Here’s a sentence you’ll never hear anyone say: “I can’t wait to see my broker today”. Insurance brokers remind us of the world around us and that our society seems to be fractured in so many different ways and no matter how hard we try – whether personally or in business, we can’t escape it.

Did you know that the recent protest action across the United States is estimated to have cost businesses around $2 BILLION in damages and insurance claims having insurance, to begin with, could help you cushion the blow of something like that happening to you, that only covers physical replacement or rebuilding costs, lost time, production, selling…that adds up fast and is often the real business killer.

Then, we have not even started talking about weather, fire or incidental damage to premises or machinery. All of these “potential” issues become something of a headache for business owners as well individuals with short and long-term insurance products, yet so few of us understand how the insurance industry works at all. That’s what we’re going to take a short look at with this post.

WHAT IS “UNDERWRITING?”

Underwriting is the process that your insurance company undertakes before deciding to offer you an insurance product. The process takes into account all of the relevant elements that pertain to your application for insurance and helps the insurer determine your potential “risk” should an insured event take place. Once they’ve assessed these elements against your particular profile, personal or otherwise they’ll decide the amount of insurance that you could be eligible for as well as what that coverage is going to cost you in monthly payments.

How insurance companies determine what they’ll pay for and under what circumstances is dictated by the “policy wording” of your insurance product and that’s why it is beyond critical that you’re absolutely au fait with what is contained in the finer details of your policy wording, as one word or line here and there can have massive repercussions later on.

It is also very important that you fully and honestly disclose all of your circumstances to your broker when applying for insurance as what may seem like the smallest or most insignificant of details to you, could have an impact on an insurer paying out a claim should they come to know about this later on. Full disclosure will also have an impact on what your premiums will be, and in fact, you could get reduced premiums in certain circumstances.

Take short term motor insurance, for example, in the UK you can find out how convictions can alter the price of motor insurance.

BEING PRUDENT ABOUT DIFFERENT INSURANCE PRODUCTS

Insurance extends beyond commercial, business or personal short-term insurance, the process of underwriting also covers your potential life insurance and retirement planning. Choosing the wrong product could cost you dearly and by the time you have figured that out – it could be too late.

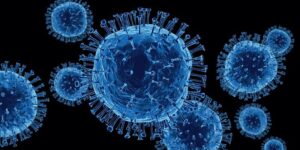

So when considering life insurance underwriting, it is likely that your potential insurer is going to want to know as much as possible about your lifestyle. How do you manage your stress, what your cholesterol count is, do you have hypertension or a genetic or hereditary chance of disease?

How much alcohol do you drink and are you overweight and unfit? As technology is changing it is becoming so much easier for life insurers to monitor our activity levels with gadgets like Apple Watches that link to workout programs and provide feedback to insurers, with healthier individuals receiving better benefits and reduced monthly premiums.

HOW LONG DOES UNDERWRITING TAKE?

This depends entirely on the product you applying for and in which capacity. Commercial and business underwriting is usually, and predictably more complex than say personal car and homeowners insurance. Each company uses an algorithm and standard that is unique to its profile and business model and therefore not every insurer is the right insurer for you.

Some companies also look at your claim history, and if you’re a “non-claimer” and can prove a certain number of claim-free years, you may well be entitled to reduced premiums and better benefits or even “cash back” incentives after a certain period.

But one thing that all insurers have in common is a fairly stringent process of underwriting, so again, the onus is on you to be open and transparent with your potential insurer as “lapsed” information disclosures cause delays and could cost you your business should a potentially insured event take place while you’re awaiting an underwriting decision.

The weather doesn’t wait for your broker – and neither should you.

HOW CAN YOU OBTAIN CHEAPER INSURANCE?

This also depends on the insurance you’re applying for. Commercial and business insurance premiums depend on a complex and highly investigative process for underwriters to reach decisions about premiums and coverage. But, thanks to advances in technology and information gathering, these days decisions are usually reached in a matter of days for commercial and business insurance and for personal short-term insurance – minutes, and online without the need to see or deal with a broker.

PERSONAL RESPONSIBILITY

OK, so no one is a fan of insurance companies – until we need them, and for the most part insurance companies are regulated and monitored by various government as well as non-government agencies and you can find the best (and worst) product providers online. This is where brokers are also useful, but take care to note that brokers get paid by insurers as well, so you need to ensure that yours is providing you with the best product for you, not just for how much money they’re making.

Now, when it comes to providing information to your potential insurer, you are ultimately going to be responsible for the integrity of that information, as well as the transparency of the information you hand over. Providing false or misleading information to get cheaper premiums or extended coverage could result in your claims not being paid out or worse – legal action.

So, if it ain’t true – don’t say it is.

![Read more about the article [Funding alert] Silvassa-based MYFITNESS raises around $1M in seed round led by 9Unicorns](https://blog.digitalsevaa.com/wp-content/uploads/2021/07/MYFITNESS-1627556897021-300x150.jpg)

![Read more about the article [Funding alert] Edtech platform Leap Finance raises $17 M in Series B round led by Jungle Ventures](https://blog.digitalsevaa.com/wp-content/uploads/2021/03/Imageor46-1615872653165-300x150.jpg)