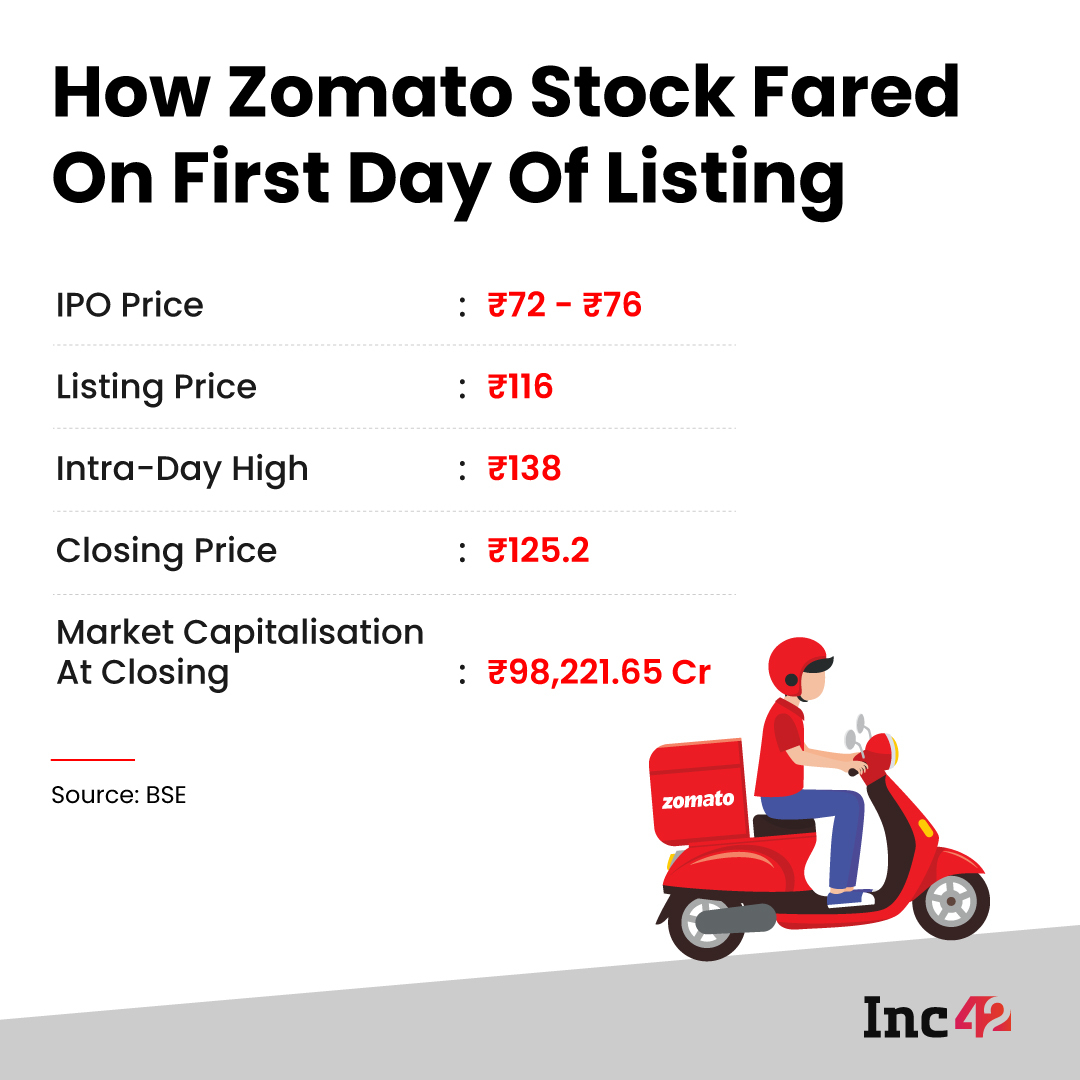

Zomato’s stock ended its first day of trading at INR 125.20 — after it listed at INR 116 which was at a premium of 53% to the IPO price of INR 76

The stock touched a high of INR 138 briefly and powered the company’s market capitalisation to over INR 1 Lakh Cr

Zomato founder and CEO tweeted soon after saying: “A lot of people are calling this a ‘historical moment’

Zomato’s stock ended its first day of trading at INR 125.20 — after it listed at INR 116 which was at a premium of 53% to the IPO price of INR 76.

The foodtech startup’s shares started trading on the bourses on Friday (July 23) at around INR 120, a nearly 53% premium over the issue price of INR 76 per share. While the food delivery major’s stock has hovered around the INR 125 mark till a few hours after the listing, it touched a high of INR 138 briefly and powered the company’s market capitalisation to over INR 1 Lakh Cr.

“The analysis and gyaan can wait. Today is a day to savour what is an amazing moment for India and Indian business. Really happy for Zomato and their super successful IPO. These pioneers are blazing the trail for a new chapter of Indian enterprise,” tweeted Rajeev Mantri of Navam Capital earlier in the day.

Zomato founder and CEO tweeted soon after saying: “A lot of people are calling this a ‘historical moment’. It is not. History is always made in hindsight. Never in the present. Back to work.” Meanwhile, stock market investors and stakeholders in the startup ecosystem bursted with enthusiasm on social media.

“Congratulations and very well done team Zomato and Deepinder. Great things take time to build. Thank you for making us look like smart investors,” tweeted Sanjeev Bikhchandani, founder of InfoEdge and one of the earliest VC backers of the food delivery firm.

However, Professor Aswath Damodaran, a finance professor at New York University who is popularly referred to as the ‘Wall Street’s dean of valuation’ sounded a word of caution with a blog post published in lead up to the Zomato listing.

According to Damodaran’s calculation, even assuming that Zomato will be the market leader in India’s food delivery sector with 40% market share, the company’s stock price should not be worth more than INR 41.

“The assumption that will make or break Zomato as a company, since so much of the potential in the company is dependent on how the food delivery/restaurant market in India evolves over the next decade… Even allowing for robust growth in India and improved digital access, I find it hard to see the total market exceeding $40 Bn, with $25 Bn (at present) , in ten years, being a more likely outcome,” he added.

Other veteran watchers of the stock market have also been flummoxed by the high revenue-valuation asymmetry of Zomato. For instance, ace investor Rakesh Jhunjunwala said in an interaction with fellow market veteran, Raamdeo Agrawal, Chairman, Motilal Oswal AMC: “It is not my party, I do not go there. This party will get spooked at some stage,” he added. Talking about the recently concluded IPO of food-tech unicorn Zomato, the big bull said that he sees 20% upside but 60% downside potential for the company. “This is driven by discounting next 15 years,” he added.

Zomato’s initial public offering was oversubscribed by 38.96 times on the final day of bidding, data with stock exchanges showed on July 16.

![Read more about the article [Funding Galore] Over $309 Mn Raised By Indian Startups This Week](https://blog.digitalsevaa.com/wp-content/uploads/2022/04/Social_25-30-April-300x157.jpg)