Temasek and Falcon Edge Capital have led a $220 million investment in Indian omni-channel eyewear retailer Lenskart, valuing the Bangalore-based startup at $2.5 billion.

The new investment, which includes primary and secondary transactions, is part of a new round Lenskart unveiled a month ago when it raised $95 million from global investment fund KKR. Bay Capital and Chiratae also participated in the new round.

Peyush Bansal, founder and chief executive of Lenskart, said the profitable startup — which sells eyeglasses and contact lenses online and through about 750 physical retail outlets across the country — has seen a surge in sales of eyewear products in the pandemic year.

The startup, which counts SoftBank among its investors, sold about 8 million pairs of eyewear last year.

Now the firm, which claims to lead the market in India, plans to scale its operations in Southeast Asia and Middle East. The combined market opportunity for eyewear in these regions will be about $15 billion by 2025, the startup said, citing its own projections.

“We’re already the largest eyewear player in India and in the top 3 in Singapore. Lenskart envisions to have 50% of India wearing its specs over the next 5 years and become the #1 eyewear platform in Southeast Asia and Middle East over the next 18 to 24 months through organic and inorganic expansion,” he said.

According to industry estimates, more than half a billion people in India are affected by poor vision and need eyeglasses, but only 170 million of them have opted to get their vision corrected.

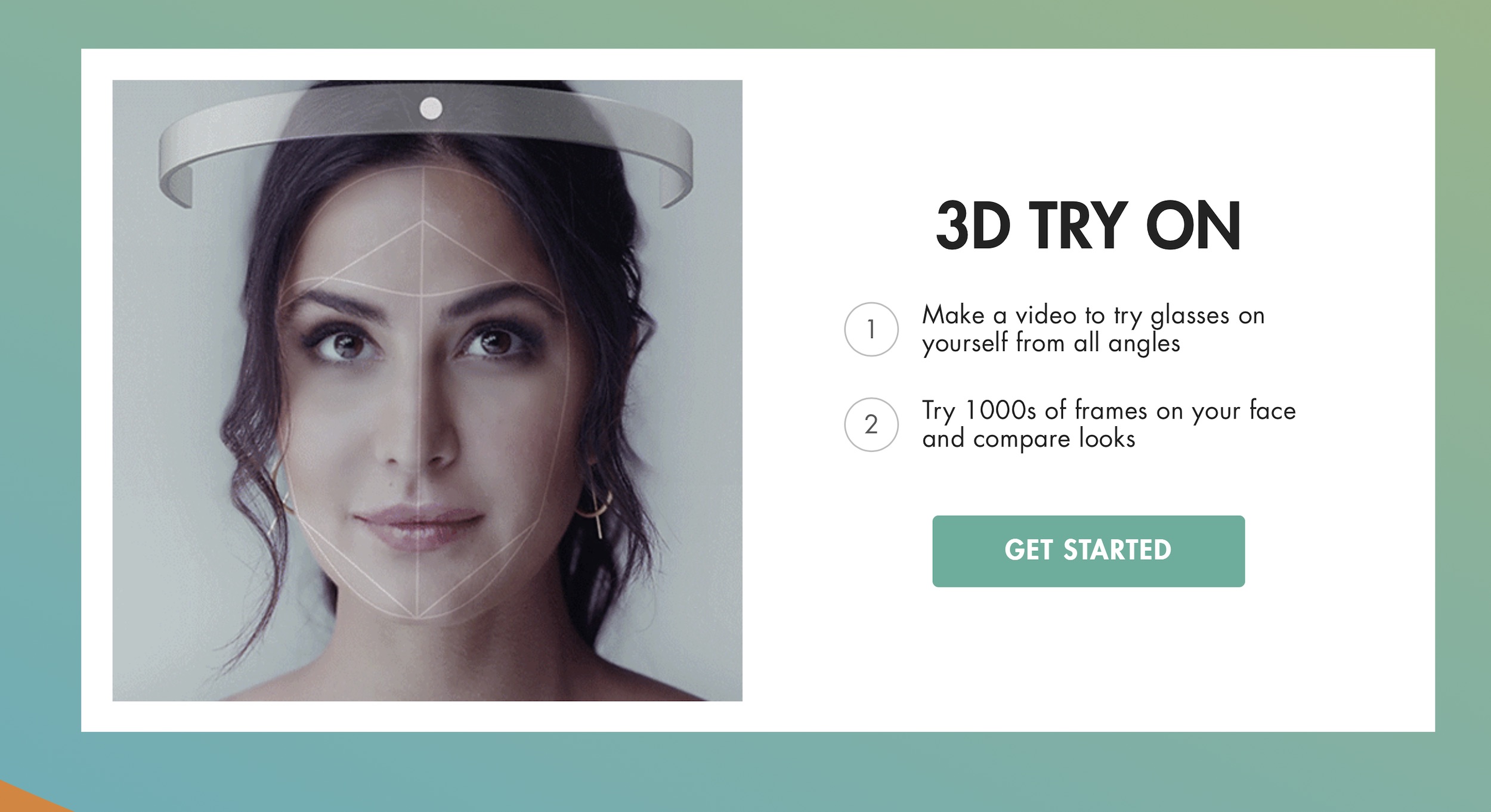

The firm also plans to deploy some capital to broaden its technology stack to create a more personalized experience for its customers. The startup, which recently launched ‘Lenskart Vision Fund,’ said it is also looking to invest in other younger firms that are operating in eyewear, eyecare and omnichannel retail spaces.

“We are thrilled to join Peyush and his team in this journey and look forward to working closely with Lenskart’s team in helping them scale their business internationally, especially in the MENA region” said Navroz Udwadia, co-founder and partner at Falcon Edge Capital, in a statement.

The new investment comes at a time when Indian startups are raising capital at a record pace and a handful of mature firms are beginning to explore the public markets. Zomato raised $1.3 billion last week in the country’s first consumer tech IPO in a decade.

Paytm, the pioneer digital payments startup, as well as its rival Mobikwik also filed for IPOs last week.