Buy-now-pay-later startup will shut down its operations and let go of its remaining 150 employees, according to a report by MoneyControl.

Addressing the employees at townhall on a December 5, the fintech company announced its decision to wind down operations. A skeletal legal and finance team will oversee the shutdown process.

The startup has promised employees two months of severance pay and outplacement support.

The crisis at Zest Money started after the Reserve Bank of India barred non-banks from loading credit lines into prepaid payment instruments, typically e-wallets.

The lender started crumbling after PhonePe called off the potential acquisition of ZestMoney for a sum ranging between $200 million and $300 million. PhonePe decided to abandon the deal, citing concerns related to due diligence.

Lizzie Chapman, Priya Sharma, and Ashish Anantharaman, the co-founders of ZestMoney, officially resigned from the company a couple of months later.

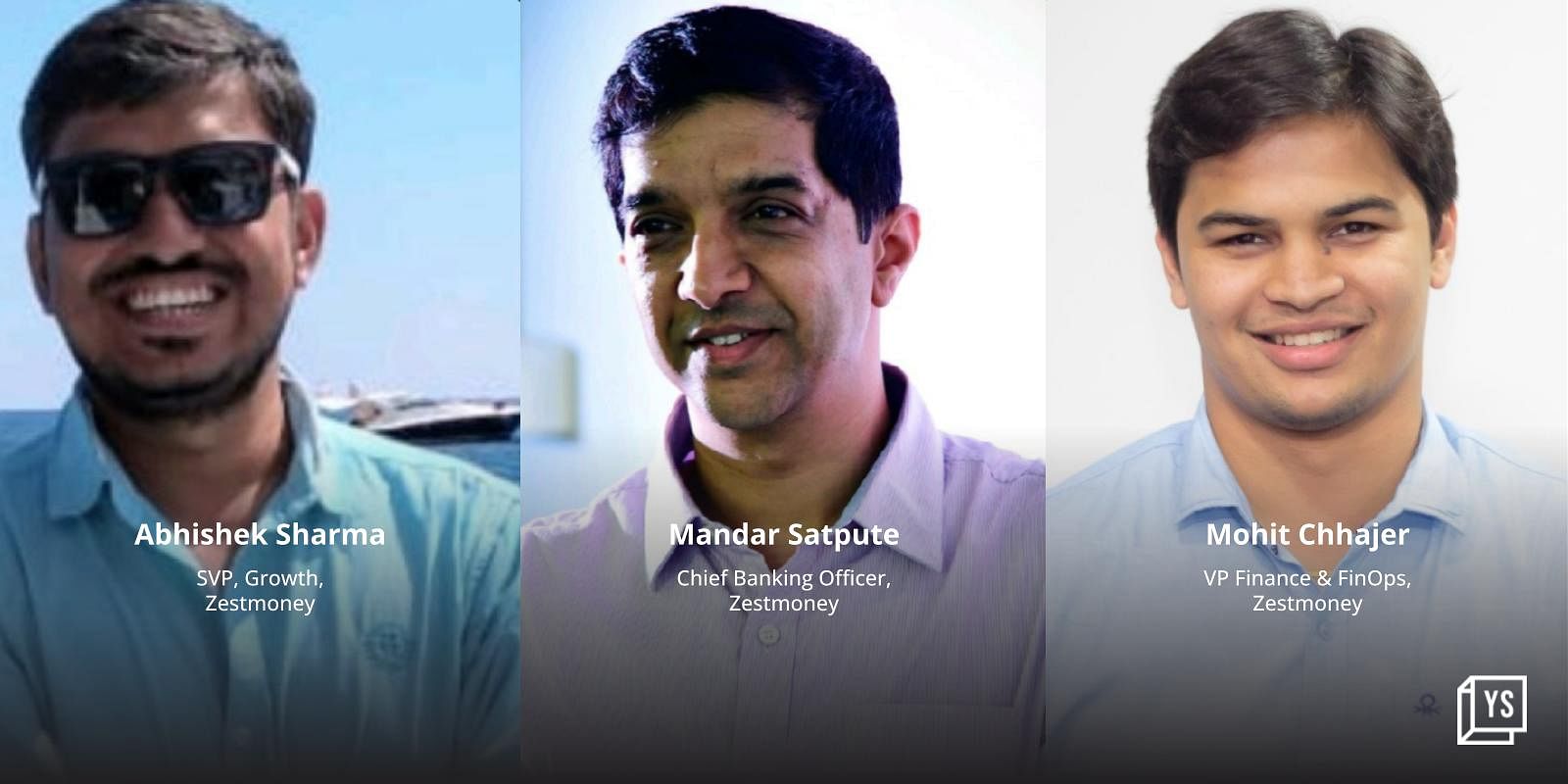

Abhishek Sharma, former Head of Growth; Mandar Satpute, former Chief Banking Officer; and Mohit Chhajer, former Vice President of Finance and Financial Operations—all appointed from within—assumed leadership roles at ZestMoney in May this year.

PhonePe later acquired some of ZestMoney’s tech and intellectual property and independently recruited approximately 130 employees. In fact, PhonePe had given a loan of about $18 million to the firm last year.

Earlier, in August, ZestMoney raised fresh capital from existing investors—Quona Capital, Omidyar Network India, Flourish Ventures, Zip, and Scarlet Capital—to support its business and continue operations.

“While Zest has experienced some challenges following the stalled PhonePe deal, the management team has rolled up its sleeves and worked hard to right-size the business to take advantage of the huge market opportunity presented by its significant merchant and customer client base,” said Ganesh Rengaswamy, Managing Partner at Quona.

Edited by Megha Reddy

![Read more about the article [Funding alert] Esports platform IGL raises $500K from Hungama and Hindustan Talkies](https://blog.digitalsevaa.com/wp-content/uploads/2021/03/Imagerr6t-1614680207113-300x150.jpg)