Pay Later solution platform on Tuesday said it has raised fresh capital from existing investors—Quona Capital, Omidyar Network India, Flourish Ventures, Zip, and Scarlet Capital—to support its business and continue operations.

The undisclosed fundraise comes two months after the beleaguered fintech firm had received a new lease of life from existing backers, along with a leadership overhaul, post its buyout deal fallout with PhonePe over due diligence concerns.

With a new management team and fresh funds, ZestMoney will look to drive its business towards profitability, it said in a statement.

“While Zest has experienced some challenges following the stalled PhonePe deal, the management team has rolled up its sleeves and worked hard to right-size the business to take advantage of the huge market opportunity presented by its significant merchant and customer client base,” said Ganesh Rengaswamy, Managing Partner at Quona.

Post the deal fallout with the Walmart-backed payment firm in March, ZestMoney had been struggling with cash runway as it looked to sell off its NBFC license and find new takers for its business.

On May 15, co-founders—Lizzie Chapman, Priya Sharma, and Ashish Anantharaman—announced their resignations to 175 employees, while the investors stepped in to take charge.

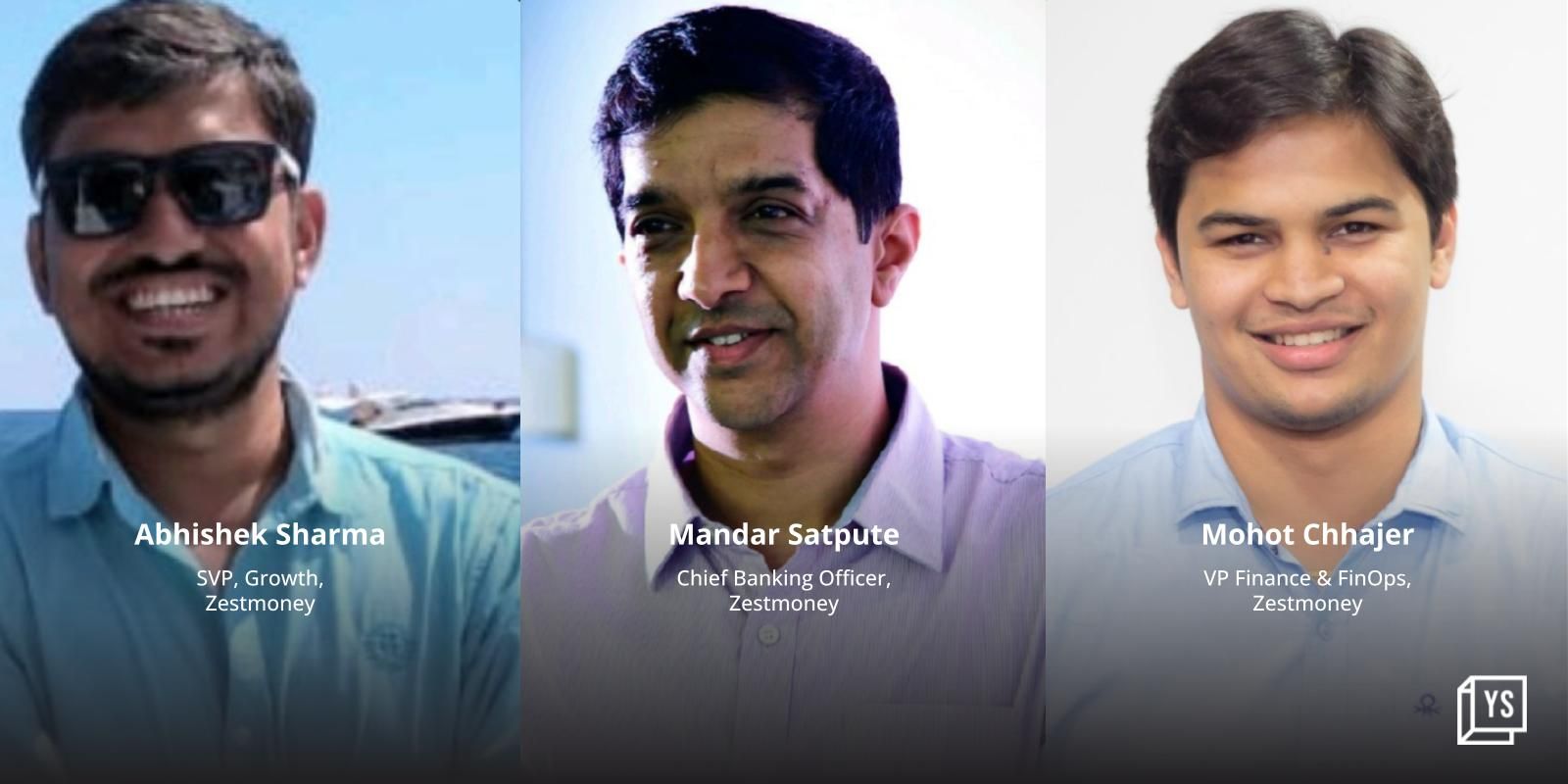

While the trio continued to hold a significant shareholding in the company, a new leadership team, including Abhishek Sharma (Head of Growth), Mandar Satpute (Chief Banking Officer), and Mohit Chhajer (Vice President of Finance and Financial Operations (FinOps), was set in place, followed by capital infusion from investors.

“When talks stalled with PhonePe over a potential acquisition, the company’s new leadership adapted and reset the business. Today, with a streamlined platform and a laser focus on profitable growth, it’s an even stronger investment case for us as investors,” said Peter Gray, COO of Zip.

Founded in 2015, ZestMoney offers provides pay-later options to customers at online and offline merchant outlets. It claims to have over 17 million consumers registered on the platform, 10,000 online partners, and 85,000 retail touchpoints across the country. Its EMI network is integrated with platforms like Amazon, Flipkart, Myntra, MakeMyTrip, Nykaa, Samsung, Apple, Vivo, Croma, and Reliance Digital.

ZestMoney’s growth plans now include doubling down on becoming a leading checkout financing platform. The company said it is working closely with the top lenders, including one of the largest banks in the country.

“This capital—combined with the unwavering commitment of our more than 150-strong team—enables us to successfully serve our consumers, merchants, and lender partners, while continuing to keep non-payment rates at under 2.5% in the largest and fastest-growing EMI market globally,” said newly-appointed CEO, Abhishek Sharma.

Edited by Suman Singh