Head Utsav Somani — who is responsible for bringing the Naval Ravikant and Babak Nivi-co-founded startup-investment platform to India — is launching iSeed II, a $15 million micro-fund to support over 50 Indian tech startup founders and help them access venerable names from Silicon Valley, many of whom are backing the fund.

The launch of iSeed II — which comes less than a year after the launch of iSeed I in May 2020 — is buoyed by Utsav’s conviction that the next decade truly belongs to Indian tech entrepreneurs and that any company that leverages technology will stay ahead of the crowd.

“The next decade belongs to Indian tech startup founders. I think the ecosystem is robust. There is quality talent. There is liquidity that is coming in now across IPOs and late-stage startups. Overall, the ecosystem has now come of age where we are finally on the map and people are taking India more seriously,” says Utsav, who considers himself a ‘realistic optimist.’

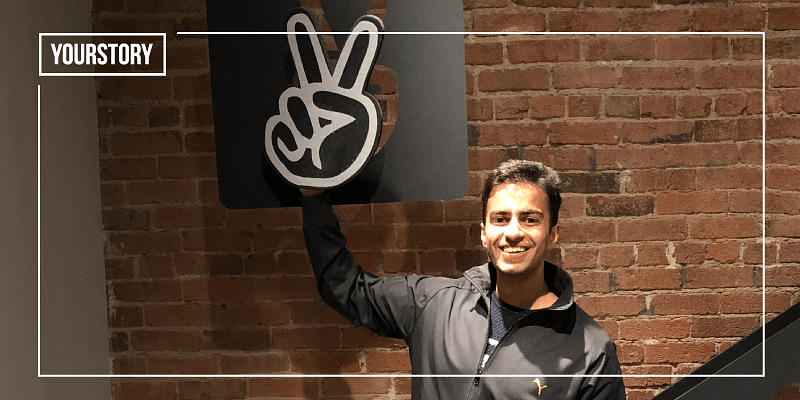

AngelList India head Utsav Somani with AngelList Co-founder Naval Ravikant and Product Hunt Founder Ryan Hoover

Indeed, the optimism in the Indian startup ecosystem has been palpable this year, particularly earlier this month when India added a record six new unicorns in just one week, taking the overall number in 2021 to 10. That’s just shy of the total number of 11 unicorns added in the whole of 2020 and takes the total unicorn count for the ecosystem to around 50.

In addition, the new year has also heralded several other milestones for the startup ecosystem, including Nazara Technologies’ strong stock market debut even as more revered names from across different sectors are expected to go public this year amidst a slew of soonicorns that are set to join the coveted $1 billion-valuation club.

“I think the next decade truly holds amazing promise for the Indian startup ecosystem. And I am not saying it because I am launching a new fund. I am saying it because I really believe it, and I’m putting my money where my mouth is,” emphasises Utsav, whose $15 million iSeed II micro-fund will make investments in tech-based startups across sectors over a period of two years.

Indeed, funding activity in the first quarter of 2021 has also been robust, with Indian startups raising $3.76 billion across 257 deals, of which at least 10 were valued at more than $100 million, data analysed by YourStory Research showed. That’s up from Q1 2020, when startups raised $3.5 billion across 257 deals, with just eight deals valued at over $100 million.

With India positioned to be a hotbed for innovative tech-based products and solutions, Utsav’s thesis for iSeed has been simple: leverage the fund to connect Silicon Valley entrepreneurs and investors with promising, young Indian founders so they receive global advice and network to scale, while also providing its limited partners with an understanding of and exposure to the Indian market through a top-tier portfolio.

iSeed = smart, connected, knowledge capital

With iSeed II, Utsav’s mission is no different than that of iSeed I: support startup founders with “smart, connected, knowledge capital” and provide early-stage entrepreneurs rare access to the fund’s limited partners, who include prominent Indian and Silicon Valley-based investors, entrepreneurs, and venture capital fund managers such as:

- AngelList Co-founder Naval Ravikant

- early Stripe employee and angel investor Lachy Groom

- Thumbtack Co-founder Jonathan Swanson

- Teachable Co-founder Ankur Nagpal

- Rippling Co-founder Prasanna Sankar

- Betfair Co-founder Josh Hannah

- TaskUs Co-founder Bryce Maddock

- wikiHow Founder Jack Herrick

- B12 Co-founder Nitesh Banta

- Freshworks Co-founder Kiran Darisi

- HotelTonight Co-founder Sam Shank and

- Left Lane Capital Partner Vinny Pujji, among others

The other marquee names include partners of Matrix Partners China, US, and India as well as institutions like RTP Global, FJ Labs, Tribe Capital, Hummingbird, and Kamco Jedi Fund, and co-founders or executives of top companies like Xiaomi, Uber, Facebook, Google, MoonPig, FuboTV, Auttomatic, SongKick, 99Designs, Suki, Protonn, Index Ventures, and Evolve Ventures, among several others.

