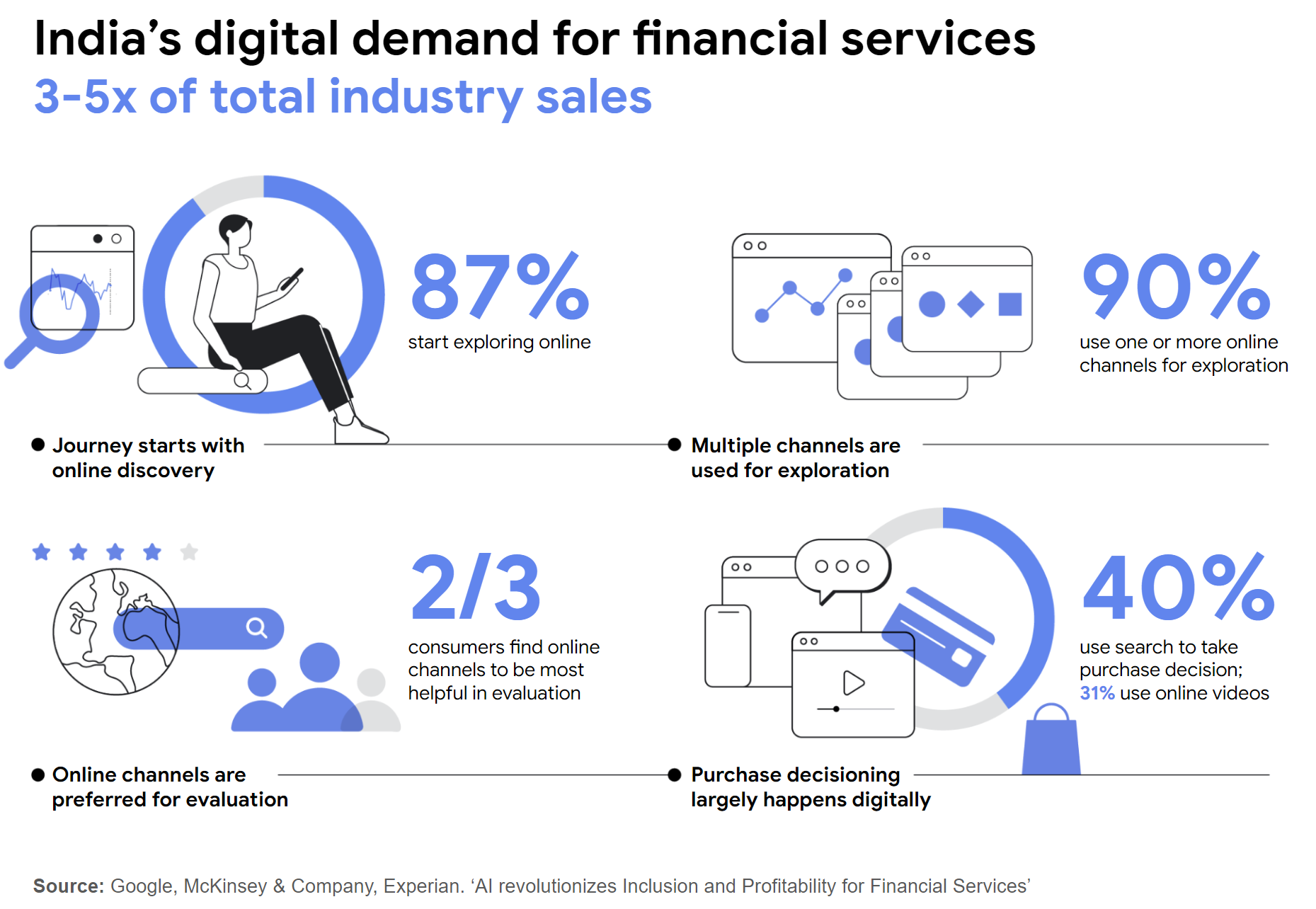

About 87% of financial services consumers start their journey online, with two-thirds finding online channels more helpful for purchase decisions. About 40% of consumers use search and 31% use online videos to help them with decision-making, a report by Google and McKinsey & Company revealed.

The and report titled ‘AI revolutionizes inclusion and profitability for financial services’, suggested that integrating AI with digital solutions will enable India’s BFSI sector to provide its full range of products to over 700 million internet users, based on customer preference for digital exploration.

According to Google India’s Director of Omnichannel Businesses, Bhaskar Ramesh, India’s digital adoption and UPI success presents a significant opportunity for the BFSI sector to serve the needs of millions of internet users.

<figure class="image embed" contenteditable="false" data-id="525945" data-url="https://images.yourstory.com/cs/2/6c7d986093a511ec98ee9fbd8fa414a8/Digitaldemandforfinancialservices-1694606038422.png" data-alt="digital demand" data-caption="

Digital demand for financial services

” align=”center”> Digital demand for financial services

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

“The report highlights the potential for providers to offer digital-led financial inclusion to around 300 million people. As early adopters of foundational tech, the BFSI industry can integrate AI to create personalised, privacy-preserving, secure, and profitable omnichannel customer journeys,” he added.

Combining analysis of Google search trends with data and insights, the report revealed that online demand will outstrip total purchases across all product categories three to 3-5X in 2022.

.thumbnailWrapper

width:6.62rem !important;

.alsoReadTitleImage

min-width: 81px !important;

min-height: 81px !important;

.alsoReadMainTitleText

font-size: 14px !important;

line-height: 20px !important;

.alsoReadHeadText

font-size: 24px !important;

line-height: 20px !important;

Online demand for credit cards, home loans, and car loans has seen significant growth, driven by innovative features and prices, the report added. Existing digital products like life insurance and savings accounts saw lower demand, with brand-specific interest being the primary focus.

The report also highlighted the untapped digital demand across 18 categories of financial services, including loans, insurance, savings and investing such as equities and mutual funds.

It suggested AI integration can provide more inclusive, customised experiences to 300 million active internet users who are not yet using BFSI products like retail loans, health insurance, life insurance, fixed deposits, and UPI.

Edited by Kanishk Singh

![Read more about the article [Matrix Moments] Why Captain Fresh is looking closely at the online B2B seafood market](https://blog.digitalsevaa.com/wp-content/uploads/2021/12/matrixmoments-audioboom-episode82-b-1639228699308-300x157.jpg)