CarTrade is making a pure offer for sale (OFS) for 1,23,54,811 equity shares and is said to be looking to raise INR 2K Cr through its IPO

Among the shareholders offloading stake in the IPO are CarTrade investors Warburg Pincus (Highdell Investment), Temasek (MacRitchie Investments), JP Morgan (CMDB II) and March Capital

For the nine months ended December 31, 2020 and financial years 2020, 2019 and 2018, CarTrade has seen profit before tax margin and EBITDA consistently improve

Automobile marketplace CarTrade has filed its draft red herring prospectus (DRHP) with Indian markets regulator Securities and Exchange Board of India in preparation for its upcoming initial public offering (IPO).

The company is going for the IPO under the name CarTrade Tech, which includes its subsidiaries Shriram Automall India Limited, Adroit Inspection Services Pvt Ltd, CarTrade Exchange Solutions India Pvt Ltd, CarTrade Finance Pvt Ltd and Augeo Asset Management Pvt Ltd.

CarTrade was founded in 2009 by Vinay Sanghi and as of last year, it claimed to be selling 1 Mn vehicles a year. More than 40 OEMs and 15,000 plus dealers work with the CarTrade Group and it has over 180 owned or franchisee stores. The company last raised INR 321 Cr in a Series H round, as reported exclusively by Inc42 last June, from HighDell, MacRitchie Investments and others.

Here’s everything you need to know about CarTrade’s upcoming IPO through its draft red herring prospectus:

Offer For Sale With INR 2K Cr Target

With the public offering, CarTrade is making a pure offer for sale (OFS) for 1,23,54,811 equity shares of the company. CarTrade is said to be looking to raise INR 2K Cr through its IPO. The offer constitutes nearly 27% of the company’s post-offer paid-up equity share capital.

The offer for sale indicates that CarTrade is not looking to capitalise but give returns to its investors. A bulk of the shares are reserved for institutional investors, with just 10% of the offering being reserved for the retail portion.

Axis Capital, Kotak Among Bank Partners

With the public offering, CarTrade is making a pure offer for sale (OFS) for 1,23,54,811 equity shares of the company, as per Axis Capital, which released the DRHP on its website. Axis Capital is the lead book running manager, while Kotak Mahindra Capital Co, Citigroup Capital Markets and Nomura have also been signed up as investment banks for the IPO.

CarTrade is said to be looking to raise INR 2K Cr through its IPO. Axis Capital has provided details of the price band for the sale of equity shares, which have a Rs 10 face value.

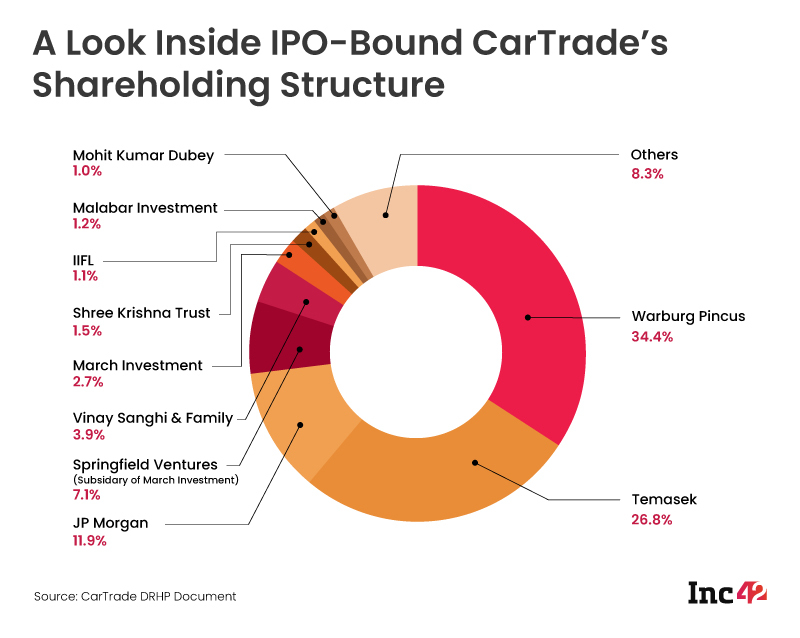

The Shareholding Pattern Before The IPO

Among the shareholders offloading stake in the IPO are CarTrade investors Warburg Pincus (Highdell Investment, Temasek (MacRitchie Investments), JP Morgan (CMDB II) and March Capital (Springfield Venture International). JP Morgan will sell 16,08,324 equity shares, Highdell Investment and MacRitchie will offload 35,68,217 shares, while Springfield Venture International will sell 11,24,700 shares. Among the promoters, Bina Vinod Sanghi will sell 1,83,333 shares.

These are currently the top five shareholders for CarTrade. Only Warburg Pincus and Temasek hold more than 25% stake in the company, but their shareholding will be reduced to below 25% mark after the IPO. Nineteen of the total 26 shareholders of the company account for 95.63% of CarTrade’s shareholding. The remaining 7 investors account for 4.37% stake in the cap table.

Warburg Pincus is the largest stakeholder in CarTrade, with a shareholding of 34.44%, followed by Temasek’s 26.48% shareholding. JP Morgan holds about 11.93%, whereas March Capital owns about 9.79 shares through Springfield Venture (7.09%) and MCP3 SPV LLC (2.7%). Founder Sanghi and family has a shareholding of 3.56% in CarTrade.