“Through iSeed, India’s largest solo GP-micro fund, I want to bring the era of solo-capitalists and emerging fund managers or micro-VCs to India to better serve our Indian startup founders. The goal is to have the weight and heft of an institution like seed-stage VC firm First Round Capital at the earliest stages for Indian founders with the size of an angel cheque,” explains Utsav.

Admittedly, that’s exactly what iSeed does.

The fund offers founders the trust and confidence of its LPs in the form of capital as well as their commitment in the form of time dedicated for knowledge-sharing sessions with the startups.

“iSeed was designed to be the most helpful cheque on an Indian startup’s cap-table at the earliest stages. Apart from regular interactions between the limited partners of the fund and founders, we also set up the Knowledge Council to bring world-class operators to come speak with the portfolio in a private setting,” Utsav tells YourStory.

The Knowledge Council includes Sriram Krishnan, General Partner at A16Z, Akshay Kothari, COO of Notion, Sahil Lavingia, Founder of Gumroad, and Anne Dwane, Co-founder of Village Global.

(Graphics: Aditya Ranade)

Innovation in the face of crisis

Through iSeed I, Utsav has, over a period of nine months, invested in over 35 founding teams, some of them with top-tier funds like Founders Fund, Sequoia Capital India, and Lightspeed India Partners. These investments have been in startups across various sectors, including healthcare, fintech, logistics, SaaS, ecommerce, hardware, and real estate.

They include SMB-focused startups FloBiz, GoKwik, and PagarBook, fintech startup Velocity, insure-tech startup BimaPe, social platform qoohoo, content marketplace Pepper, collaborative customer onboarding startup RocketLane, and tech platform Zoko, among several others.

(Graphics: Aditya Ranade)

On the kind of investments iSeed I has made in the middle of the pandemic, Utsav — who generally prefers to avoid making predictions and forecasts about the future — recalls something he wrote at the time of launching the micro-fund: “Crisis doesn’t limit innovation. If anything, the opposite is true.”

True to word, the market has validated this statement in the past year by demonstrating that technology is a force for good and that the tech industry can help stem the devastating effects of a crisis, including job losses, says Utsav.

He notes that some of the best companies are born in the most adverse of times and takes the example of AirBnB, which was launched during the global financial crisis of 2008 but has today metamorphosed into a global home-sharing giant.

Closer home too, the past eight to nine months have shown that innovation cannot be restricted by human ingenuity, nor by something as widespread as a pandemic, adds Utsav, who, ever since the launch of iSeed, is known to many as AngelList India CEO by day and Founder and GP of iSeed by night/weekend.

Clearly, Utsav was inspired by the likes of Product Hunt Founder Ryan Hoover who launched the Weekend Fund in 2017 because “he likes to tinker around on the weekends,” or rather use this time to invest in early-stage startups around the world.

Utsav was also inspired by Naval Ravikant, someone who he looks up to and considers a privilege to be working with at AngelList. Naval’s belief that we have to identify the ones from the countless millions who are going to change the world and truly invest in them resonated deeply with Utsav, as did his philosophy about ‘work.’

“Naval says that if you think of work as play, you are never going to work another day in your life. So I don’t think of my job of running iSeed or AngelList India as a job or work. I truly love what Naval and AngelList and the team have done so far and we want to bring that kind of outsized impact to India as well. So, for me, iSeed is really just an extension of that,” Utsav says.

Entrepreneur and investor Naval Ravikant

For the love of angel investing

As an angel investor, who started “down the rabbit hole of angel investing” by joining various angel networks in India back in 2014, Utsav says his frequent interactions with startup founders had him convinced he needs to do more to support them.

“I was interacting with so many founders and I could not stop asking myself: how do I support them more; how do I level up with my personal investing; and how can I help Indian founders be more connected and closer to the Silicon Valley ecosystem. iSeed is doing just that,” says the angel investor, whose background in coding and finance fuelled his initial attraction to the world of tech startups.

Utsav’s own portfolio of angel investments include edtech startup Testbook, Bharat-focused social commerce platform Mall91, neo-banking startup Jupiter, D2C cosmetics brand SUGAR Cosmetics, fintech startup BharatPe, electric micro-mobility startup Oye Rickshaw, India’s crypto exchange CoinDCX, and D2C coffee brand Sleepy Owl, among others.

Angel investments in the Indian startup ecosystem have seen a surge in the recent past, with investments by super angels and angel networks rising 24 percent to hit a new record of 341 in 2020, a recent report by Indian Private Equity and Venture Capital Association (IVCA) showed.

