Info Edge got an exceptional gain of INR 9,511.6 Cr in FY22, mainly due to selling some of its stake in Zomato IPO and unrealised mark to market gain

Info Edge’s net profit rose over 70% to INR 120.6 Cr on Q4 FY22

Info Edge’s cash EBITDA grew 140% to INR 811.6 Cr in the financial year ending March 2022

Noida-based online classifieds company Info Edge reported a multifold rise in its net profit for financial year 2021-22 (FY22) to INR 8,922.5 Cr due to gains from listing of food giant Zomato on the stock exchanges.

Info Edge was one of the earliest investors of Zomato and held an 18.6% stake in the startup before it went public. The company received INR 375 Cr for its sale of over 4.9 Cr shares of Zomato through an offer for sale (OFS) during its initial public offering (IPO).

“Effective listing date, Zomato Ltd has ceased to be a joint venture and has been reclassified as financial investment which will be fair valued at each reporting date…Accordingly, unrealised mark to market gain of INR 89411.95 Mn till date of listing of Zomato has been credited to P&L through exceptional item,” Info Edge said.

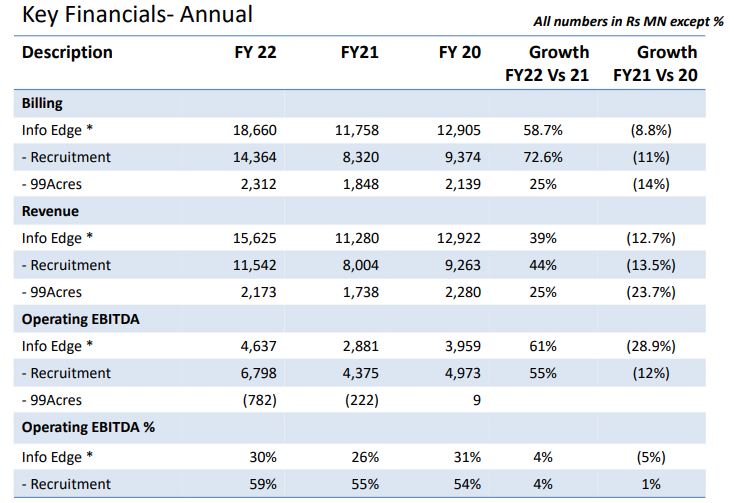

Ite revenue grew 38% year-on-year (YoY) to INR 1,562.4 Cr during the year. Info Edge operates its classified business through online recruitment platform Naukri.com, real estate portal 99acres.com, matrimony portal Jeevansathi.com and education portal Shiksha.

The company also saw its FY22 billing surge 58% to INR 1,866 Cr. Info Edge’s cash EBITDA also grew 140% to INR 811.6 Cr in the financial year ending March 2022.

The growth was primarily led by Naukri, which saw its segment revenue shoot up to INR 1,154.2 Cr in FY22 from INR 800.3 Cr in FY21. 99acres.com also saw its revenue surge to INR 217.3 Cr in FY22 from INR 173.7 Cr in FY21.

Naukri also saw its billing surge 72.6% to INR 1436 Cr in FY22, largely on account of addition of billing of its acquired businesses of Zwayam and Do Select. The real estate platform’s yearly billing for FY22 stood at INR 231.2 Cr, up nearly 25% on a yearly basis.

“We are experiencing strong tailwinds in recruitment and real estate verticals. Post pandemic the gap between supply and demand of skills has increased globally. We expect this trend to continue in the mid to long term and will create demand for platforms like naukri”, Info Edge managing director (MD) and chief executive officer (CEO) Hitesh Oberoi said.

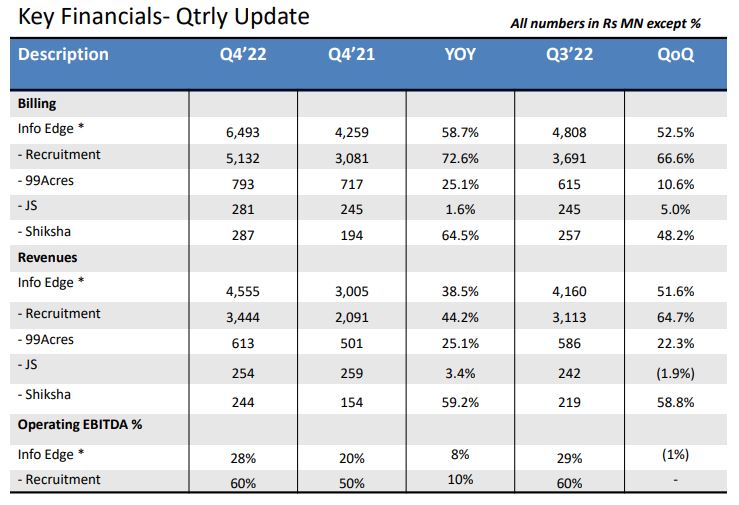

On a quarterly basis, Info Edge’s revenue from operations soared 38.5% YoY to INR 455.5 Cr in Q4 FY22 from INR 300.5 Cr in Q4 FY21. Profit after tax (PAT) for the quarter ended March 2022 grew 73% to INR 120.6 Cr from INR 69.6 Cr in Q4 FY21.

On a quarterly basis, Naukri.com’s Q4 FY22 revenue stood at INR 344.4 Cr, up more than 44.2% YoY from INR 209.1 Cr a year ago. Meanwhile, 99acres reported a quarterly revenue of INR 61.2 Cr in Q4 FY22, up 22% compared to INR 50.1 Cr in Q4 FY21.

Shares of Info Edge ended 4.01% higher at INR 3,693.65 on the BSE on Friday.