CarTrade Looks To Build On Profit Growth

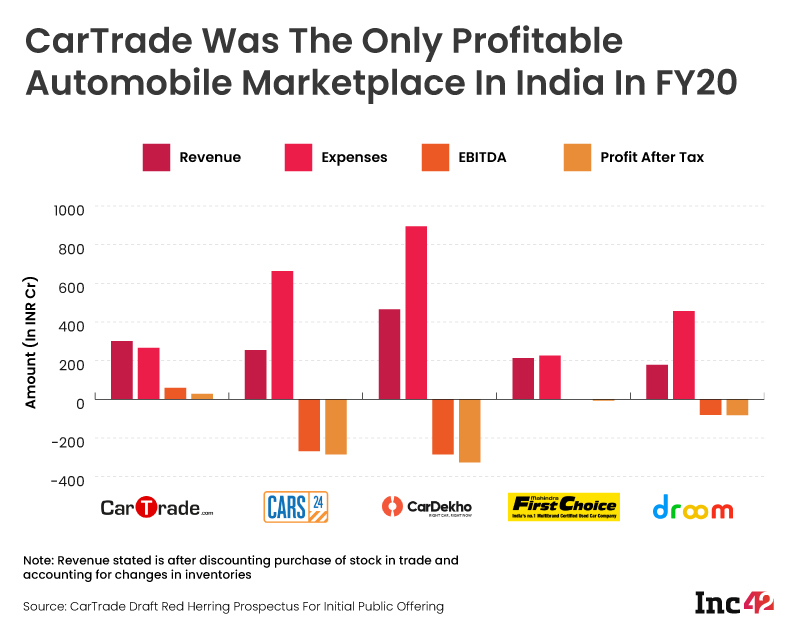

On a consolidated level, CarTrade reported revenue of over INR 318 Cr, which resulted in a net profit of INR 31.2 Cr. Further till December 2020, the company has reported income of INR 189.6 Cr for FY21 (9 months) with a net profit of INR 85 Cr. The company first reported a profit two years ago and remains the only profitable automobile marketplace in India.

Among the key competitors, CarTrade has compared its financial performance to unicorns Cars24 and CarDekho (owned and operated by Girnar Software Pvt Ltd), as well as Mahindra First Choice and Sandeep Aggarwal-founded Droom. Mahindra First Choice is the only other competitor to have a positive EBITDA, but only just barely at INR 50 Lakh.

EBITDA Improvements

One of the major improvements from the financials point of view has been in the EBITDA margins and profitability of the company in FY21. “This operating leverage has helped drive growth in our Adjusted EBITDA margins as our revenues have scaled.”

For the nine months ended December 31, 2020 and financial years 2020, 2019 and 2018, CarTrade has seen profit before tax margin and EBITDA consistently improve — In FY21, till December 31, 2020, the company had a profit before tax (PBT) margin of 14.52%, compared to 12.22% in FY20, 13.28% in 2019 and a negative margin of 1.97% in 2018. Similarly, its adjusted EBITDA margin has improved to 26.46% in FY21 (9 months), from 22.71%, 24.42% and 6.00%, respectively in the previous three full fiscals.

Over 30 Mn Monthly Unique Visitors In Jan-March 2021

CarTrade is a multichannel auto platform with coverage and presence across vehicle types and value-added services through brands such as CarWale, CarTrade, Shriram Automall, BikeWale, CarTrade Exchange, Adroit Auto and AutoBiz. “In the three months ended March 31, 2021, our platforms had an average of 31.99 Mn unique visitors per month and 814,316 vehicles were listed for auction in FY 2021,” the CarTrade IPO prospectus stated.

Overall, between March 2020 and 2021, the company claims to have recorded an average of 25.66 Mn unique visitors per month across its consumer platforms CarWale, CarTrade and BikeWale, while its Shriram Automall auto auction site witnessed 814,316 auction listings.

Focus On Organic Acquisition

In FY21, in a post-pandemic market, the primary area for cost-cutting for CarTrade was advertisement, marketing and sales promotion expenses. Such spending amounted to INR 7.7 Cr from March 2020 to December 2020, which came up to 4.11% of the total income in the nine months in the fiscal year 2021. In comparison, in FY2020, CarTrade spent INR 24 Cr or 7.56% of the total income in the fiscal.

“Our advertisement, marketing and sales promotion expenses per unique visitor on CarWale, CarTrade and BikeWale has decreased to ₹2.33 in the nine months ended December 31, 2020, compared to ₹10.88 and ₹8.91 in the financial years 2020 and 2019, respectively. Going forward, we plan to further optimize our customer acquisition costs through investments in technology and product and content which will improve customer experience and thus our traffic.”

This was facilitated by a renewed focus on organic acquisition by targeting search rankings and through content marketing through Carwale and Bikewale, both of which CarTrade claimed outperformed rivals on Google. As a result, 88.44% of the unique visitors to CarTrade-owned sites in the financial year 2021 were organic visitors, the company said.

![Read more about the article [Funding alert] Cultural startup Indic Inspirations raises angel funding of Rs 2.5 Cr from marquee investors](https://blog.digitalsevaa.com/wp-content/uploads/2021/03/Eajz3g3UMAAI0aX-1608619243276-300x150.jpg)