With startups typically considered a risky investment, India’s crop of angel investors have so far been dominated by seasoned entrepreneurs, investors, and tech executives. However, recent trends show that’s slowly changing, with the ecosystem witnessing new entrants as angel investors such as executives from traditional, non-tech industries as well as high net-worth individuals and professionals at various levels.

“Angel investing in the Indian startup ecosystem is coming of age in some sense,” says Utsav. “There’s a lot of liquidity now as well and stories of angels having cashed out and seeing stellar returns on their investments are instilling confidence amongst a broader base of investors, not limited to just founders or professional investors.”

(From L-R) BharatPe Co-founders Shashvat Nakrani and Ashneer Grover

BharatPe, in which Utsav continues to be invested as an angel, is a case in point.

Earlier this year in February, BharatPe announced that 18 of its 27 angel investors have exited their investment in the company after its Series D funding round. They recorded returns of as much as 80X on their investments over a period of two years.

“Stories like these instil confidence in potential angel investors that there are guaranteed returns to be made in the ecosystem while also supporting the next wave of wealth creation. It is a trend which is going to continue because people have realised that startups are definitely a source of wealth creation,” says Utsav, who is also advising early stage VC firm Village Global, which is backed by some of the world’s most successful entrepreneurs.

As Network Leader for Village Global, Utsav has co-invested with them in more than seven investments in South-east Asia and India.

At AngelList India, Utsav also raised an institutional fund, The Collective, from top-tier funds such as Accel Partners India, DST Global, and Matrix Partners, as well as individuals and seasoned entrepreneurs like Flipkart Co-founder Binny Bansal.

Redefining angel investing in India

Indeed, supporting thousands of investors of all types — CxOs, employees, founders investing in other founders, alums of IITs and IIMs investing as club together — is AngelList India, a platform that Utsav helped launch in India in 2018 and which has since been used by Indian investors to access and invest in top startups by either joining a syndicate, or leading one, or raising an angel fund themselves.

In India, AngelList pioneered Syndicates, a private single-deal investment vehicle that allows investors in India to invest in startup allocations shared by syndicate leads, enabling more angels to participate by getting access to top deals. It also pioneered Angel Funds, which allows experienced angels or a group of investors to raise capital upfront to invest across multiple startups and use AngelList India’s infrastructure to run their investment back office.

“To be honest it was an entirely new model for the country. Angel investors in India were typically used to investing directly into companies. They were not used to joining a syndicate or having to pay a carry. It was a new concept — this emphasis on merit-based fundraising and monetising deal access,” Utsav says.

But AngelList India is solving for many things, he adds.

“Founders receive a single cheque on the capital and so a clean cap-table. We are also solving for angels by removing the challenges they otherwise face with regulations and compliance. So, we are really trying to take away all of that headache to just allow people to focus on what they do best: sourcing and finding best allocations and deals in rounds that they invest in,” Utsav says.

In effect, AngelList India — which has become one of the fastest-growing, most active seed investors in the country — is on a mission to achieve in India, what it was able to do in the US: democratise the infrastructure to create the AWS of angel investing.

“AngelList has become that infrastructure platform for angel investing. And that’s a beautiful position to empower new syndicate leads to do their best work and support more future-looking founders and future-creating entrepreneurs. And that’s the beauty of angel investors,” says Utsav, who famously wrote a cold email to Naval after hearing him talk about his personal journey as an angel investor and everything else, from his philosophy to his life and his work.

“I truly believe AngelList is here to change the game. I told Naval at the time that I want to bring it to India and this is what we did. And I’m super excited about where we have come. We have done over 250 investments. We are doing one investment every two days now in India. Sometimes even more. We did over 100 investments last year, mostly with top-tier names where people used our infrastructure in different ways,” adds Utsav.

Still, in between managing all of the many hats he dons at work, Utsav tries to find time to unwind with his family, be it movie nights with his wife or quiet family dinners and lunches. Then, there are also the attempts at cooking and at staying healthy by working out or going for long runs.

And yet, if there’s one thing Utsav clearly enjoys without doubt: it’s his ‘job’ as an angel investor or what he refers to as ‘the privilege’ to partner with exciting entrepreneurs and experience their real entrepreneurial journeys early on.

He sums it up aptly when he says,

“Investing is a form of pseudo entrepreneurship. Most investors give a lot of credit to themselves. I think I have taken up too much credit too. But I believe it is truly the founders who do the best work, and being a part of even one percent of their journey is very exciting. It’s a chance to learn new things daily. To come up with new ideas. And mainly, a way to stay young forever.”