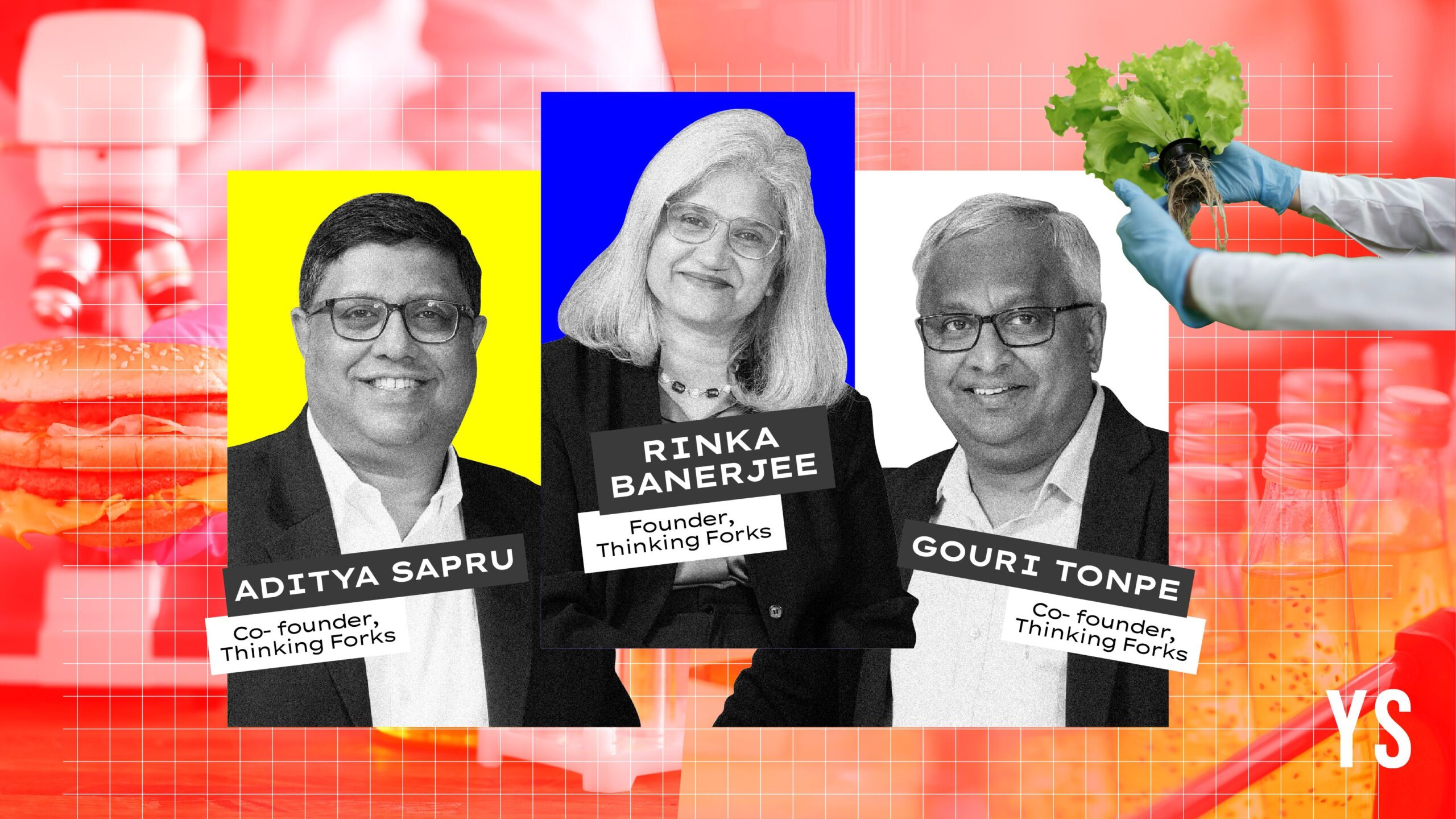

She realised there was a gap for R&D consultancy and teamed up with former colleagues Gourinandan Tonpe and Aditya Sapru to build Thinking Forks in 2014 using their personal savings. The Bengaluru-based full-stack foodtech R&D consultancy firm helps startups build products from the ground up and brings their ideas to market.

“While countries like the US, the UK, and Australia have R&D consultancies focused on product development, India did not have an R&D consultancy which could take innovations to scale, deliver a basket of services, and be a real growth enabler to the food industry,” the CEO of Thinking Forks tells YourStory.

From concept to market

Thinking Forks focuses on articulating the idea, defining the design brief, understanding competition in the market, and identifying its clients’ advantages. Its end-to-end R&D solutions cover the complete product lifecycle and span developing strategies, conducting research and development, and designing products for businesses.

It is equipped with in-house food labs and kitchens, along with a consumer interaction centre, where experts benchmark products against competitors through blind sensory tests. The 40-member team also analyses product ratings as well as the feedback resulting from small-scale consumer interaction studies.

“All of these areas are covered before you hit the market. This is very valuable for startups because they don’t really have that knowledge as to how to do it. They just have an idea,” Banerjee explains.

Thinking Forks has partnered with an AI firm to leverage the data generated in-house to accelerate product development, generate recipes based on specific requirements such as protein content and ingredient preferences, and digitise the R&D process.

“In India, we are observing the trend towards cleaner label foods. This includes products with fewer artificial ingredients, colours, flavours, and preservatives. There is also a growing demand for preservative-free, ready-to-cook, and convenient food options,” she adds.

The next steps include prototyping products, conducting market research and analysis to guide product strategies, and ensuring new products and packaging meet market needs. Focus is placed on packaging materials, shelf life, and nutrition claims. It further offers launch support to ensure a successful market entry.

Future plans

Currently bootstrapped with an office in Singapore, the startup is looking to secure funding.

Thinking Forks has over 150 clients and has launched more than 200 products since its inception. Its portfolio includes notable D2C snacking brands such as Yoga Bars, , and 4700 BC. Additionally, it has also assisted larger companies like , , and with product quality standards and acceleration processes.

Some of its competitors include Food Buddies and independent consultants.

In the last two years, the company has experienced 2.5X growth in revenue and generates 50% of its turnover from international markets. Outside India, it operates in the UAE, the UK, the Netherlands, the US, the Philippines, and Thailand.

“We have been very focused on making sure that we are profitable. In some places, we have taken aggressive calls, where we have invested in state-of-the-art labs and consumer interaction centres. We are very bullish about the entire play and India has such a headroom from growth,” Rinka says.

“We’ve already set up an R&D centre in Bengaluru, formed a strategic advisory board composed of global experts, and productising some of our services,” she adds.

Looking ahead, the company intends to expand its reach into the Middle East, North America, the UK, and Europe. It also plans on boosting its digital and technology capabilities, with a strong focus on AI and sustainability to drive growth.

The firm currently operates a single specialised research facility i.e. satellite lab, in Bengaluru and plans to expand by establishing additional labs in various locations across the country.