Validus, a Singapore-based lending platform for small and medium-sized enterprises, is acquiring CitiBusiness’ loan portfolio for an undisclosed amount to bolster its top-line revenue and customer base and expand its growing loan book.

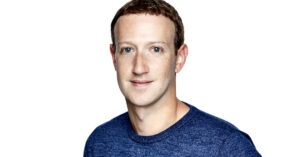

Nikhilesh Goel, co-founder and CEO of Validus, told TC that Validus expects to create synergies with the loan portfolio of CitiBusiness, Citi Singapore’s small banking unit. It is a portfolio of loans to hundreds of small businesses in Singapore, which is the target market Validus serves, Goel added.

“With this acquisition, we will not only be able to further digitally serve the financing need of these SMEs to grow but also offer them business accounts, spend management solutions, and payment services to manage their business,” Goel told TC.

Goel also said that the deal will be financed through a securitization facility Validus is arranging with a number of global financial institutions. The acquisition will be completed in April 2022.

This is Validus’ second acquisition, Goel noted. Last year, it acquired KlearCard, Singapore’s business payments and expense management platform.

In June 2021, Citi Singapore was reported to be closing its CitiBusiness unit, which serves small and medium-sized enterprise (SME) clients. Citigroup also has agreed to sell its Southeast Asia retail operations in Indonesia, Malaysia, Thailand, and Vietnam to Singapore-based United Overseas Bank for about $3.7billion in January.

“The sale of the CitiBusiness loan portfolio in Singapore follows our previous announcement to wind down our small business banking unit after a strategic review,” said Roy Phua, head of mortgage and CitiBusiness of Citibank Singapore. “Our priority is to ensure a smooth transition of our consumers and loans to Validus, who we believe can continue to serve them and meet their needs.”

Validus has made independent hires to manage the CitiBusiness team while acquiring the loan portfolio and the customers, Goel noted.

“We are confident that there is value creation for Citi customers who will be transferred to Validus,” Vikas Nahata, co-founder and executive Chairman of Validus. “Through our digital platform, they will be able to access additional financing solutions to grow their business, financial services such as business accounts, cards, money transfers and tools to manage their business finances in a smarter and more efficient way.”

Since its last funding in May 2020, Validus has grown its team substantially, adding more than 25 percent new hires. In January, the company crossed a significant milestone of over $1 billion (SG$1.6 billion) in total funds disbursed across more than 50,000 loans to small businesses in Singapore, Vietnam, Indonesia and Thailand. On average, 90% of its customer are return borrowers, Goel added.

The company will be concluding another fundraise, Goel said, without providing more detail. Validus is backed by investors including FMO, Vertex Growth, Vertex Ventures Southeast Asia and India, AddVentures by SCG, K3 Ventures, Openspace Ventures and VinaCapital Ventures.